US Housing Market – Are Prices Likely to Fall in 2024

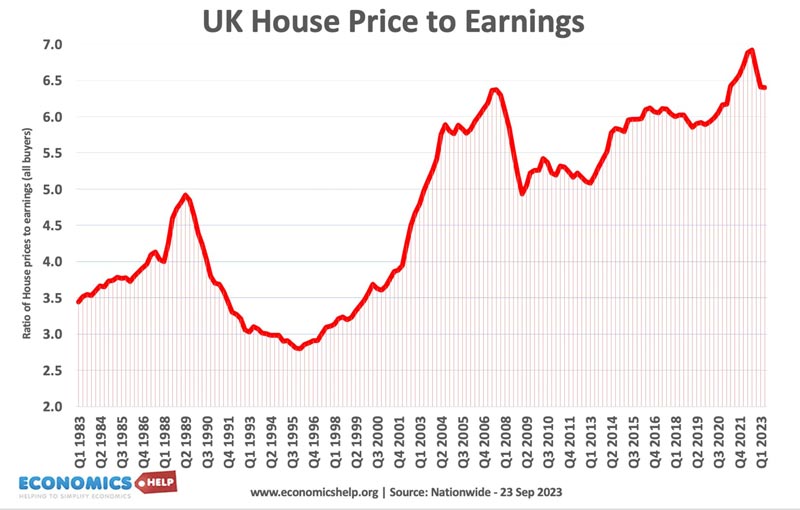

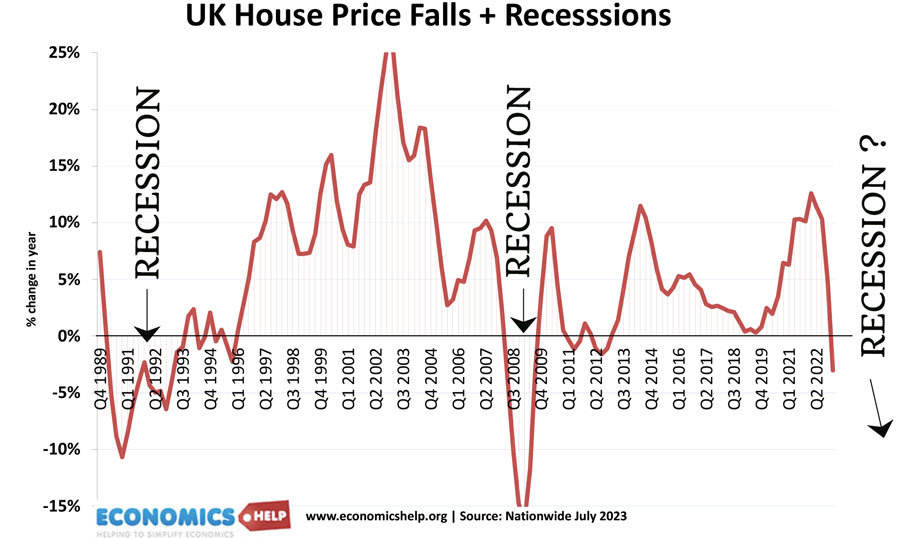

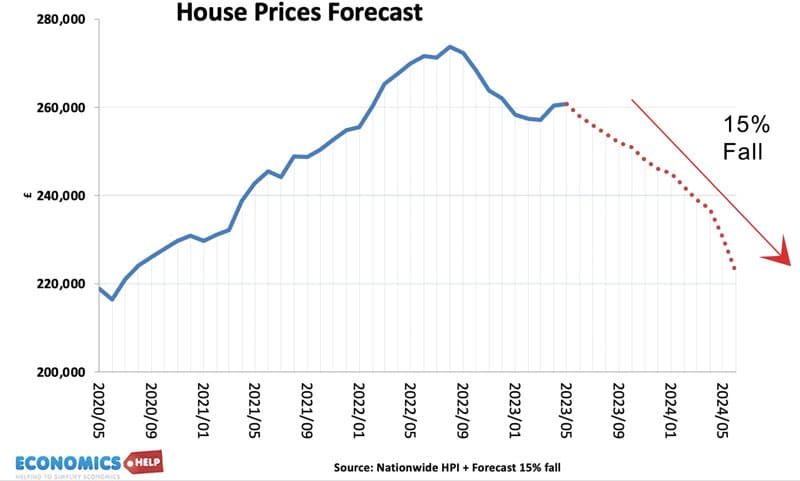

In recent months, the US Housing Market has seen record house prices, mortgage rates quadrupling from 2 to 8%, and price to income multiples worse than 2006. It is a familiar story across the world. But, so far US house prices have seemed to defy gravity. Yet how long can they remain so elevated? Is …