Pros and Cons of Inflation

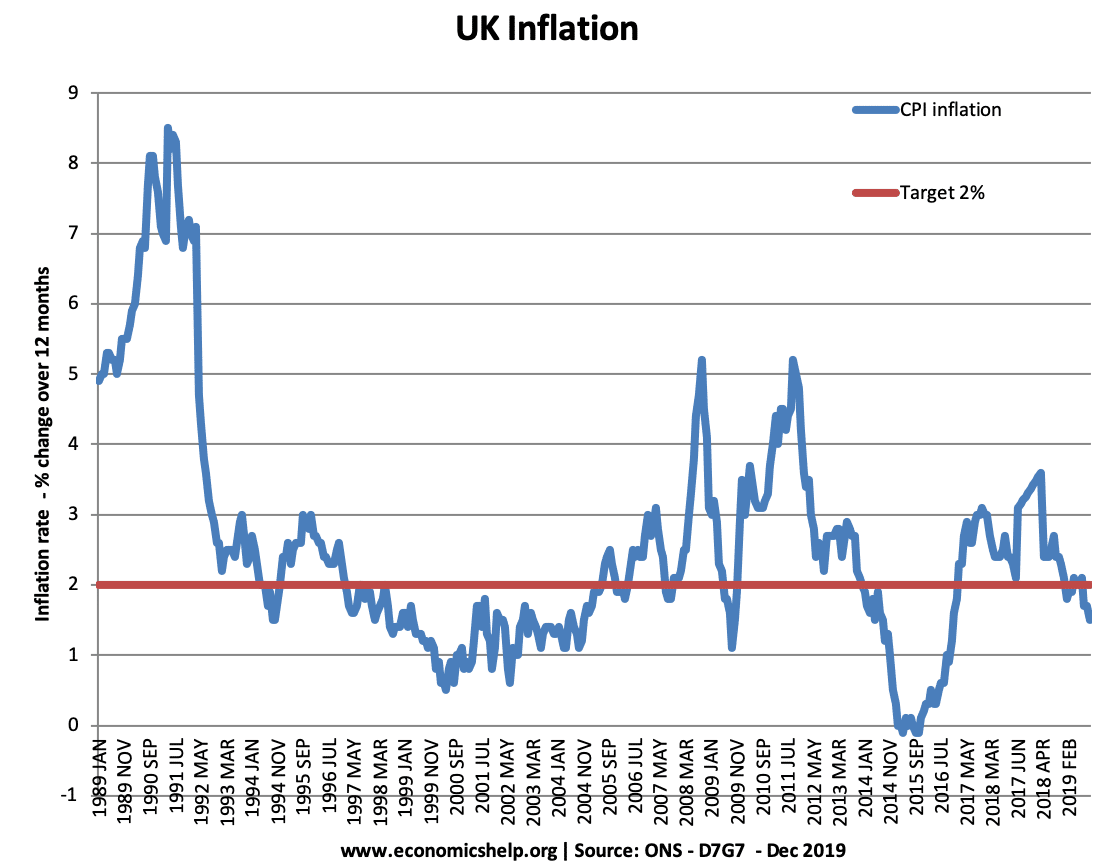

Readers Question: What are the advantages and disadvantages of inflation? The Government have an inflation target of CPI 2%. This suggests they would rather have moderate inflation than no inflation at all. Advantages of Inflation Deflation is potentially very damaging to the economy and can lead to lower consumer spending and lower growth. For example, …