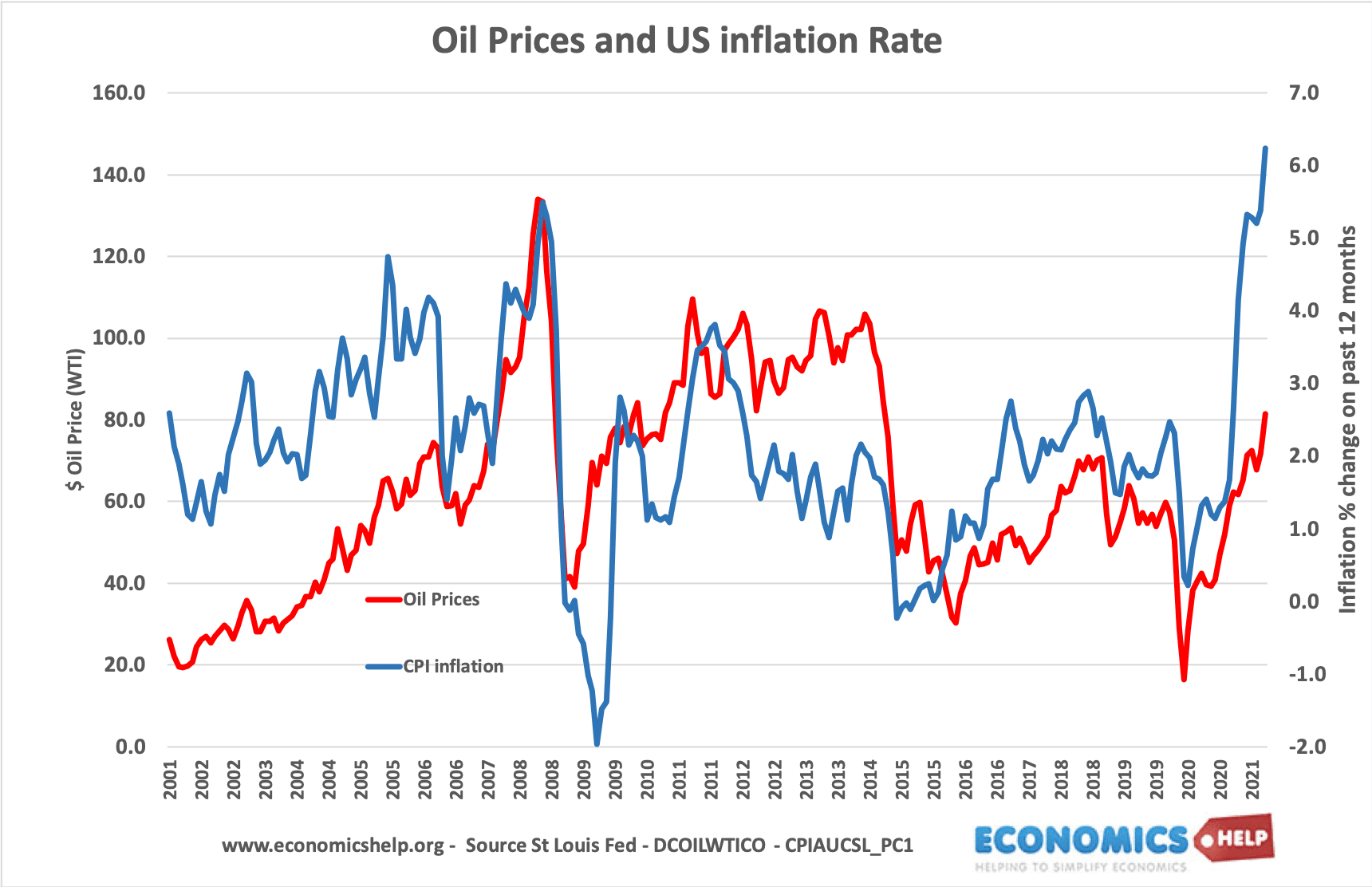

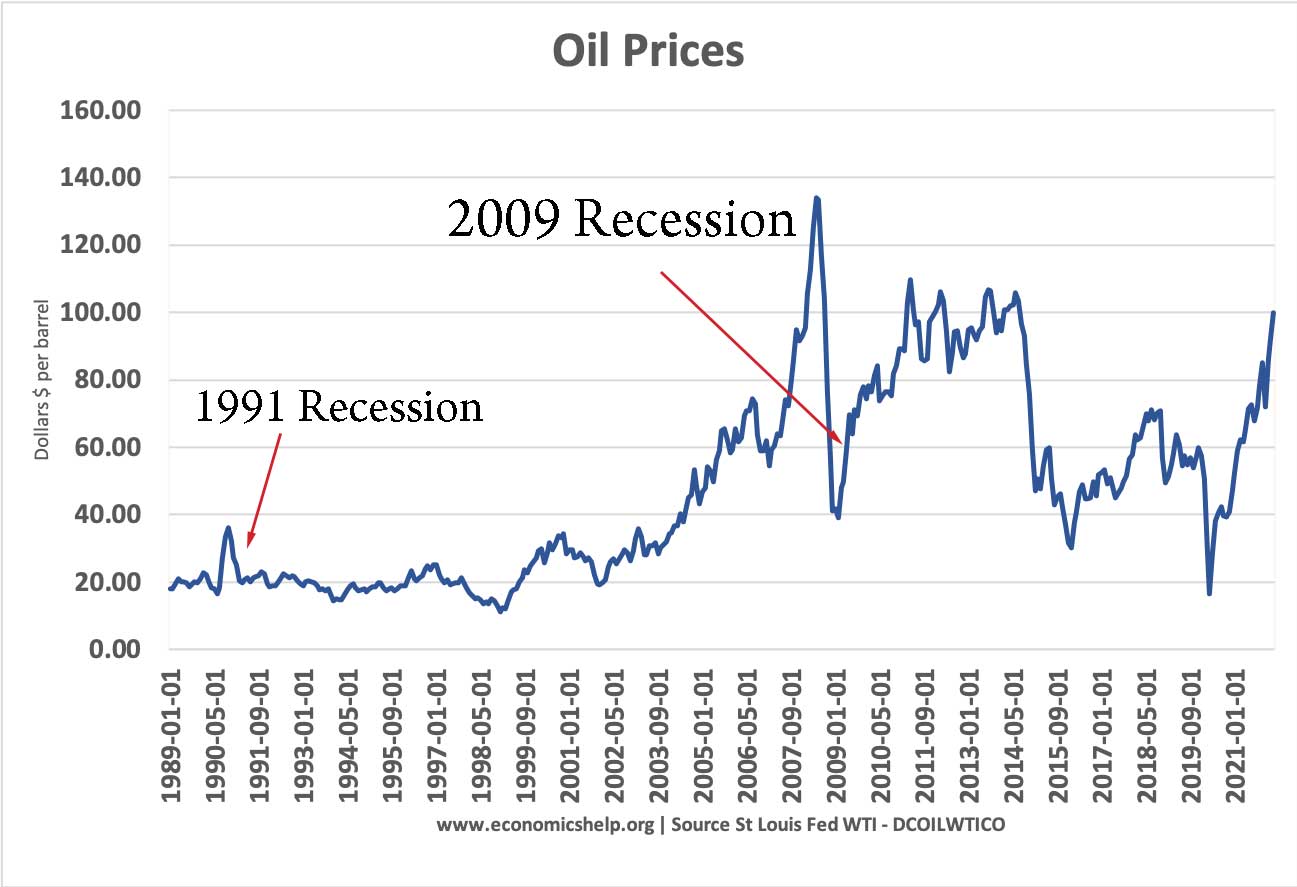

The relationship between oil prices and inflation

Oil prices have a significant effect on the consumer price index, though the correlation between oil prices and inflation is less direct than it used to be in the 1970s. St Louis Fed estimates a correlation of 0.27 between changes in the oil price and inflation. In other words, a sustained 10% rise in oil …