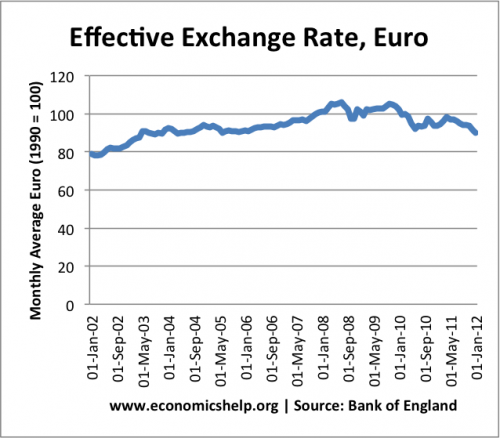

Despite the weakness of the UK economy, the Pound is forecast to rise against the Euro, due to the ongoing uncertainty surrounding the debt crisis in the Eurozone. With Greece and other countries at risk of default, and even facing the prospect of a Euro break up, the Pound Sterling looks relatively attractive – despite low growth and low interest rates in the UK.

The UK economy is slowly emerging from the worst recession since the Great Depression of the 1930s. The recovery is being helped by:

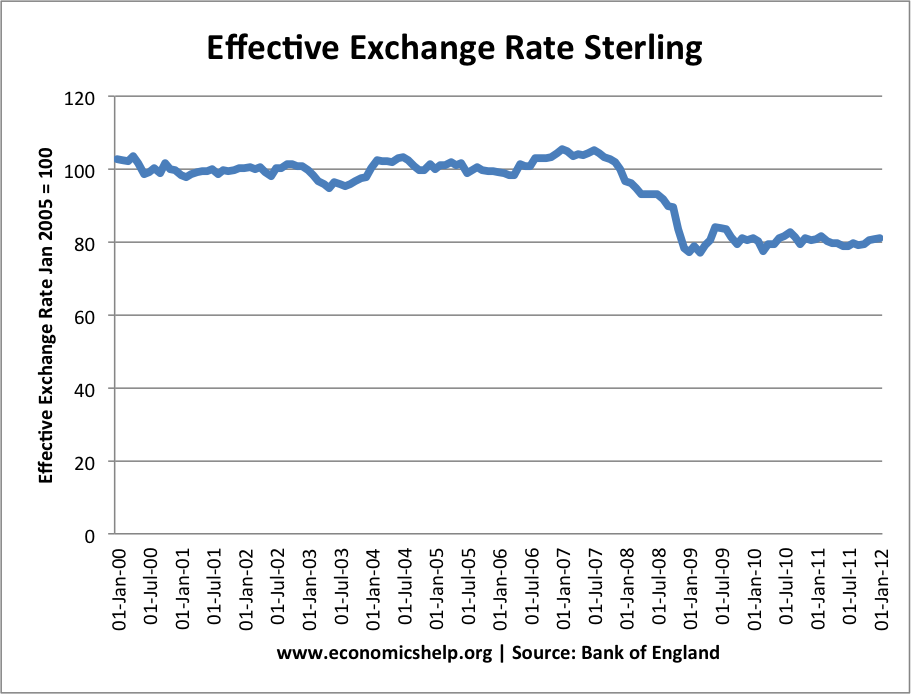

- A weak pound

- Unprecedented loose Monetary policy – zero interest rates, quantitative easing.

However, the recovery is being held back by

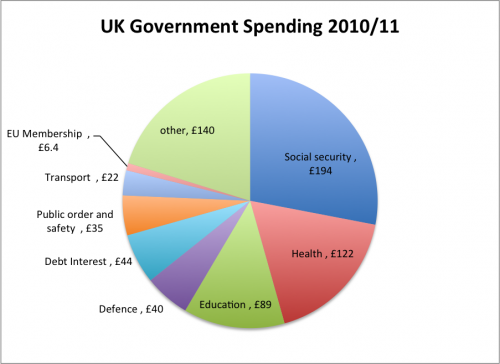

- Fiscal tightening – government spending cuts which have reduced confidence and reduced aggregate demand (AD)

- Slow economic growth in Europe

- Rise in oil prices

- Reduced real wages (inflation higher than nominal wage growth during 2011 early 2012)

In 2012, inflation is likely to fall as cost-push factor expire, however growth is still likely to be anemic and the Bank of England is very unlikely to increase interest rates before the end of 2012 (See: interest rate predictions)

With interest rates of 0.5% and slow growth – this would usually lead to a weak Pound. (Investors would save money in countries offering a better rate of interest) However, at the moment, there are few opportunities for investors to find high interest rates with also security of investment. For example, investors were buying Swiss Francs, but the Swiss authorities had to intervene to prevent the Swiss Franc rising too quickly.

Crisis in the Eurozone

Continued weakness in Euro since the start of 2010