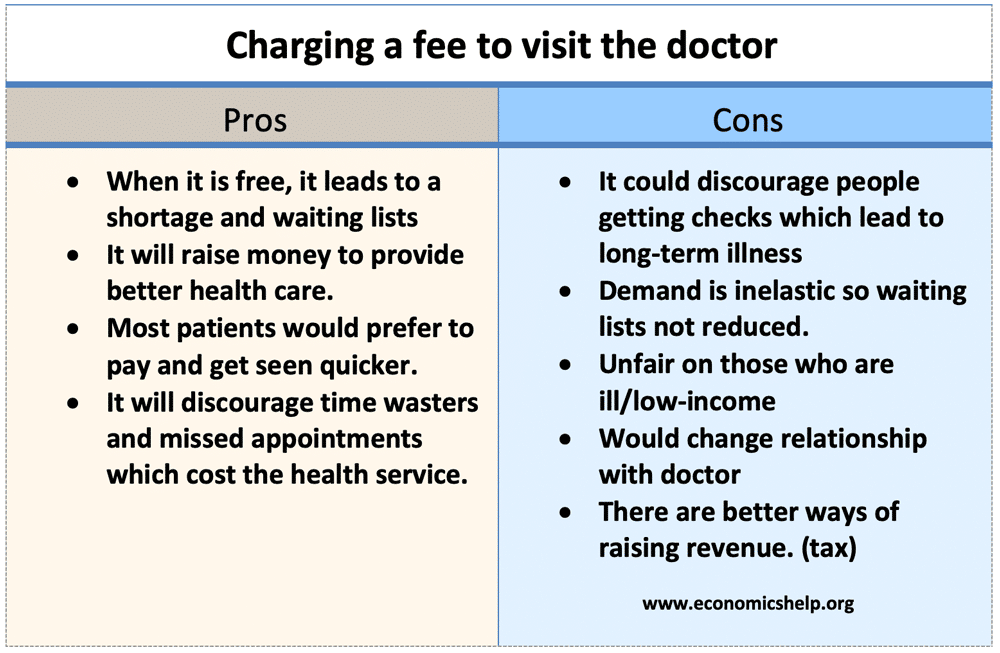

Should we pay to visit the doctor?

Should visiting a GP doctor be free or should we pay to visit the doctor? It is an emotional issue as in the UK there is a strong acceptance of free health care, but what are the economic arguments? Could we have better health care by charging people to see their GP? Benefits of charging …