Money Supply

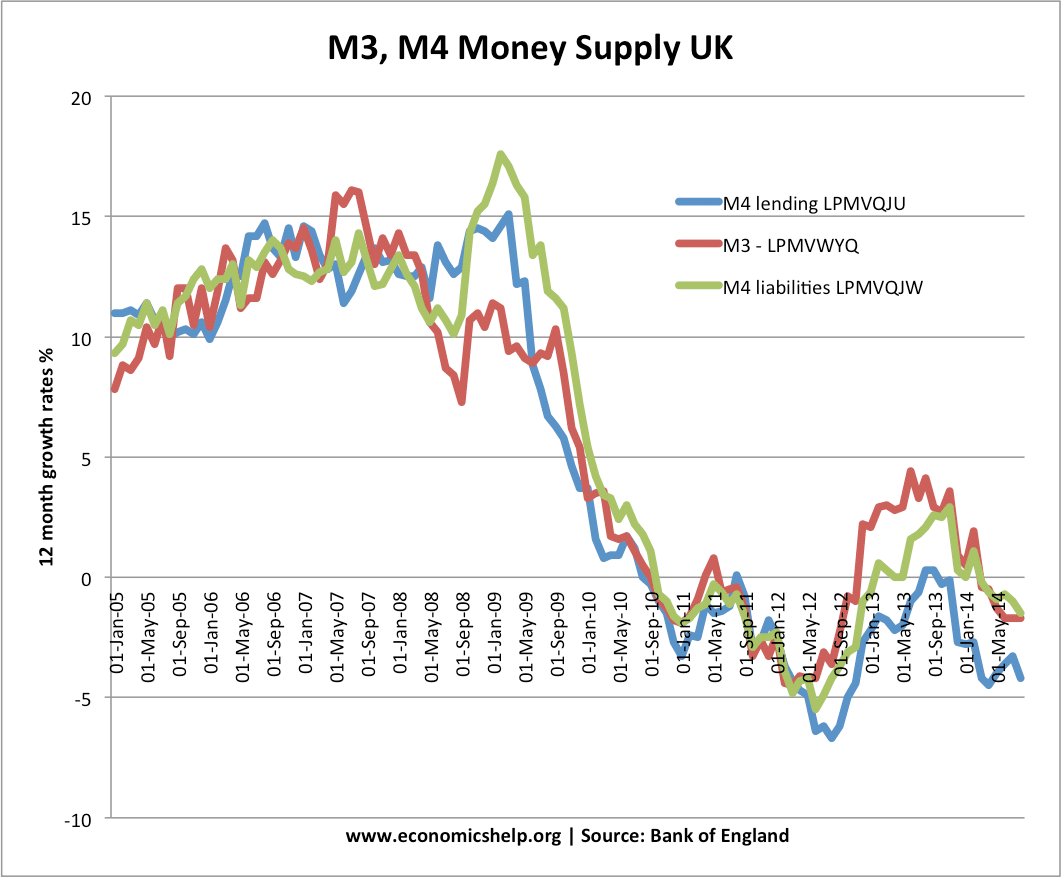

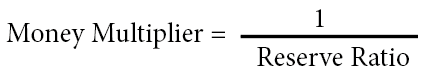

The money supply measures the total amount of money in the economy at a particular time. It includes actual notes and coins and also any deposits which can be quickly converted into cash. There are different measures of the money supply depending on how you count it. Narrow definitions include all the money supply which …