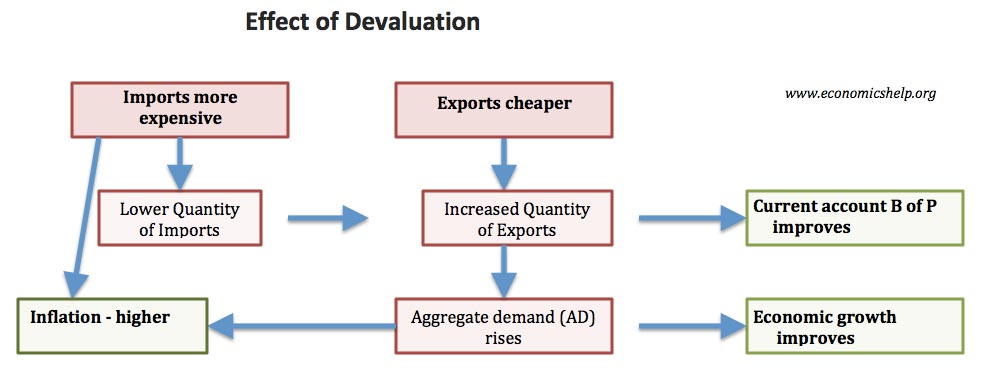

The impact of a falling exchange rate

A look at the economic impact of a fall in the exchange rate (termed depreciation or devaluation) A fall in the exchange rate is known as a depreciation in the exchange rate (or devaluation in a fixed exchange rate system). It means the currency is worth less compared to other countries. When there is a …