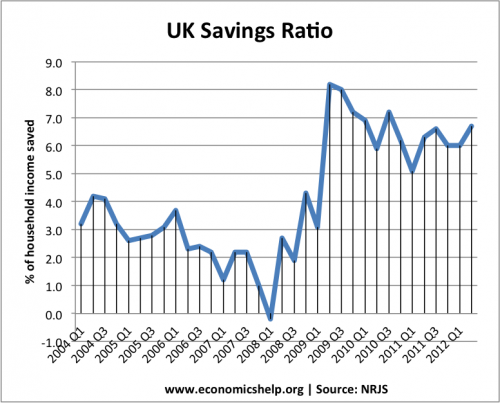

The savings ratio a big determinant of economic activity. Consumer spending accounts for 63% of GDP – dwarfing other areas, such as government spending, investment and exports. A rise in the savings ratio can have a very significant impact on economic activity.

A blogger, mentioned a minister, Liam Fox calling for more savings.

Former cabinet minister Liam Fox has urged the government to freeze public spending for five years and use the savings to cut taxes and the deficit.

Stamp duty and taxes on bank account interest could be reduced to help create a “savings investment culture”, the ex-defence secretary said. (BBC)

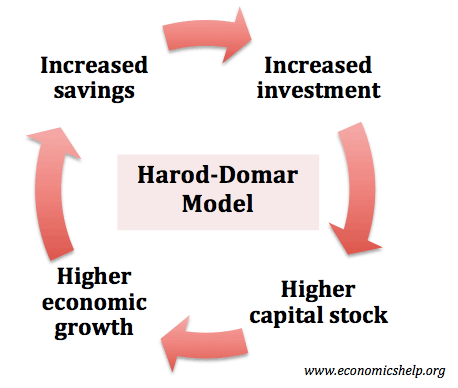

In principle, there’s nothing wrong with a ‘savings investment culture’. Higher savings can help finance higher levels of investment and boost productivity over the longer term.

- In economics, we say the level of savings equals the level of investment. Investment needs to be financed from saving.

- If people save more, it enables the banks to lend more to firms for investment.

- An economy where savings are very low means that the economy is choosing short-term consumption over long-term investment. To starve the economy of investment can lead to future bottlenecks and shortages.

- The Harrod-Domar model of economic growth suggests the level of savings is a key factor in determining economic growth rates.

Short-term rise in savings

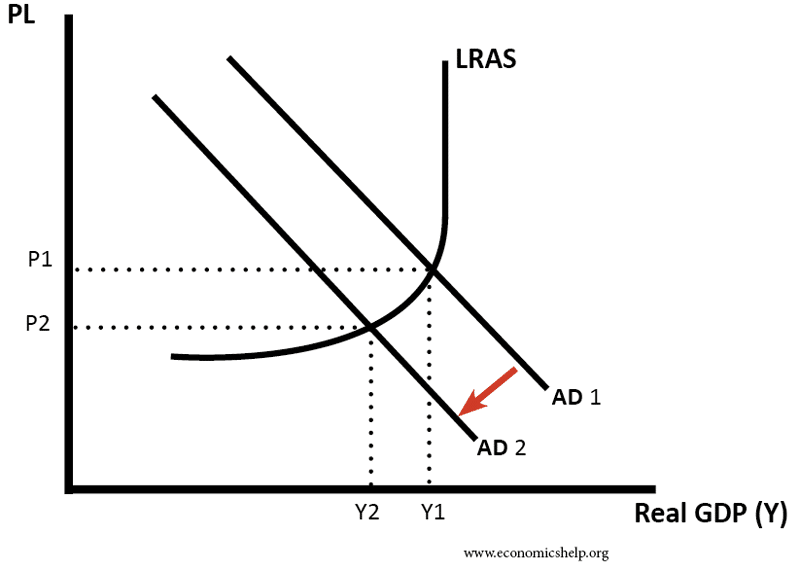

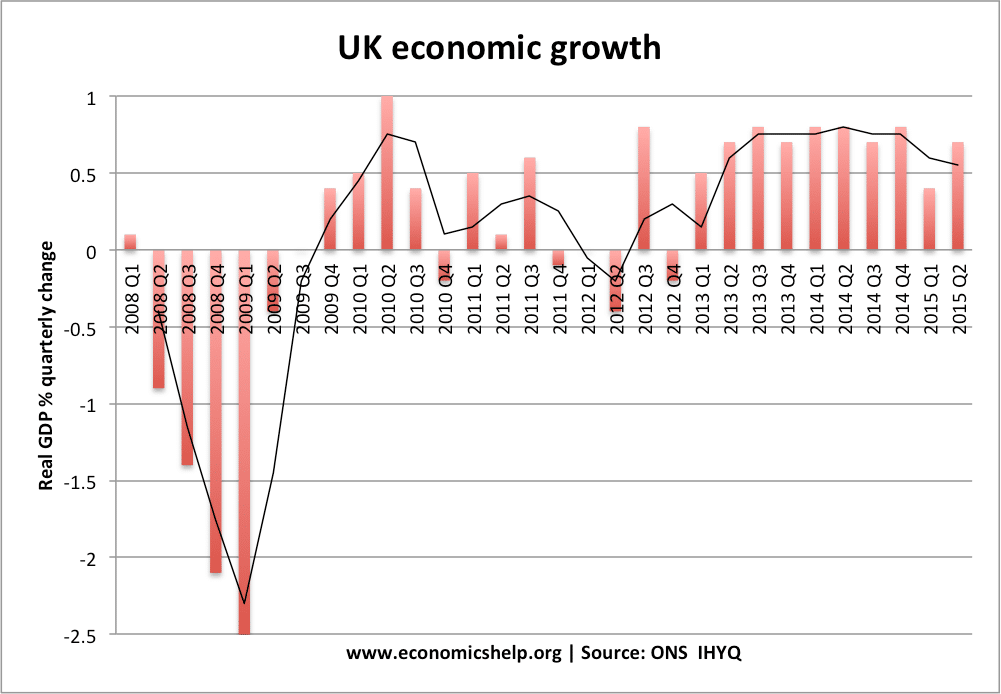

Whilst in the long-term, savings are an important factor in determining investment. In the short-term, a rapid rise in savings could cause a fall in consumer spending which can lead to a recession.

Since consumer spending accounts for 63% of GDP, this rapid increase in savings and a fall in spending was a significant cause of the 2008/09 recession. The continued reluctance of consumers to spend is a significant factor in the continued economic stagnation.

In this circumstance, a rapid rise in saving does not cause an equivalent rise in investment. Although banks see a rise in their deposits, they are reluctant to lend to firms – because the economic outlook is pessimistic. Also, in a recession, banks may not want to invest – even if banks are willing to lend at low rates. A recession, usually sees a sharp fall in investment.

At this point, a slight fall in the savings rate and corresponding rise in consumer spending would help promote economic recovery.

Paradox of thrift

It’s a bit of a paradox. We tend to think of savings as good and virtuous; and at the right time, it is. But, if everyone saves at once, it can cause a drop in aggregate demand and cause a recession. Keynes called it the Paradox of Thrift.

There is also the paradox of savings – people save more when they think it’s a bad time to save and save less when it’s a good time to save!