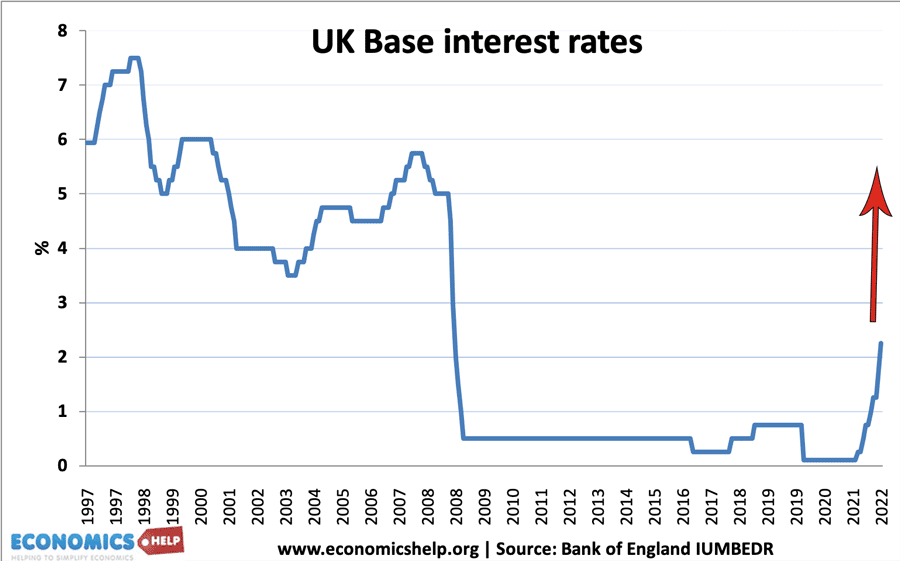

Why rising interest rates would hurt the UK economy

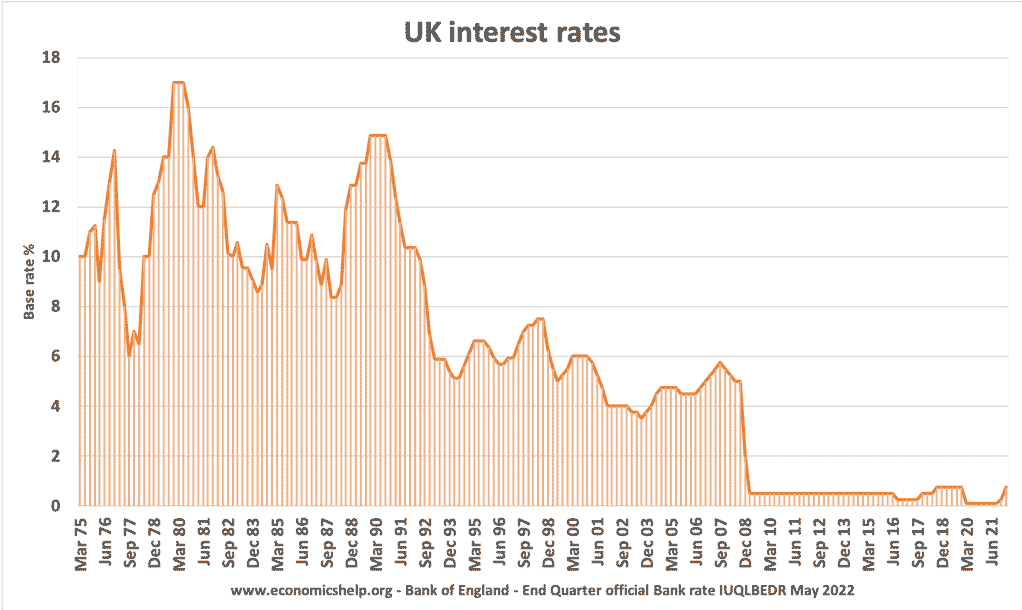

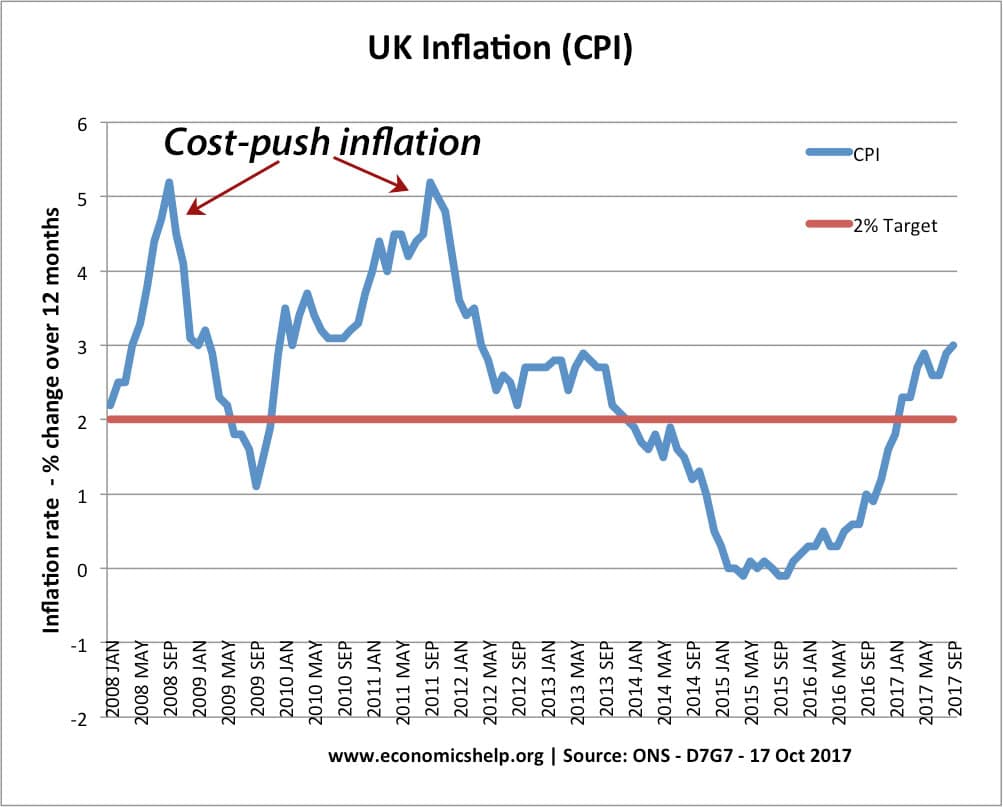

