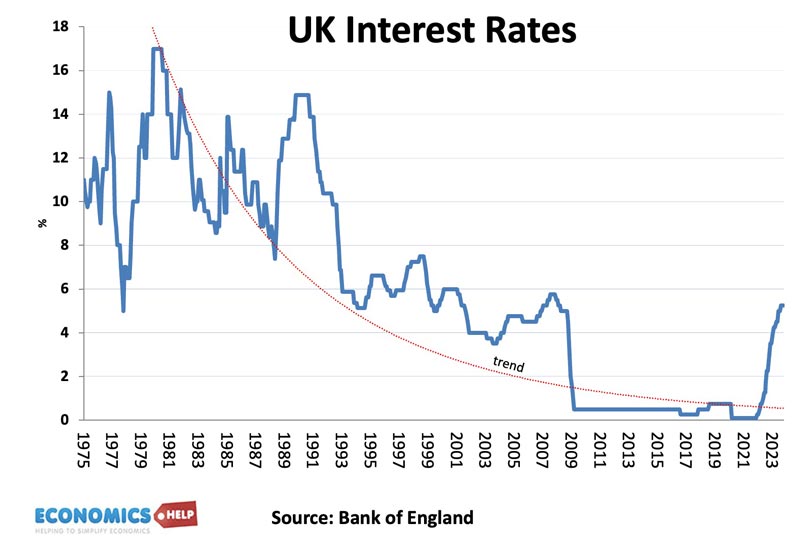

Could Interest Rates Return to Zero?

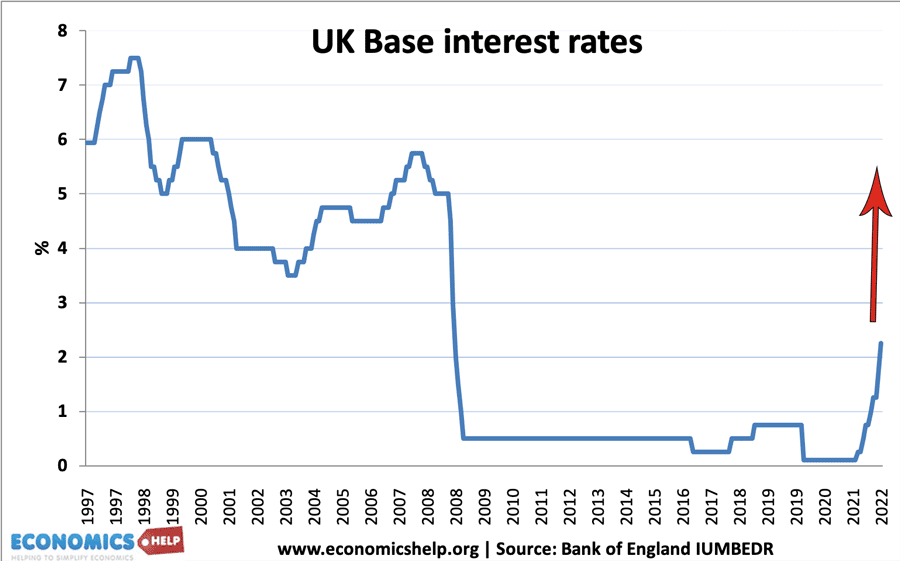

In 2009, Central Banks around the world cut interest rates dramatically to 0%. It was supposed to be a temporary reaction to a short-term crisis. Markets and experts all predicted interest rates would soon rise. But for 13 years, interest rates defied predictions staying close to zero. But, just as zero interest rates appeared to …