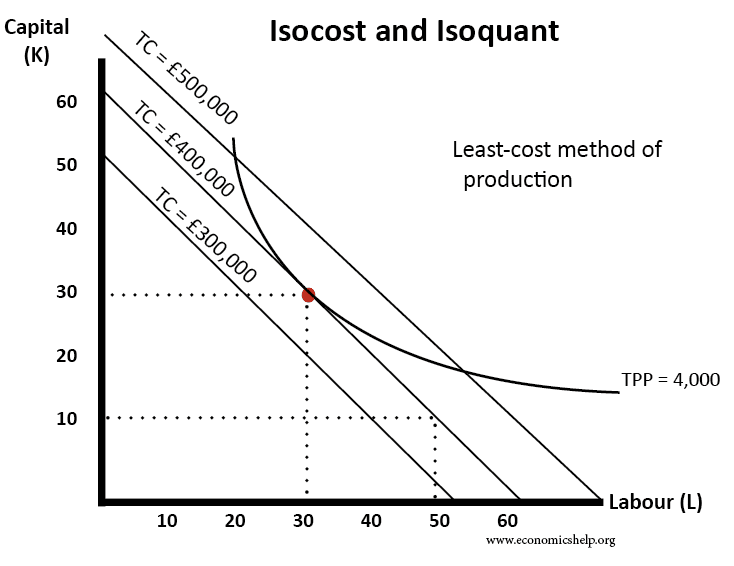

Isoquant and isocosts

An isoquant shows all combination of factors that produce a certain output An isocost show all combinations of factors that cost the same amount. Isocosts and isoquants can show the optimal combination of factors of production to produce the maximum output at minimum cost. Definition isoquant An isoquant shows all the combination of two factors …