Does inflation cause unemployment?

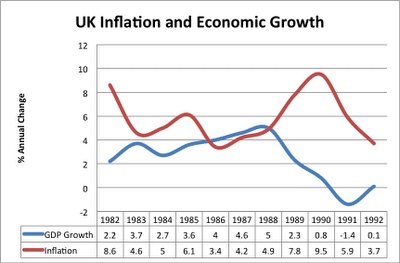

Readers Question: Does inflation causes unemployment? There are a few different scenarios where inflation can cause unemployment. However, there is not a direct link. Often we will notice a trade-off between inflation and unemployment – e.g. in a period of strong economic growth and falling unemployment; we see a rise in inflation – see Phillips …