How Brexit contributed to Inflation and Lower Investment

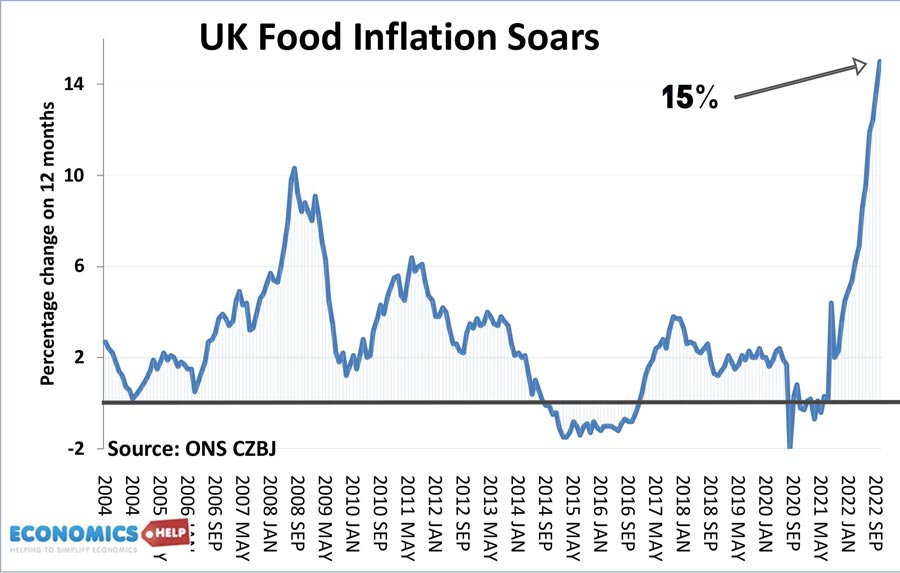

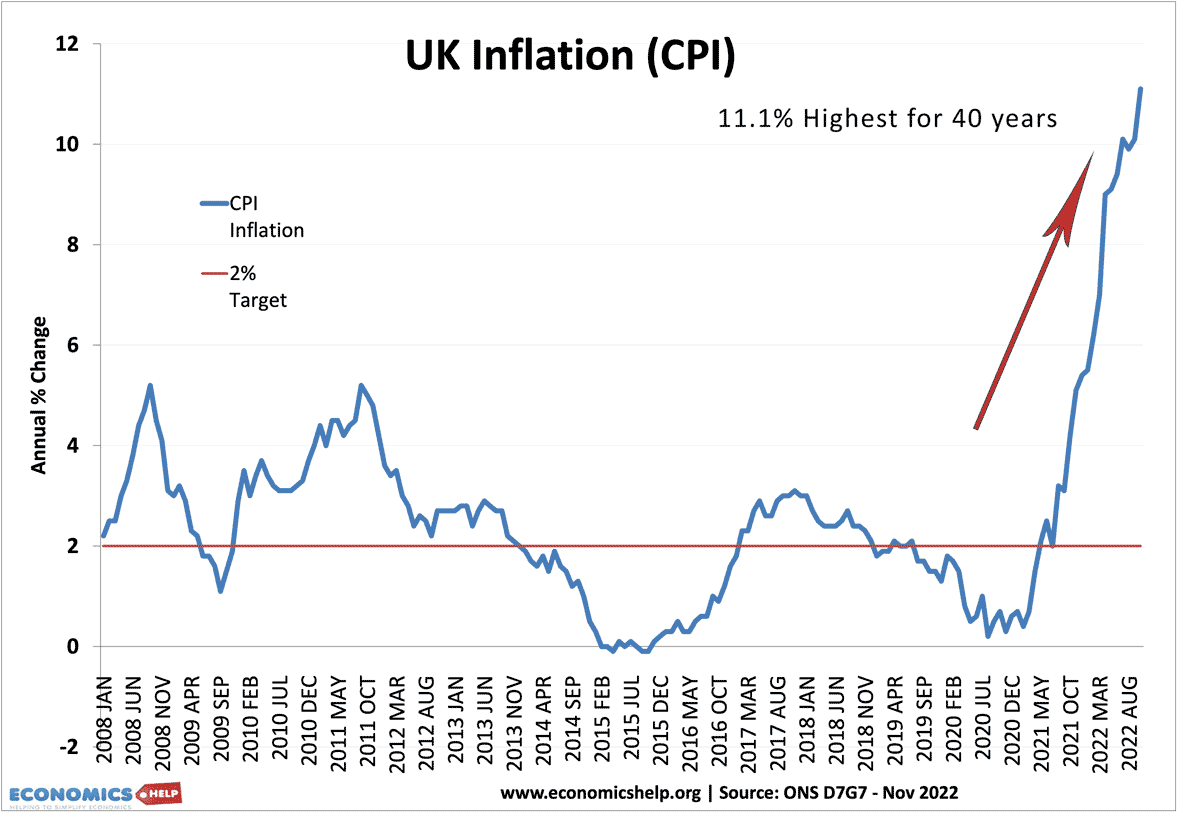

