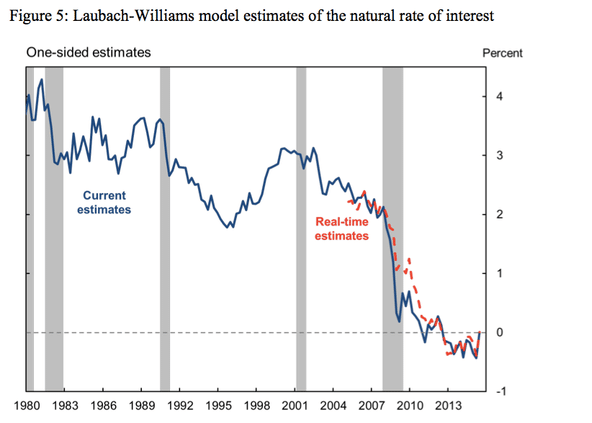

The natural rate of interest

The natural rate of interest is the interest rate consistent with maintaining economic growth at its trend rate and stable inflation. Another definition of the natural rate of interest is: “the real interest rate consistent with real GDP equalling its potential level (potential GDP) in the absence of transitory shocks to demand. (FR) In other …