Readers Question: There just seems to be many paradoxical actions taking place in markets and economies at the moment. How do we explain?

Paradoxes of UK economy

- Low interest rates have not increased spending / economic growth

- Despite recession, inflation has been above target.

- Despite recession and depreciation of Pound, current account deficit increased in size in 2012

- Spending cuts failed to reduce the budget deficit as the government hoped.

- Despite a longer recession than great depression of 1930s, unemployment is lower than in other more moderate recessions.

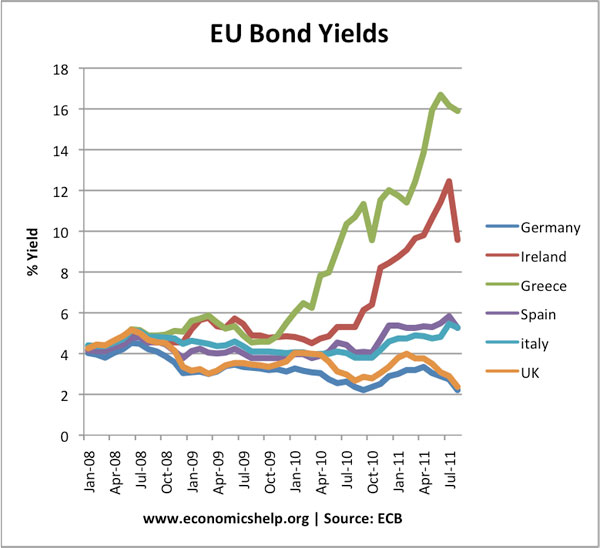

- Record levels of government borrowing have led to a record fall in government bond yields (the opposite of what some people predicted)

- Quantitative easing (increasing money supply) has not actually increased the money supply !

How to explain these paradoxes

1. Zero interest rates have not increased spending

For the past few years, we have been experiencing an unusual combination of circumstances where many ‘ordinary’ rules of economics are not occurring. The economy is currently experiencing a liquidity trap. A liquidity trap involves:

Low-interest rates failing to increase demand. Usually, lower interest rates boost spending because it is cheaper to borrow; but in this current economic situation, even interest rates of 0.5% have failed to see a rapid increase in aggregate demand. Low-interest rates have failed to increase spending and investment because

- Confidence is very low. People don’t want to invest when a double-dip recession is forecast. People are reluctant to spend when they fear unemployment

- House prices and other assets have fallen. Therefore, this creates a negative wealth effect and discourages spending.

- Banks are reluctant to lend because of their liquidity shortages. Therefore, although it is in theory cheap to borrow, it is difficult to get a loan in the first place (e.g. mortgage criteria have become much stricter)

- Banks have a funding gap. This funding gap explains why extra money supply from Quantitative easing hasn’t led to higher bank lending – they have been trying to improve their balance sheet.

- Although Central Bank base rates have fallen to 0.5%, many commercial banks haven’t passed these interest rate cuts onto consumers

