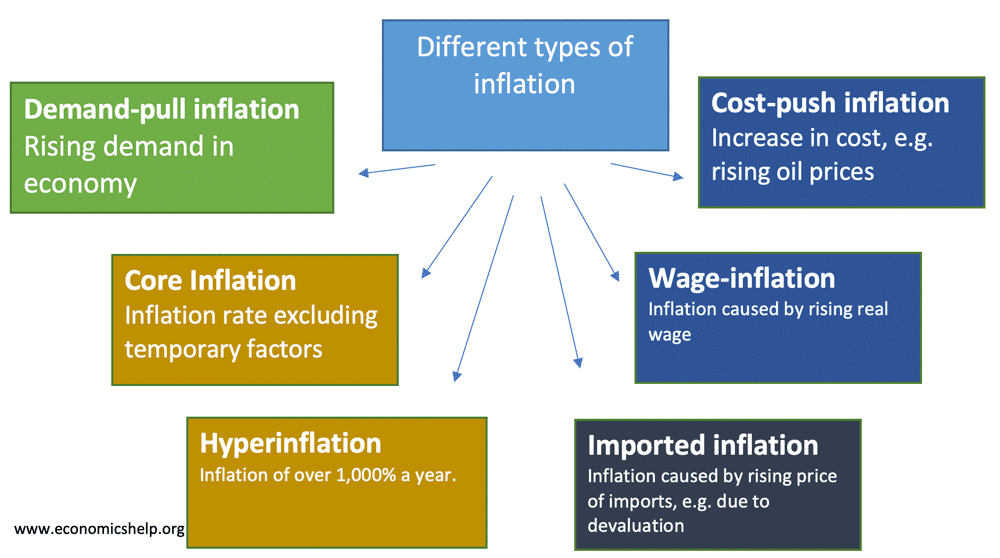

Inflation means a sustained increase in the general price level. The main two types of inflation are

- Demand-pull inflation – this occurs when the economy grows quickly and starts to ‘overheat’ – Aggregate demand (AD) will be increasing faster than aggregate supply (LRAS).

- Cost-push inflation – this occurs when there is a rise in the price of raw materials, higher taxes, e.t.c

We can also categorise inflation by how fast the price increases are, such as:

- Disinflation – a falling rate of inflation

- Creeping inflation – low, but consistently creeping up.

- Walking/moderate inflation – (2-10%)

- Running inflation (10-20%)

Types include of inflation include

1. Demand-pull inflation

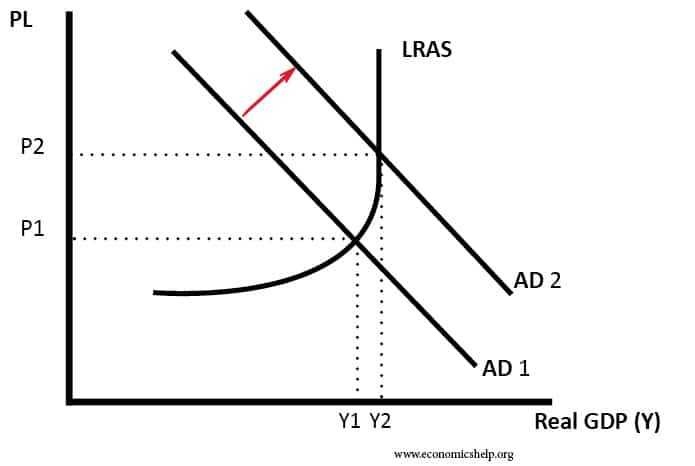

This occurs when AD increases at a faster rate than AS. Demand-pull inflation will typically occur when the economy is growing faster than the long-run trend rate of growth. If demand exceeds supply, firms will respond by pushing up prices.

A simple diagram showing demand-pull inflation

The UK experienced demand-pull inflation during the Lawson boom of the late 1980s. Fuelled by rising house prices, high consumer confidence and tax cuts, the economy was growing by 5% a year, but this caused supply bottlenecks and firms responded by putting up prices. Therefore the inflation rate crept up.

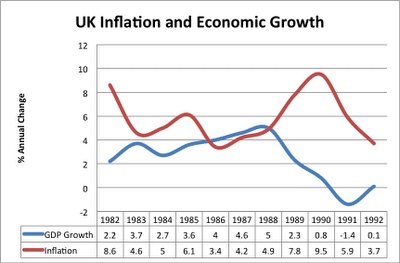

This graph shows inflation and economic growth in the UK during the 1980s. High growth in 1987, 1988 of 4-5% caused an increase in the inflation rate. It was only when the economy went into recession in 1990 and 1991, that we saw a fall in the inflation rate. See: Demand-pull inflation.

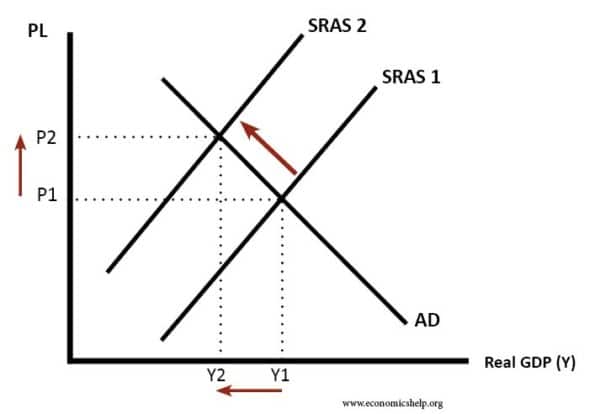

2. Cost-push inflation

This occurs when there is an increase in the cost of production for firms causing aggregate supply to shift to the left. Cost-push inflation could be caused by rising energy and commodity prices. See also: Cost-Push Inflation

Diagram showing cost-push inflation.

Example of cost-push inflation in the UK

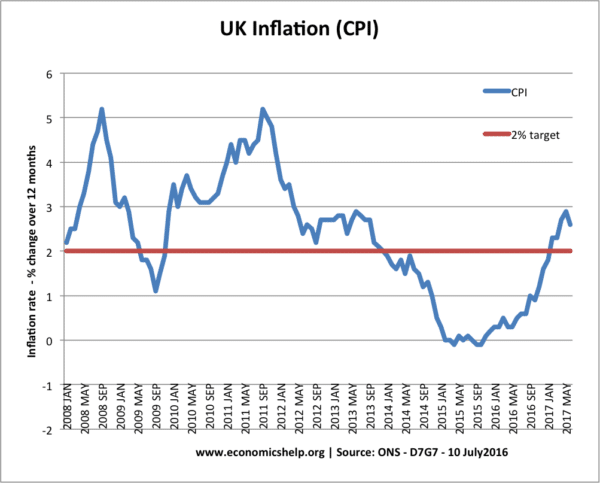

In early 2008, the UK economy entered a deep recession (GDP fell 6%). However, at the same time, we experienced a rise in inflation. This inflation was definitely not due to demand-side factors; it was due to cost push factors, such as rising oil prices, rising taxes and rising import prices (as a result of depreciation in the Pound) By 2013, cost-push factors had mostly disappeared and inflation had fallen back to its target of 2%. After the June 2016 Brexit referendum, Sterling fell another 13% causing another period of cost-push inflation in 2017.

Sometimes cost-push inflation is known as the ‘wrong type of inflation‘ because this inflation is associated with falling living standards. It is hard for the Central Bank to deal with cost push inflation because they face both inflation and falling output.