Readers Question: What should the government do to improve the American standard of living?

How could the President + Congress, make the biggest difference to improving American standards of living in the long run?

These are a few policies which I feel would improve US living standards.

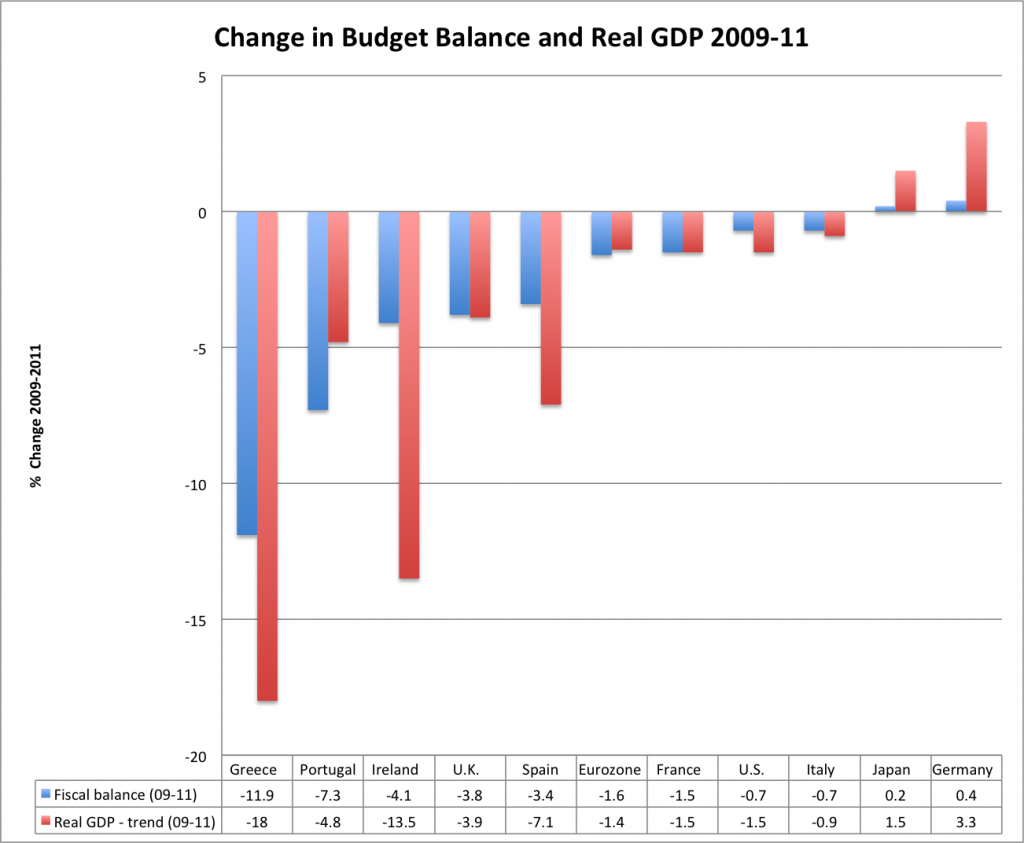

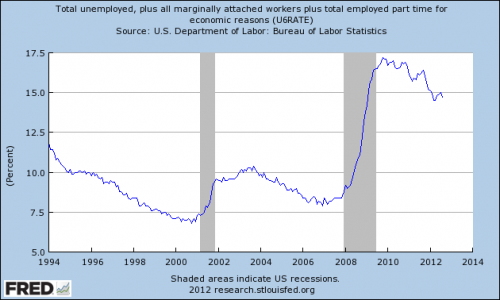

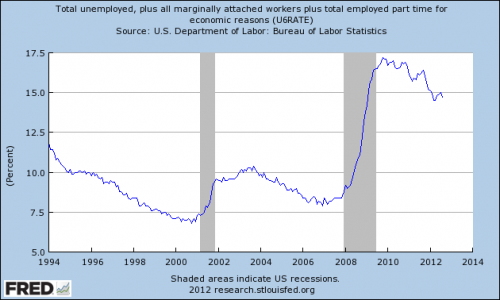

1. Reduce Unemployment. The rise in US unemployment is one of biggest social and economic problems the US faces. A key factor is the sharp rise in unemployment since the start of the recession in 2008.

