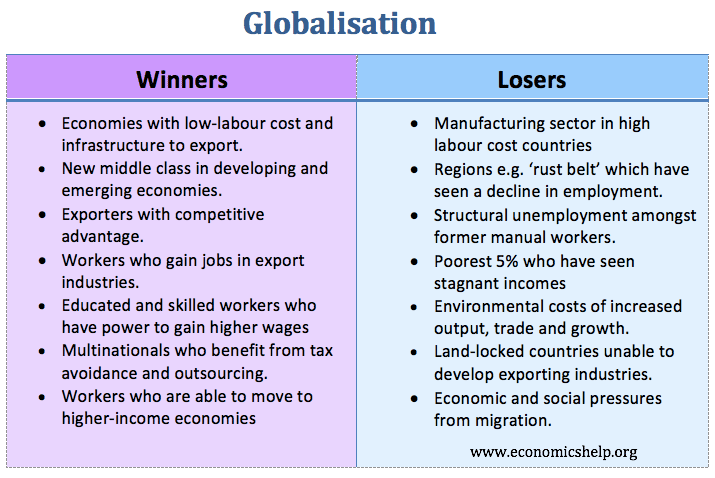

Winners and losers from globalisation

Globalisation involves the increased integration and interdependence of the global economy. Since the 1960s, there has been an increased rate of globalisation, which has been characterised by rising trade, rising exports as % of GDP, greater movement of labour and capital, and an increased interdependence of the global economy. Globalisation has benefitted some countries more …