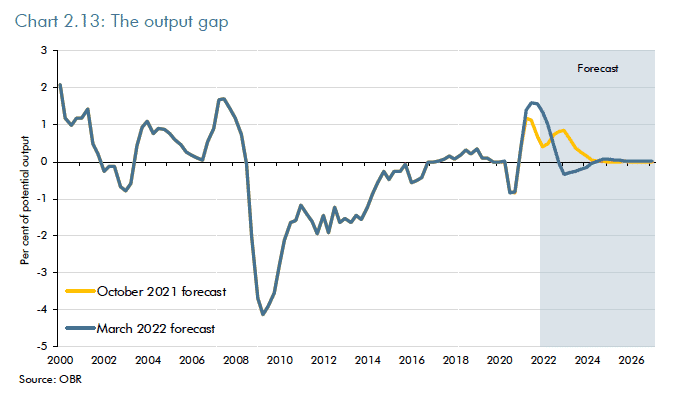

The output gap is a measure of the difference between actual output (Y) and potential output (Yf).

Output gap = Y- Yf

A Negative Output Gap occurs when actual output is less than potential output gap. In a recession, a fall in Real GDP causes a negative output gap. However, it can become difficult to know what potential output should actually be. Therefore, there can be different opinions about how the size of the output gap.