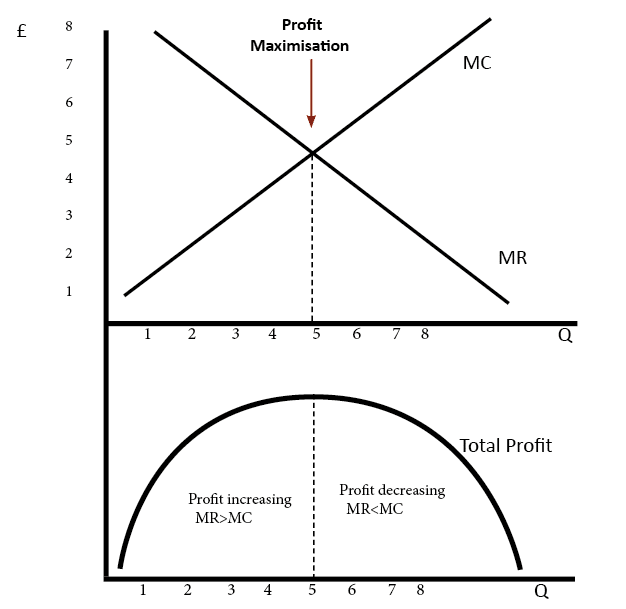

Profit Maximisation

An assumption in classical economics is that firms seek to maximise profits. Profit = Total Revenue (TR) – Total Costs (TC). Therefore, profit maximisation occurs at the biggest gap between total revenue and total costs. A firm can maximise profits if it produces at an output where marginal revenue (MR) = marginal cost (MC) Diagram …