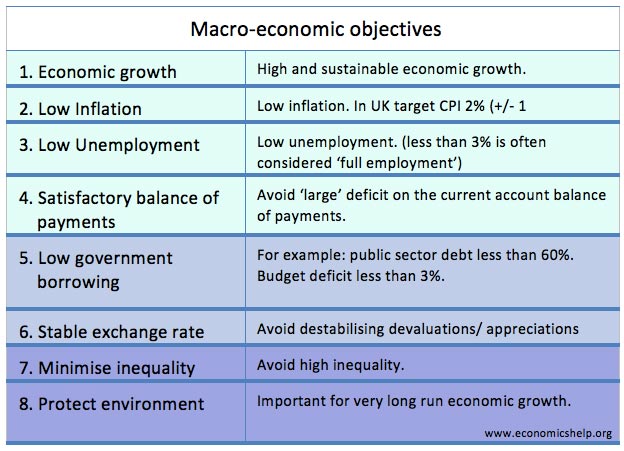

Macroeconomic objectives and conflicts

A look at the main macroeconomic objectives (economic growth, inflation and unemployment, government borrowing) and possible conflicts between these different macro-economic objectives. The main macro-economic objectives Economic growth – positive and sustainable growth (The UK, long-run trend rate is around 2.5%) Low inflation (UK target 2% +/-1) – Low unemployment / Full employment (e.g. around …