Inequality in the UK

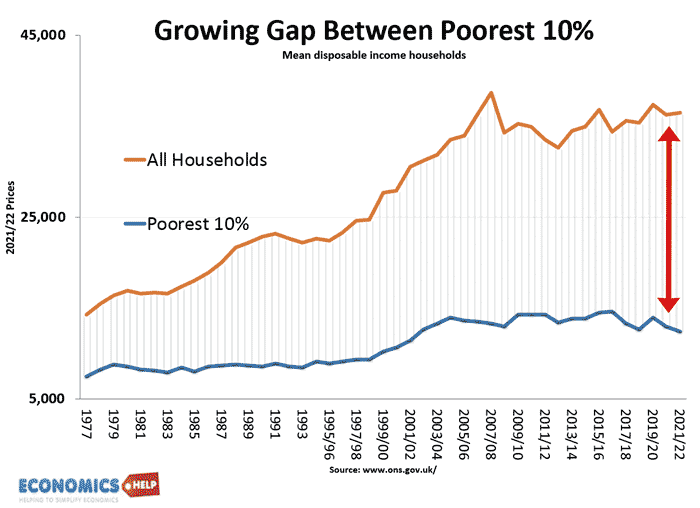

In the post-war period, there was a dramatic decline in income inequality in the UK. However, from the early 1980s, this went into reverse with a sharp rise during the Thatcher years. Unequal Britain: UK's Inequality Crisis ExplainedWatch this video on YouTube The UK has now one of the highest levels of inequality in the …