- See also: expansionary monetary policy

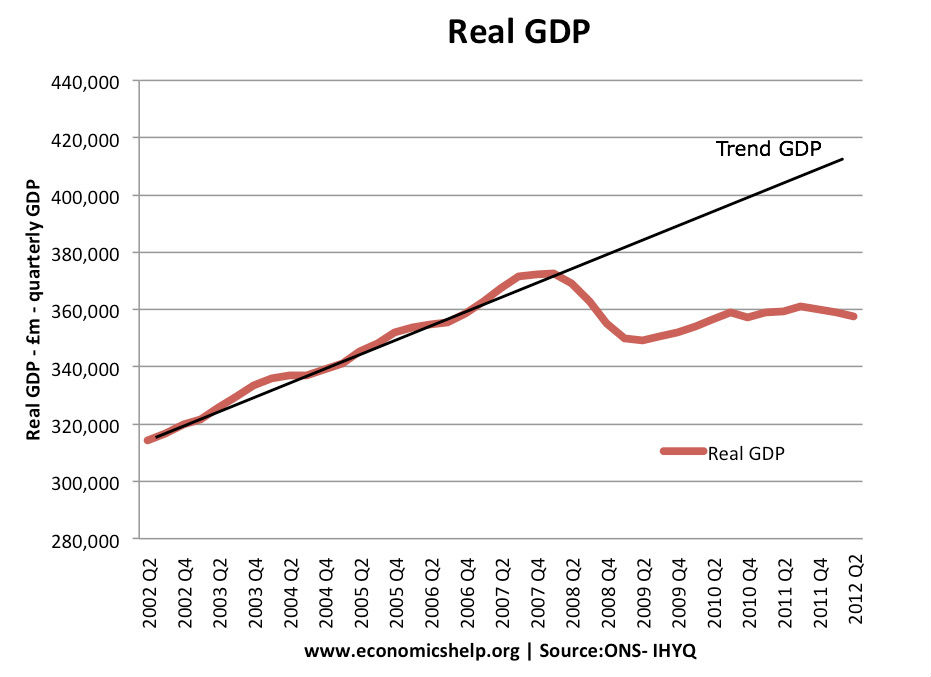

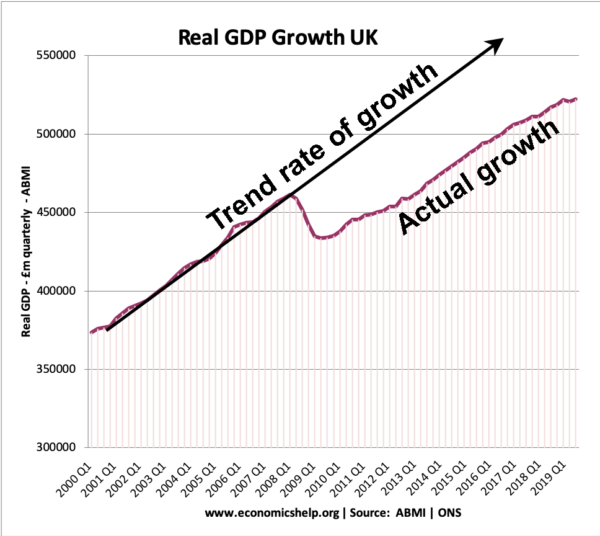

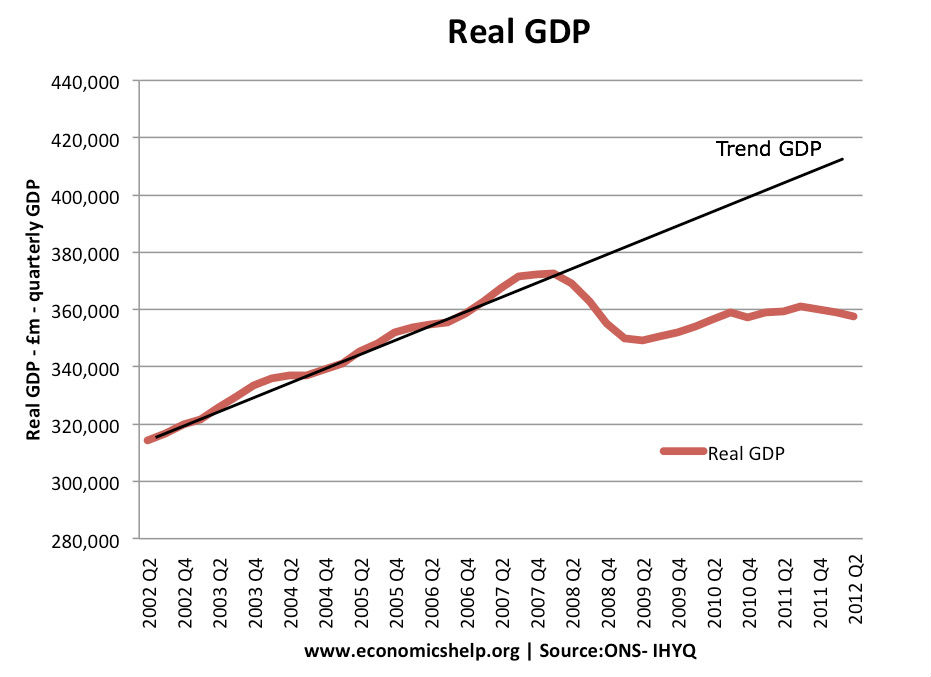

- UK recession of 2008-13 is longest on record

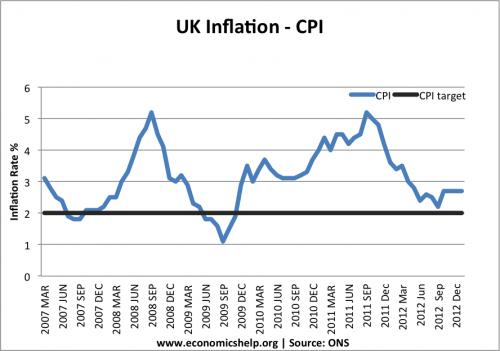

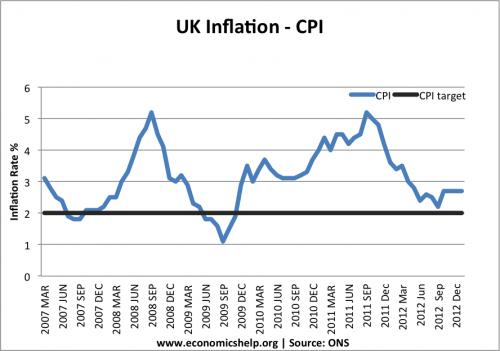

2. Despite recession – inflation above target

Despite a prolonged recession, inflation in the UK has been above target. Firstly, inflation has only been moderately above target. But, with falling wages, many households have seen a fall in their real wages – inflation has been higher than income growth. Therefore, this moderate inflation has been much more noticeable than usual. If your incomes are rising, you don’t mind price increases. But, this recession has seen an unwelcome combination of rising prices and falling wages – reducing living standards.

But, usually in a recession, you would expect a lower inflation rate (lower demand leads to lower prices, higher unemployment leads to falling wages e.t.c). Why has this not occurred?

The inflation is not due to the usual causes of inflation (excess demand in the economy).

Inflation in the UK was high between 2008 and 2012 because

- Rising price of oil – causing cost push inflation

- Higher tax rates – causing one-off increases in tax

- Impact of depreciation – causing a rise in import prices

- Rising energy prices, such as gas and electricity.

When these temporary factors are stripped away, the underlying core inflation is actually quite low. See also: inflation stats

