Failures of the Bank of England

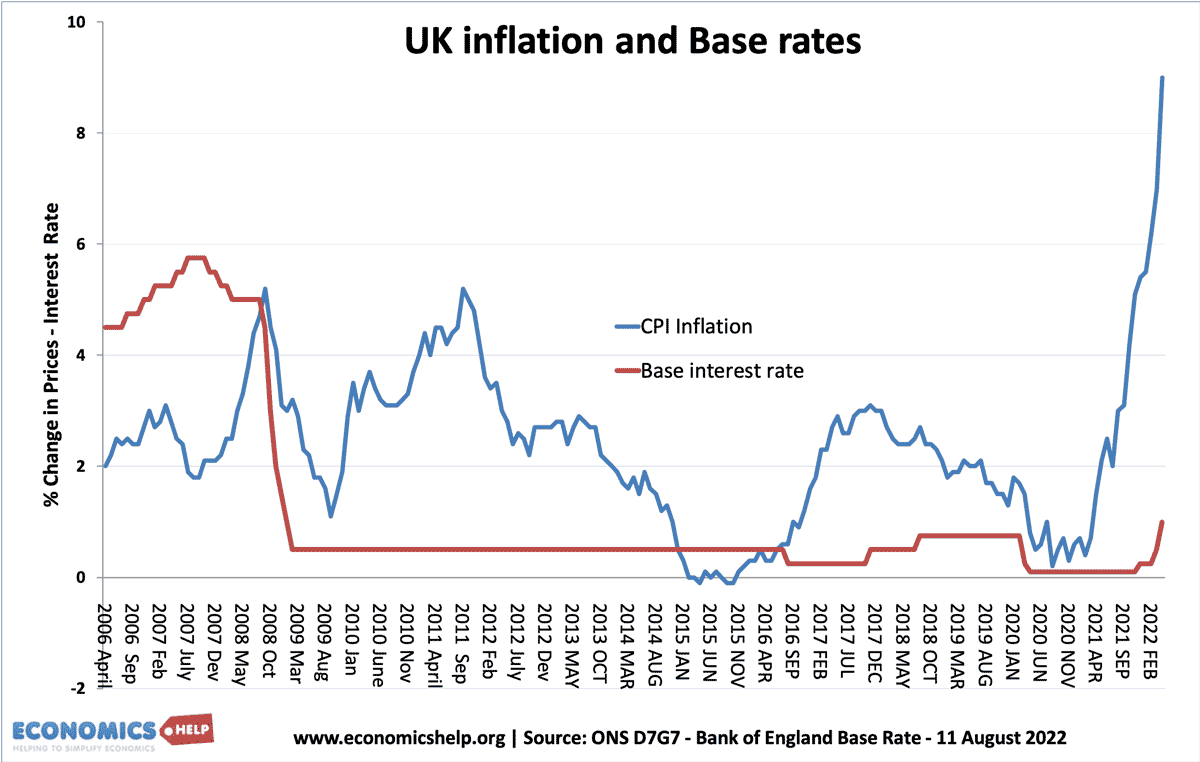

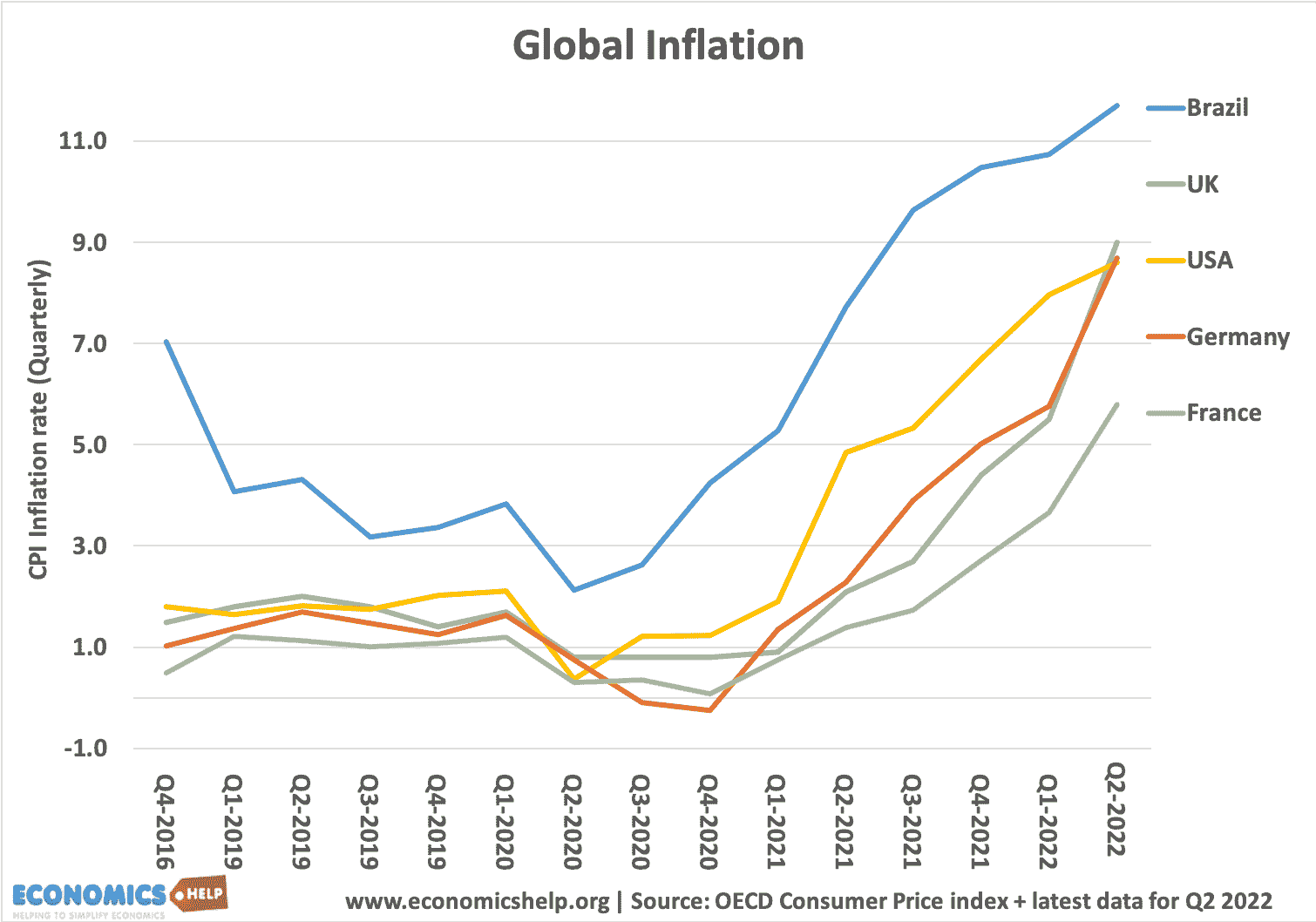

It’s not a good time to be a member of the Monetary Policy Committee. Inflation far exceeding forecasts and the Bank was forced into something of a u-turn belatedly increasing interest rates in a shock-and-awe tactic designed to regain credibility. Some critics argue the recent interest rate rises are like using a sledgehammer to crack …