Deflationary Spiral

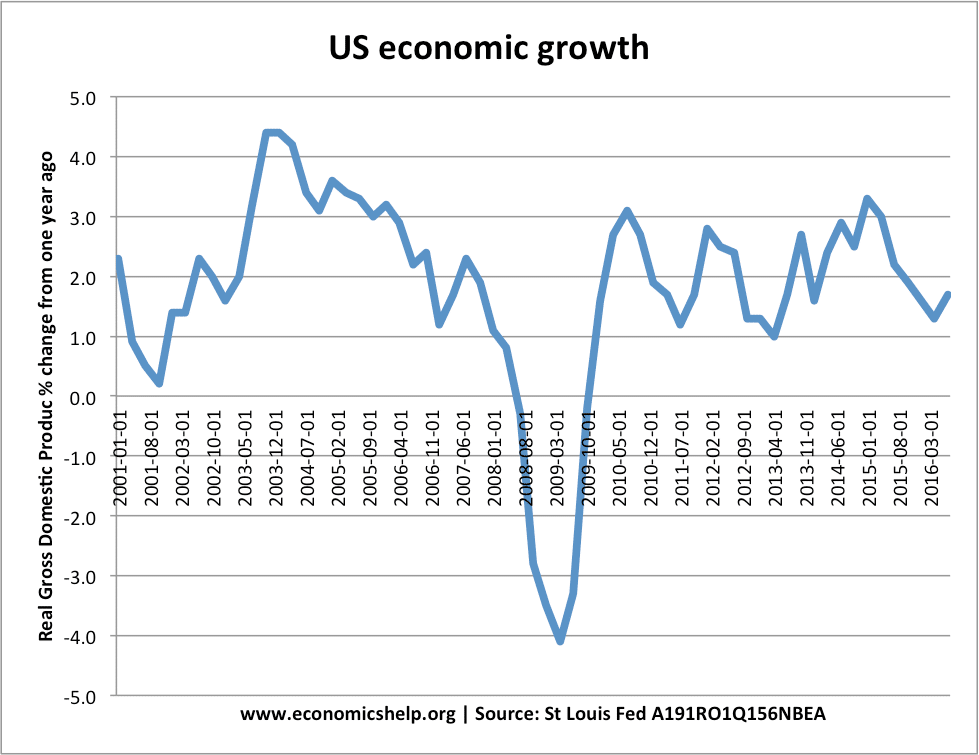

A deflationary spiral occurs when falling prices cause further deflationary pressures to cut prices. Deflation creates expectations of further price falls, and therefore consumers reduce their spending because they expect goods to become spending in the future. This fall in spending creates further deflationary pressure in the economy. Deflation increases the real value of debt. …