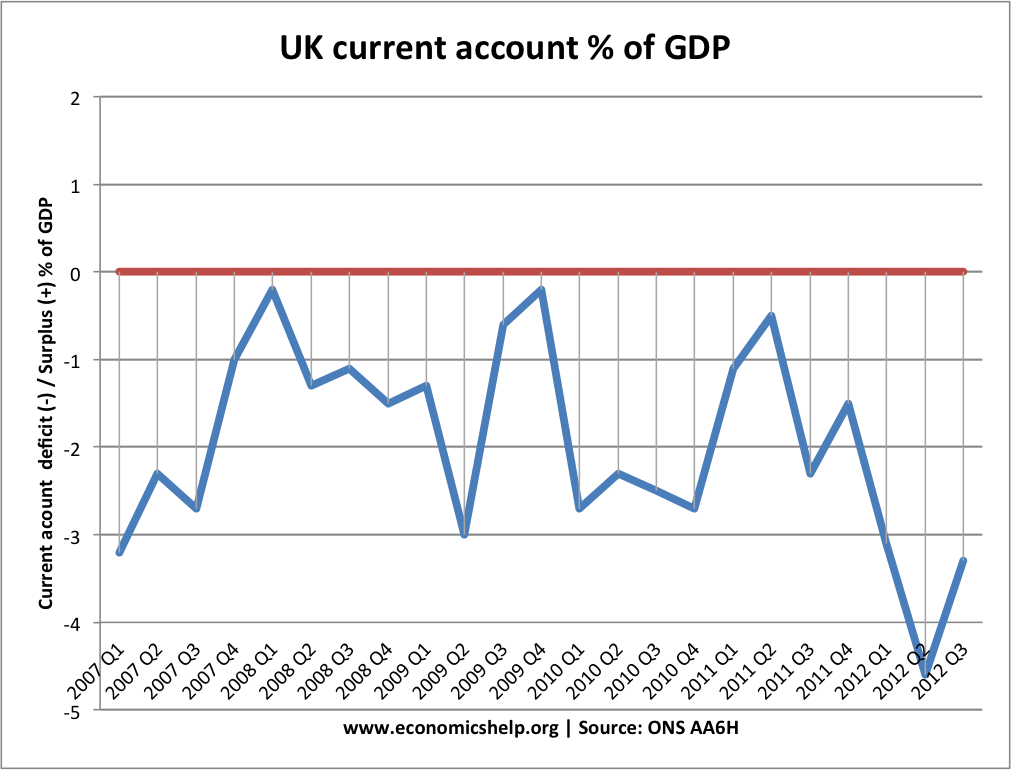

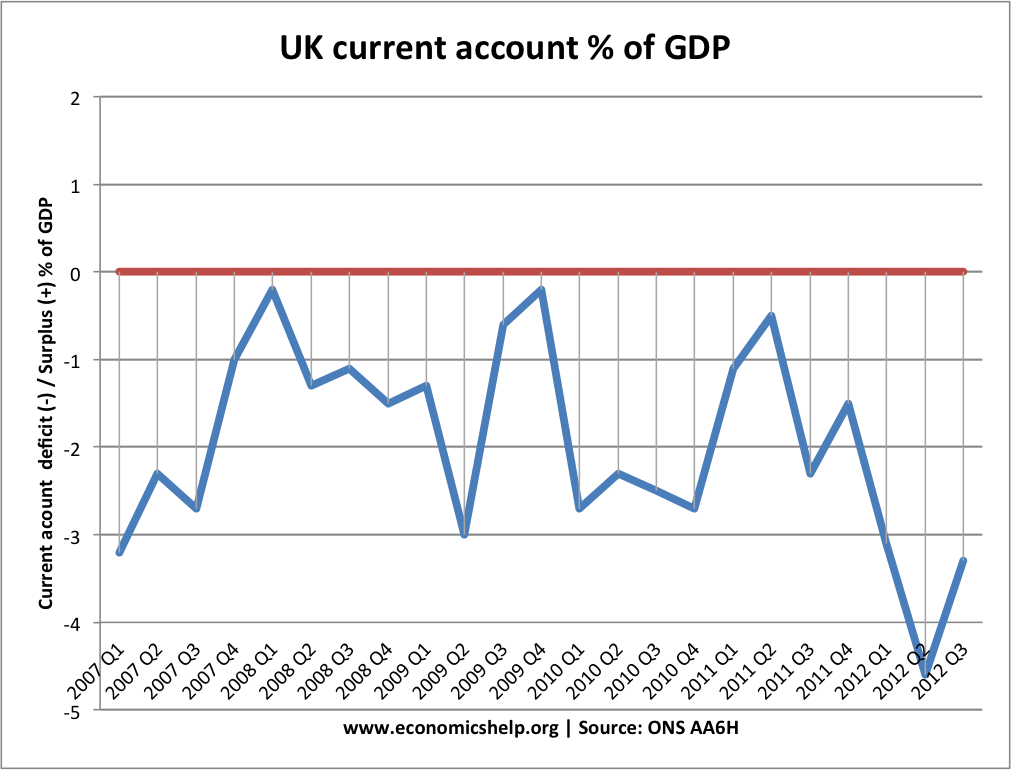

3. Despite recession and depreciation of Pound, current account deficit increased in size in 2012

In the latter part of 2012, the UK pound fell in value. Also, the double-dip recession led to lower consumer spending. Usually, this leads to an improvement in the current account. A depreciation makes exports cheaper and imports more expensive. A recession reduces spending on imports. Both should improve the current account.

Read more

(

(