This graph shows unemployment, plus ‘partial’ unemployment – workers facing part time work rather than full time job.

The US unemployment rate would have been worse without some federal fiscal expansion and the partial monetary expansion we have seen. In this regards, the US are doing better than say the Eurozone. However, there is still a need for stronger US economic growth to enable a more sustained reduction in unemployment. This requires a combination of expansionary fiscal and monetary policy to maintain the weak economic recovery. If the US recovery is sustained, that will leave them in a much better position to deal with their long term debt.

2. Tax on investment income.

Currently tax on investment income is taxed at a lower rate than income. It means that millionaires who receive their income through dividends and capital gains, pay a lower average tax rate than people on much lower incomes. Increasing tax on wealthy would help improve tax revenues and also create greater equality in society. (See also: why is US investment income taxed less than income? – business insider). Recently, President Obama developed the “Buffet Rule,” (named after billionaire investor Warren Buffet), which says rich people shouldn’t pay taxes at a lower rate than ordinary workers. Obama has stated that people making more than $1 million should pay at least 30 percent of their income in taxes. I would go further and increase the marginal tax to 40% for incomes over $1 million.

3. Tax on Gasoline

source: tax

US tax on gasoline is substantially less than in Europe. In the US, the average tax on gasoline is 48.9 cents per gallon for gas. By contrast in the UK, tax is over 70p.

Higher petrol tax help US living standards through various means:

- Raise revenue to help deal with budget deficit

- Raise revenue which can be spent on improving America’s infrastructure (roads/railroads). These are ‘public goods’ which are underprovided in a free market and need to be paid for out of general taxation. Better infrastructure would help improve the supply side of the economy.

- Reduce foreign dependency on oil. In 2008, the US spent $430 billion on importing oil from other countries. Higher gasoline tax would encourage people to use oil more conservatively. It would also encourage the purchase of more fuel efficient cars (e.g. fewer SUVs – more hybrid cars). Higher oil prices would also encourage firms to develop alternative energy sources.

- By reducing the consumption of oil, it would make a contribution to decreasing America’s CO2 emissions.

- Higher petrol tax may encourage Americans to cycle and walk rather than drive anywhere – this would help improve health standards.

4. Universal Health Care – Free at the point of use

The US spends 15% of its GDP on health care and this is rising because of an ageing population and improvement in medical science creating more expensive treatments. At the moment there is a patchy system of private insurance. This system encourages more expensive treatment, but still not everyone is guaranteed. If you look at European universal health care systems, there is a lower total % of GDP spent on health care, however there is better universal health care coverage. Universal health care free at the point of use would cut out private health insurers. It could lead to lower wage costs as firms and workers can pay less than they currently do.

Health Care in US and UK

| % of health care spending as % of GDP | Govt spending as % of total health care | Per Capita expenditure 2006 (PPP) | Doctors per 10,000 population | Nurses / midwives per 10,000 | Hospital beds per 10,000 | Life Expectancy | male obesity | |

| UK | 8.2 | 87.3 | 2815 | 23 | 128 | 39 | 80 | 22% | |

| US | 15.3 | 45.3 | 6719 | 26 | 94 | 31 | 78 | 31% | |

US health care costs were 7% of GDP in 1970. UK was 4% of GDP in 1970 (Runaway health care costs)

More on US vs British health care

In terms of the US long run budget deficit, the growing demand for health care spending (through Medicare and Medicaid) are one of the strongest demands on US federal spending. Dealing with this growth in health care spending is a key factor to ensuring sustainability in US public finances.

5. Improve Public Health

Related to health care is the issue of obesity and the growing diseases of affluence. In the United States, obesity has overtaken tobacco as the biggest killer of people. 16% of all deaths in the US (400,000 a year) are attributed to obesity. [1] Obesity and poor public health are a key factor in reducing living standards.

Rather than spending money on treatment of diseases, (which the current model promotes) there needs to be greater focus on improving health and preventing related health problems. The government could promote a healthier, less obese, population by:

- Taxing sugary / fatty foods.

- Regulation of the food industry to reduce portion size e.t.c.

- Ending the subsidies of corn starch which has encouraged growth of high sugar foods. (billions in tax subsidies to junk industry)

- Encouraging cycling and pedestrians in city centres – giving less priority to motor cars.

Read more