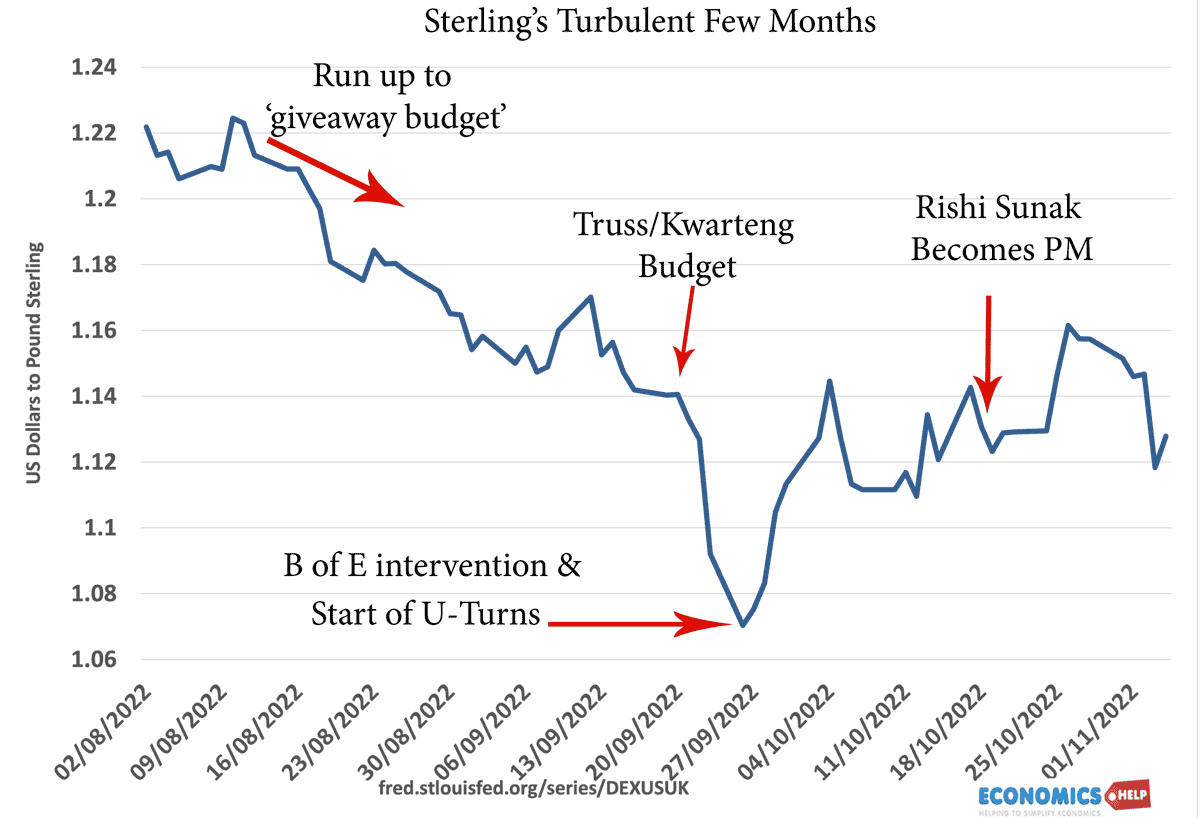

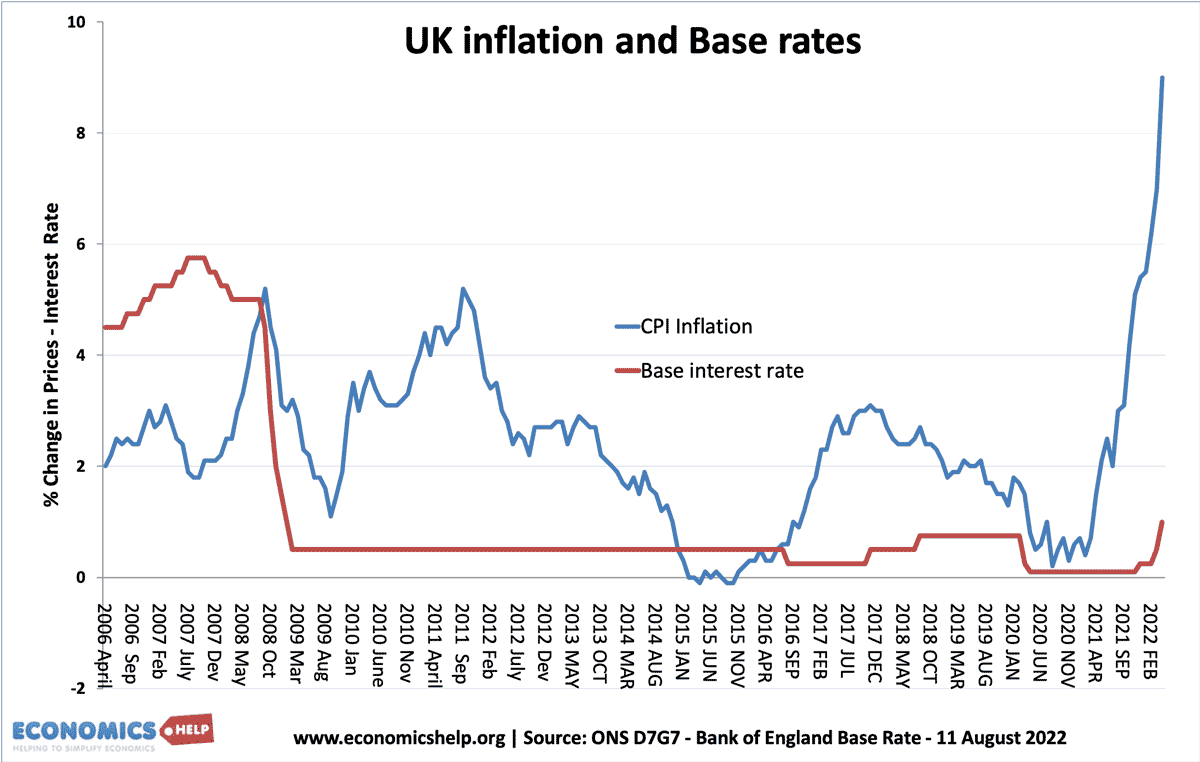

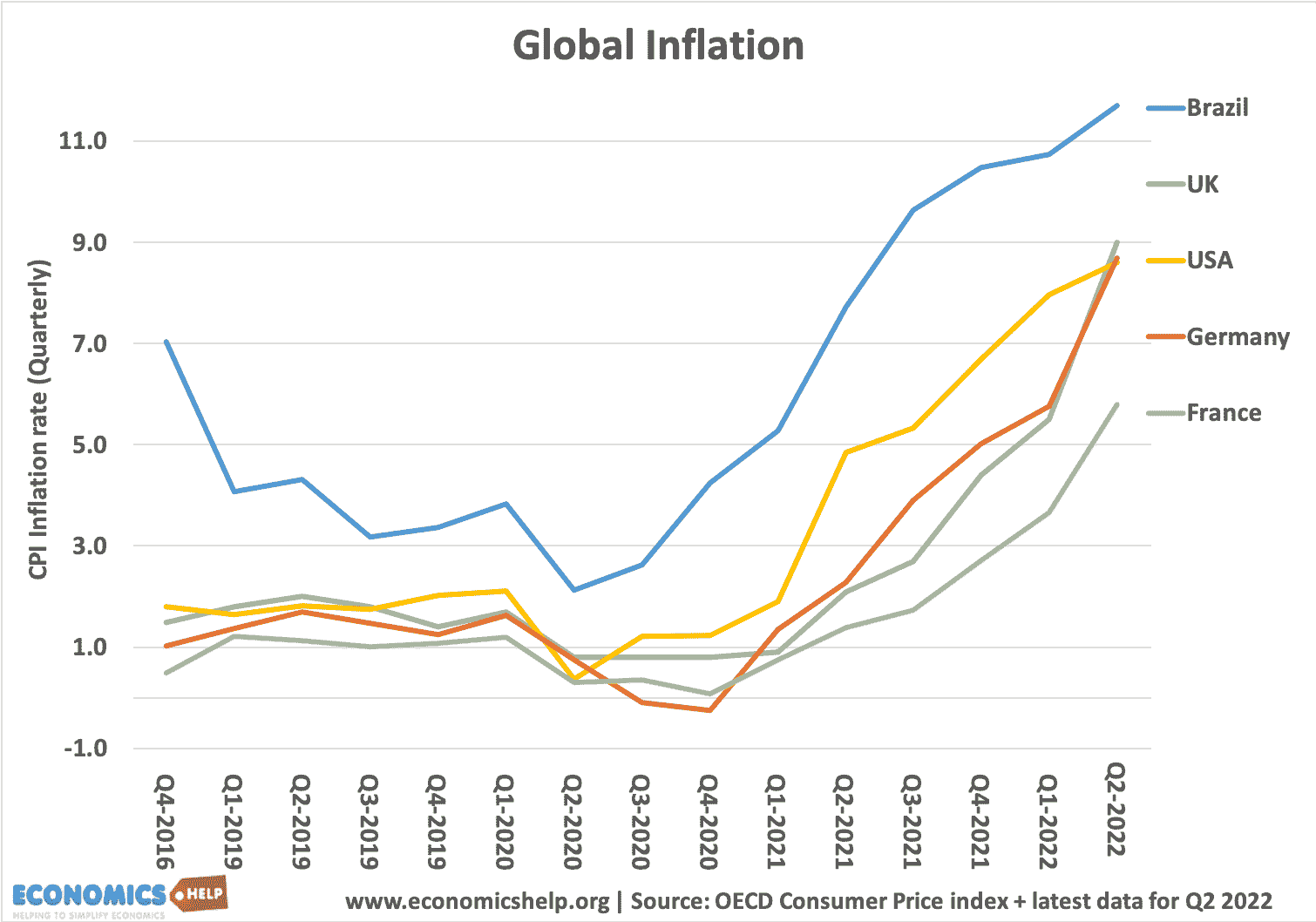

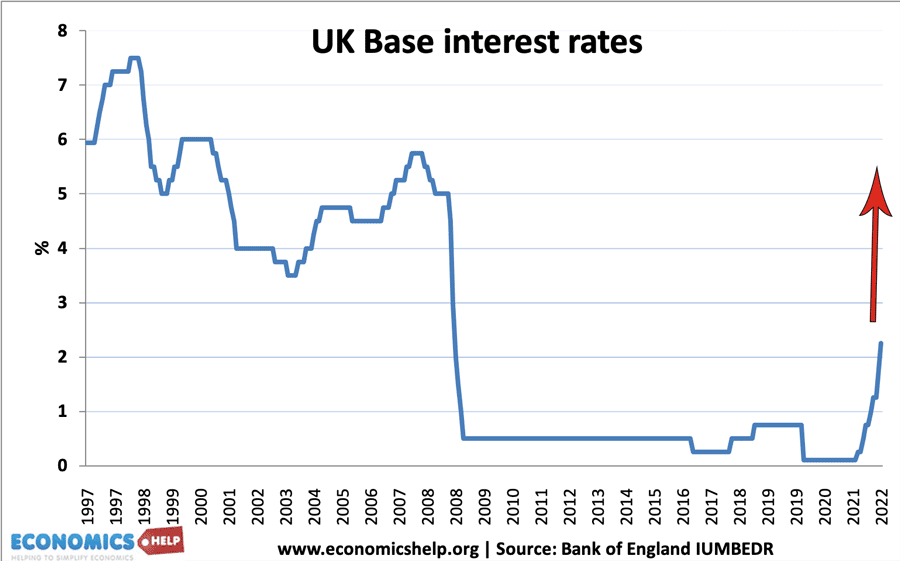

Nearly two years after leaving The Single Market, the UK economy is facing a host of problems including high inflation, low investment and falling growth. All problems exacerbated by Brexit. Last month, food inflation rose to 15%, the highest level for decades. This is primarily due to rising energy prices, But, experts at LSE state …