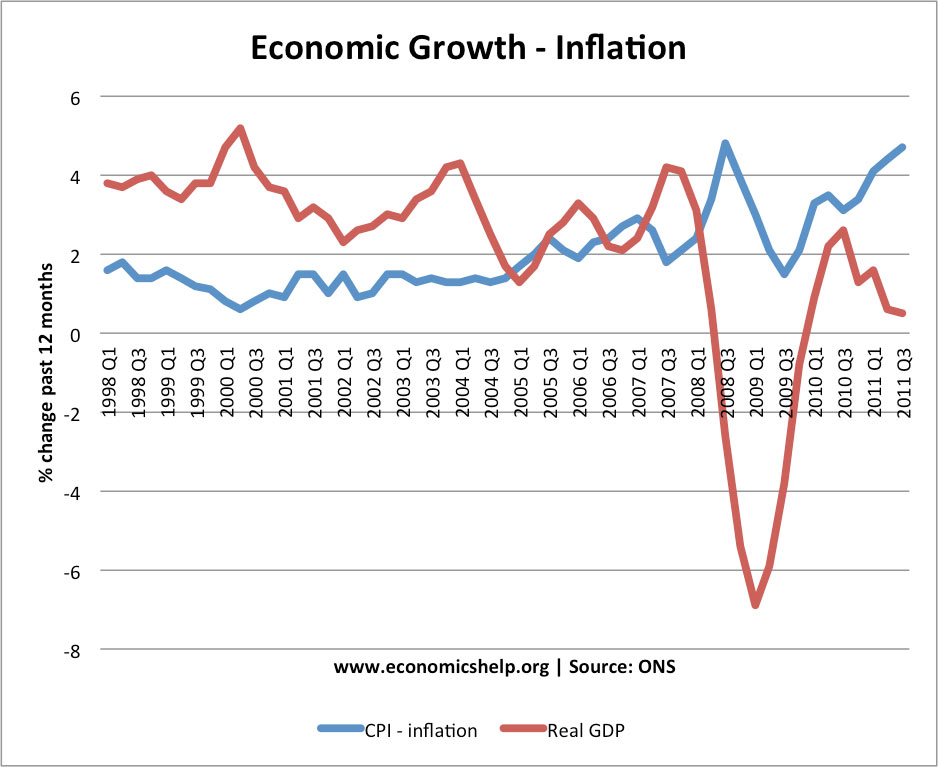

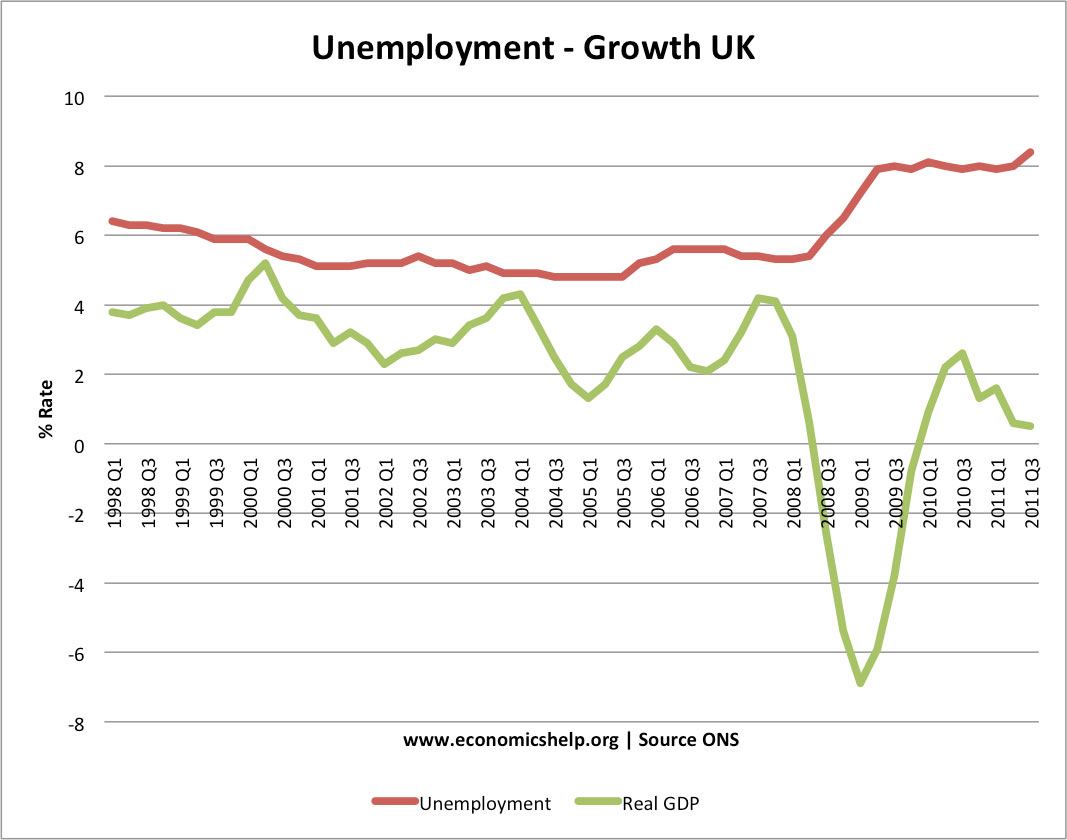

Since 2007, the UK has experienced a variety of economic shocks which have caused a prolonged period of economic stagnation, high unemployment and uncertainty. In 2011, the economic recovery proved much weaker than expected, yet inflation was stubbornly high. In 2012, fundamental weaknesses are likely to keep the UK economy depressed with high unemployment and low / negative growth. The one small crumb of comfort is the expected fall in headline inflation.

UK Snapshot

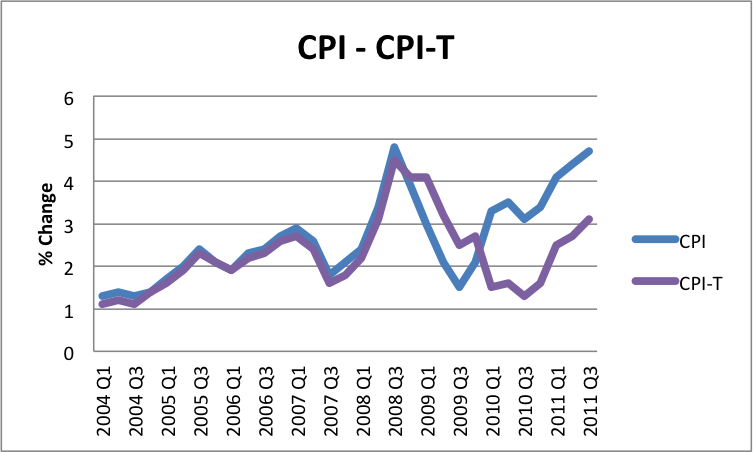

UK Inflation 2012

In 2011, CPI inflation reached 5.2%. RPI reached over 6%. (CPI RPI Inflation) However, the Bank of England forecast a sharp fall in inflation during 2012. This is because in 2011, inflation was caused by temporary cost-push factors, which will expire during the course of 2012. These cost-push factors include:

- One-off tax rises, such as VAT

- Effect of devaluation and higher import prices

- Rising commodity and food prices

In 2012, underlying inflationary pressures will be weak. Spending cuts, high unemployment and weak wage growth will prevent any demand-pull inflation. A global economic slowdown will weaken pressure on commodity prices. There is risk by end of 2012, inflation could fall below government’s target of 2%

Inflation Forecast 2012/2013

The Bank of England forecast a sharp fall in inflation in 2012. (Bank of England inflation forecast)

Interest Rate Forecast 2012

With this inflation forecast, and prospect of double dip recession it is highly unlikely the Bank of England will be wanting to increase interest rates during 2012. (Interest rate forecast)

Unemployment

2011 was a grim year for unemployment in UK and EU. The ILO measure of unemployment rose to over 2.6 million. Youth unemployment rose to over 1 million, with an increase in the average duration of unemployment. With weak / negative growth predicted for 2012, unemployment is likely to continue to slowly rise.