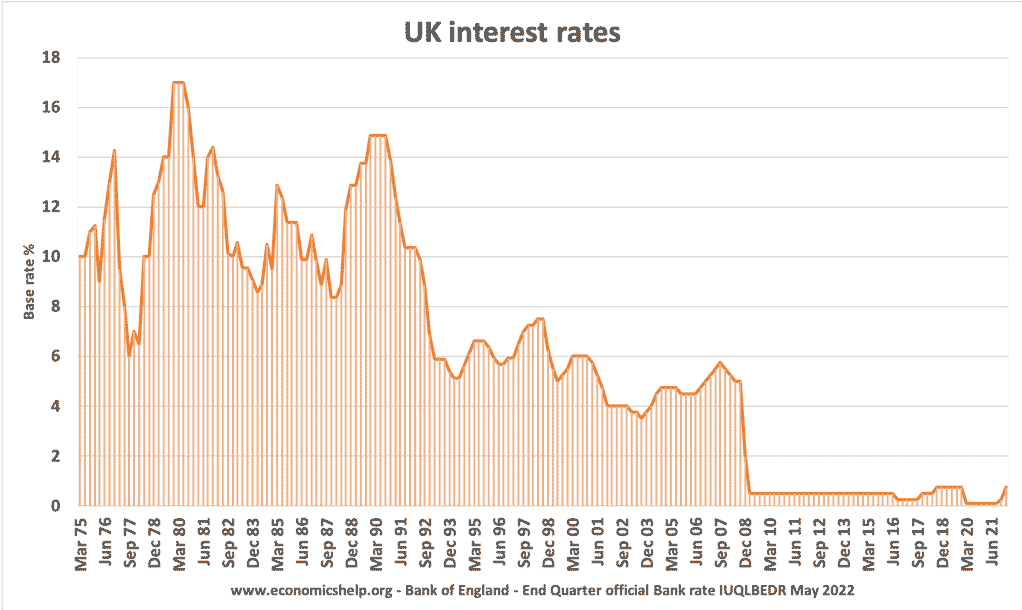

Historical Interest Rates UK

Historical Interest Rates in UK since 1800 Interest rates in the UK since 1800. Bank Rate 1830–1972 and 2006–09, Minimum Lending Rate 1972–81, London clearing banks’ base rate 1981–97, repo rate 1997–2006. End year observation.