Why are UK house prices so high?

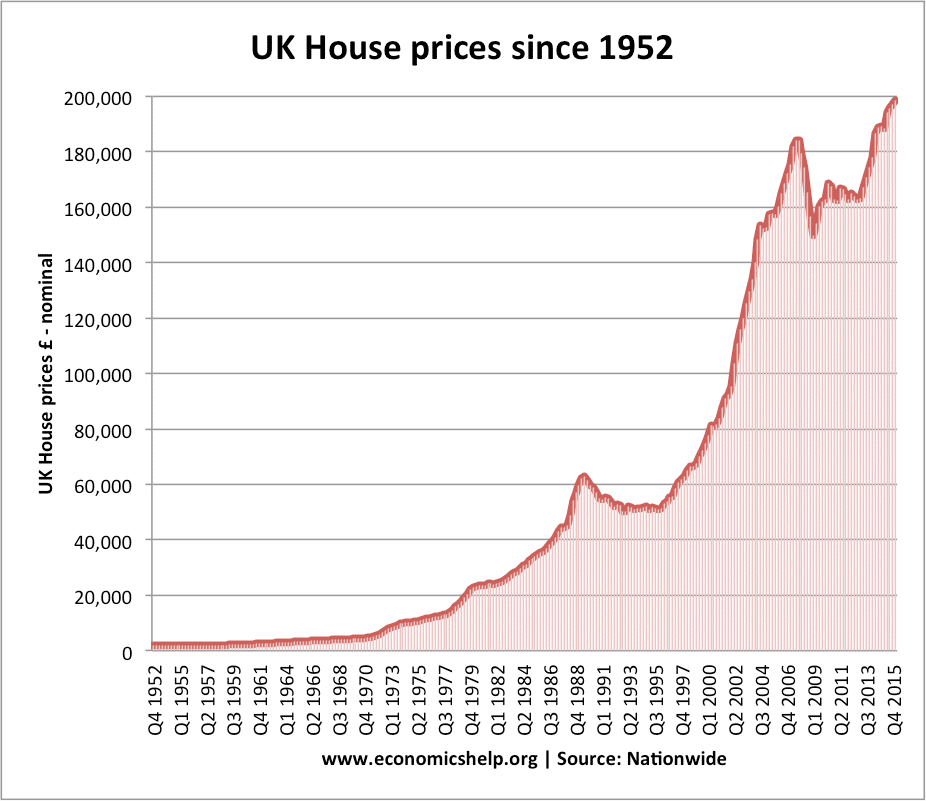

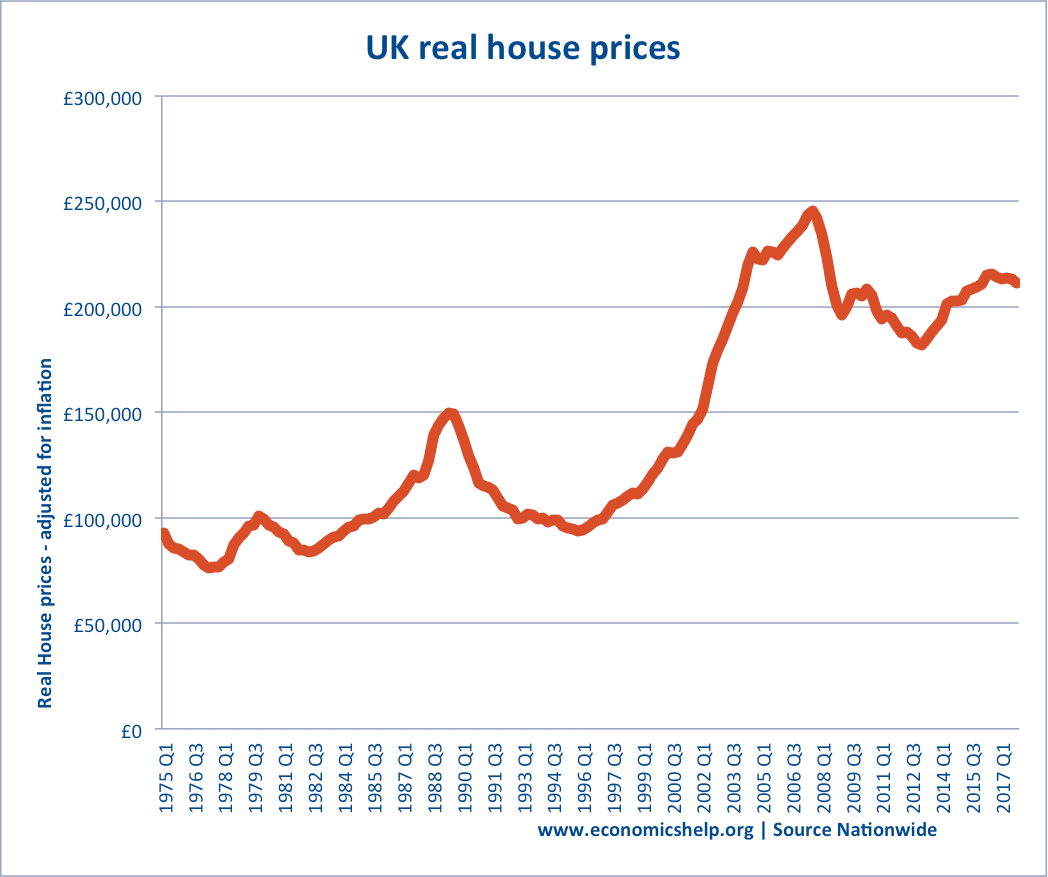

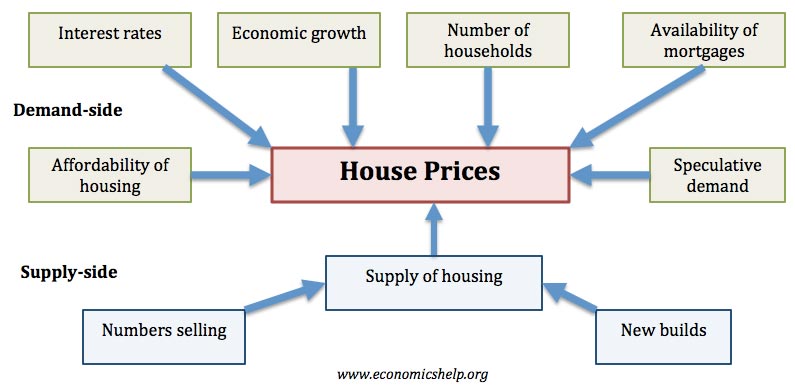

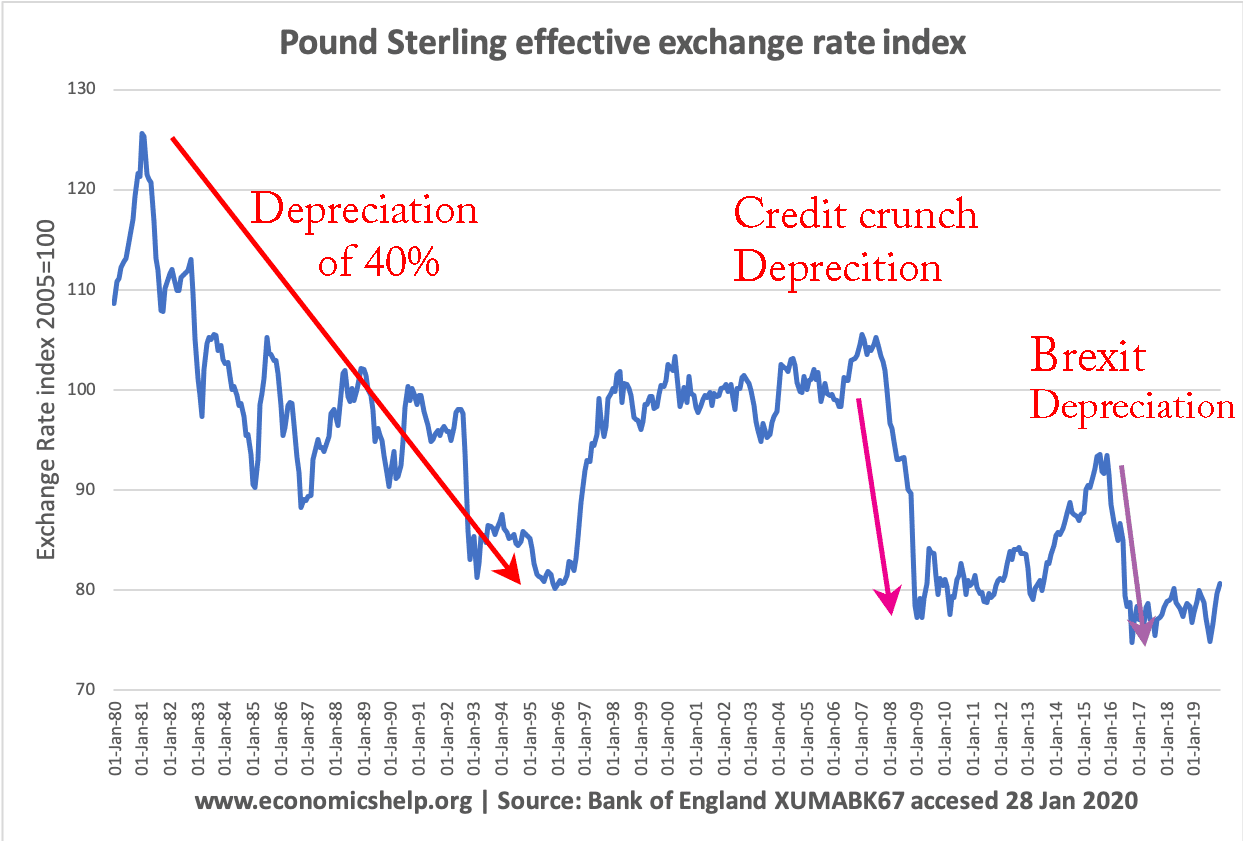

In recent years, we have had a devastating global credit crunch, the longest and deepest recession since the 1930s and then the impact of Covid. Yet, despite this financial and economic upheaval, UK house prices have bucked the trend, avoided a major collapse and now exceeded pre-crash levels. The economics of Covid have even made …