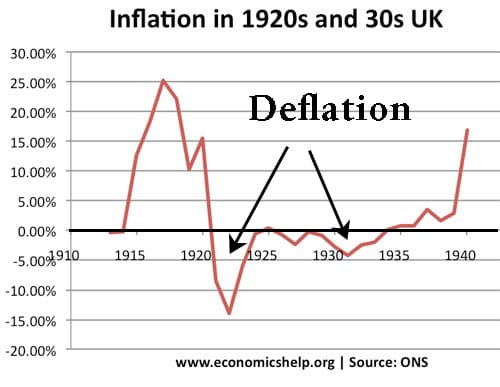

Trade off between unemployment and inflation

A look at the extent to which policy makers face a trade off between unemployment and inflation. The Phillips curve suggests there is a trade off between inflation and unemployment, at least in the short term. Other economists are more sceptical.