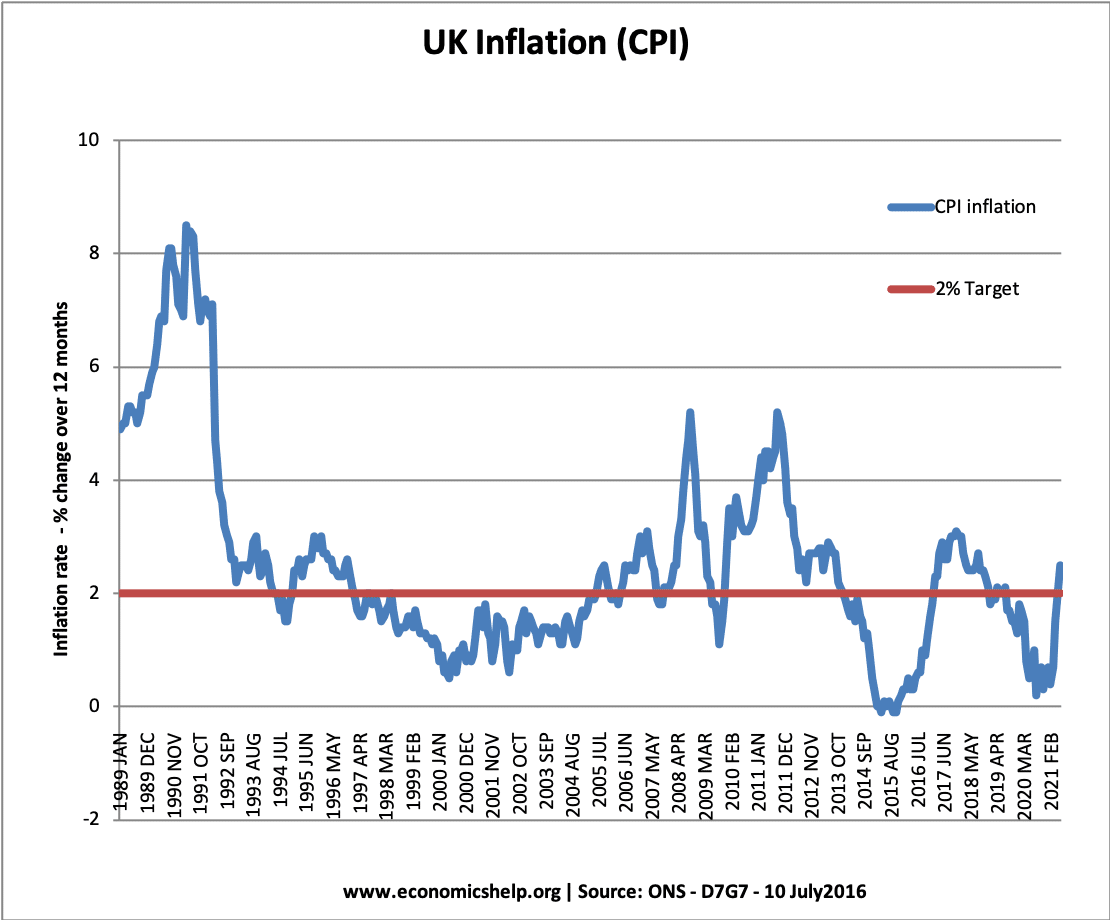

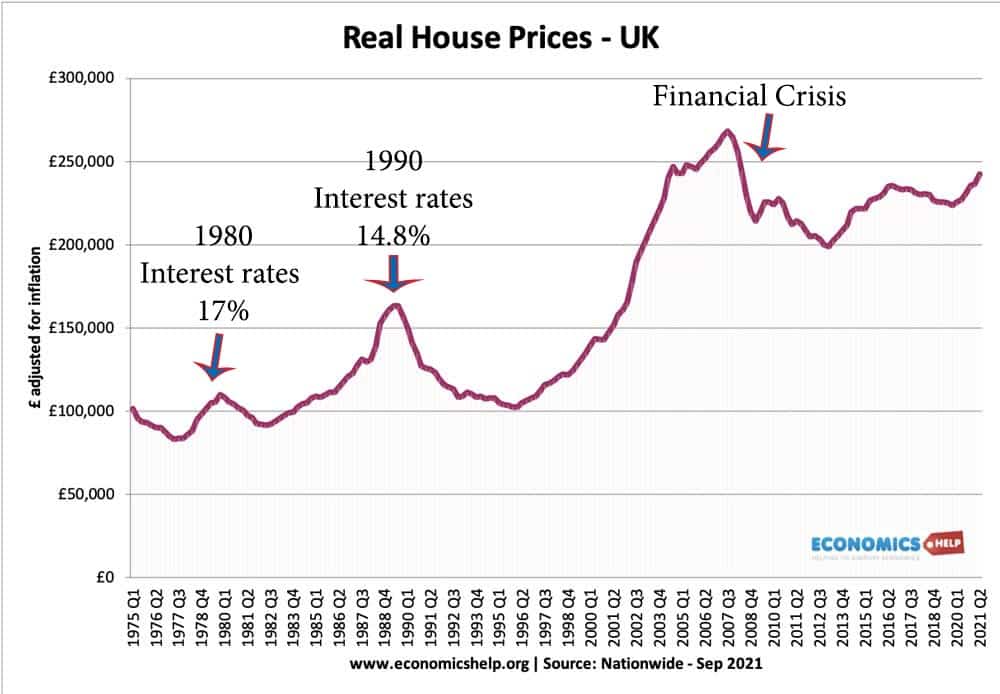

Interest rates are a tool of monetary policy. When the economy is overheating, the Central Bank can raise interest rates to cool demand and avoid an inflationary boom. In an ideal world, the Central Bank would make small adjustments in interest rates to fine-tune the economy and avoid booms and busts, but the situation the …