Monetary Base Definition

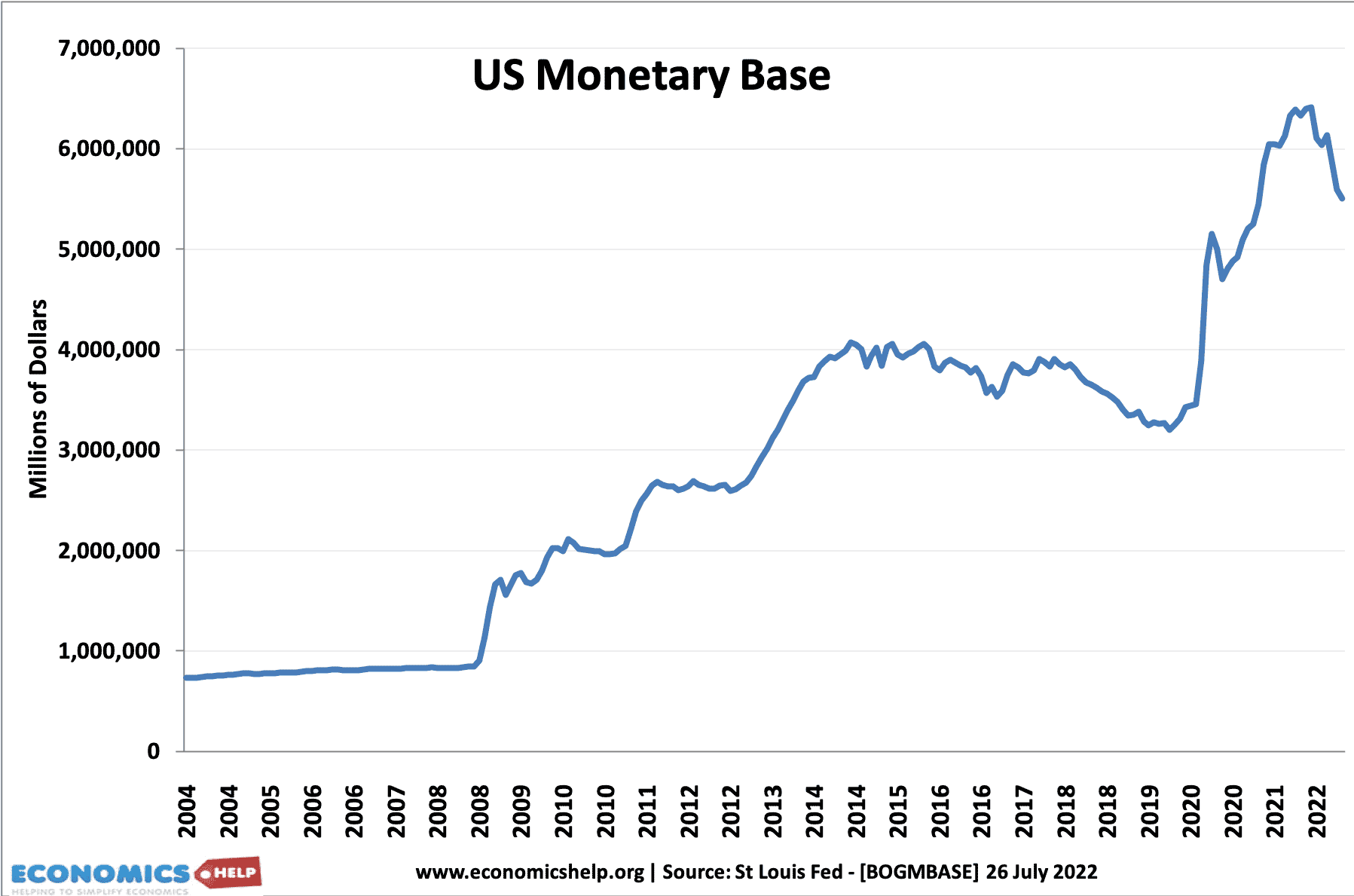

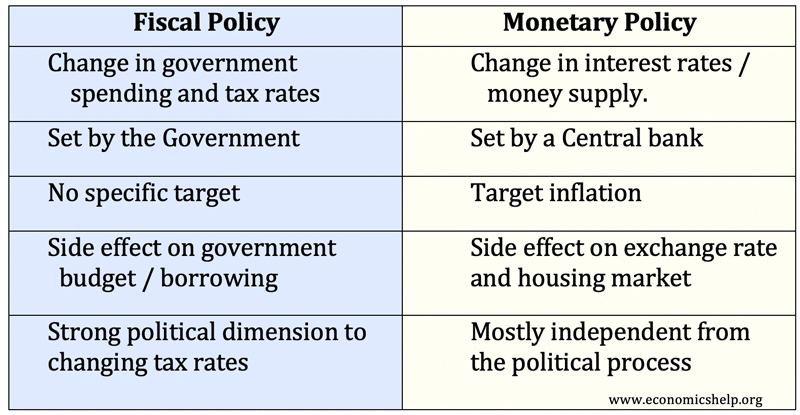

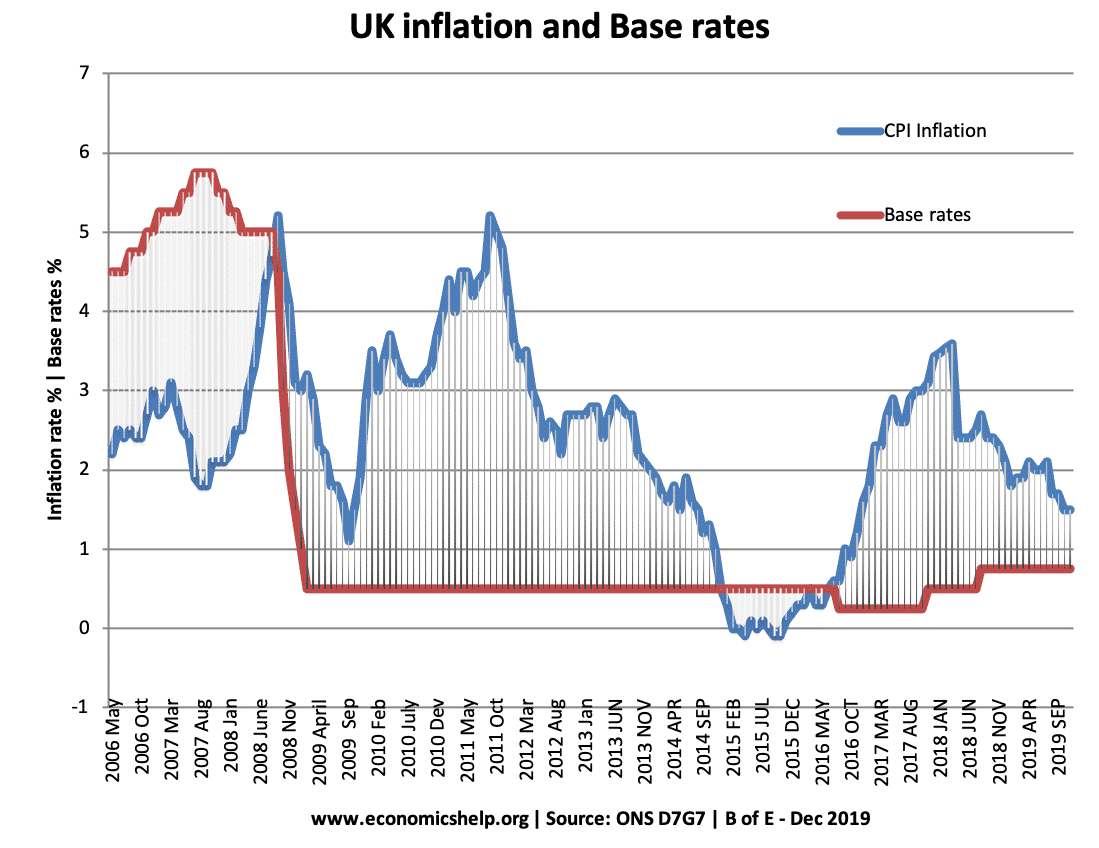

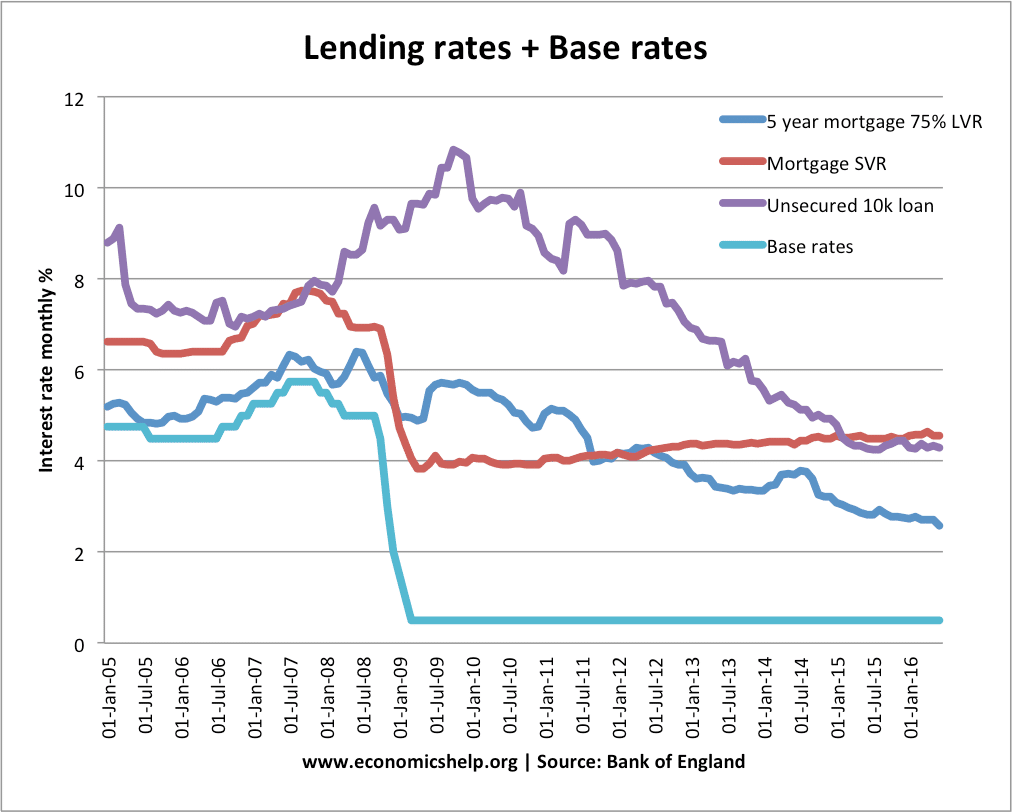

Readers’ Question: What is the difference between the Monetary base and the money supply? The monetary base is part of the overall money supply. The monetary base refers to that part of the money supply which is highly liquid (i.e. easy to use). The monetary base includes Notes and coins Commercial bank deposits with the …