Inflation and Exchange Rates

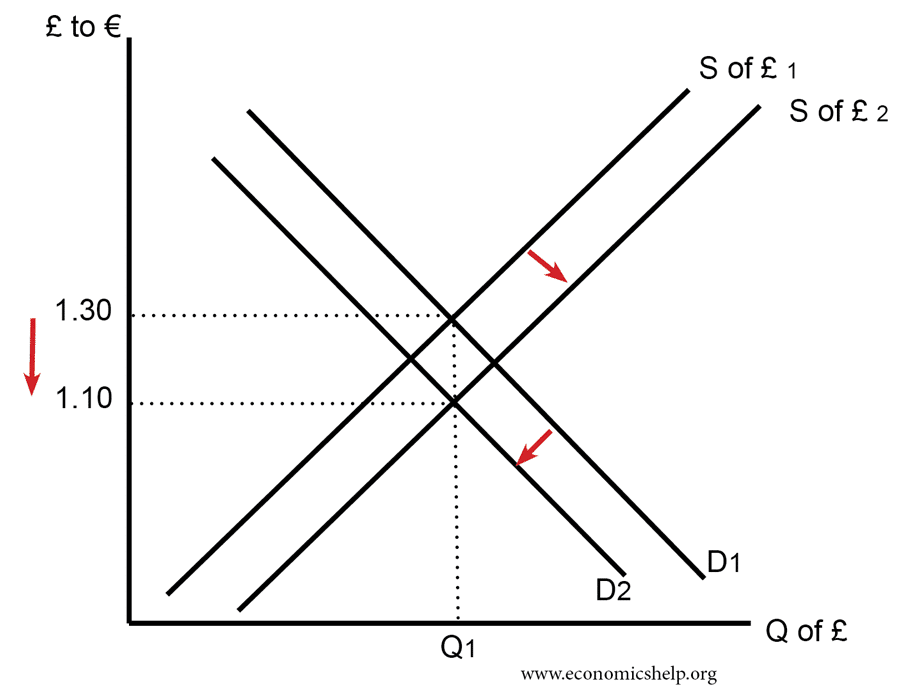

Readers Question: Why is it that the value of the exchange rate falls when there is higher inflation? How inflation affects the exchange rate A higher inflation rate in the UK compared to other countries will tend to reduce the value of the Pound Sterling because: High inflation in the UK means that UK goods …