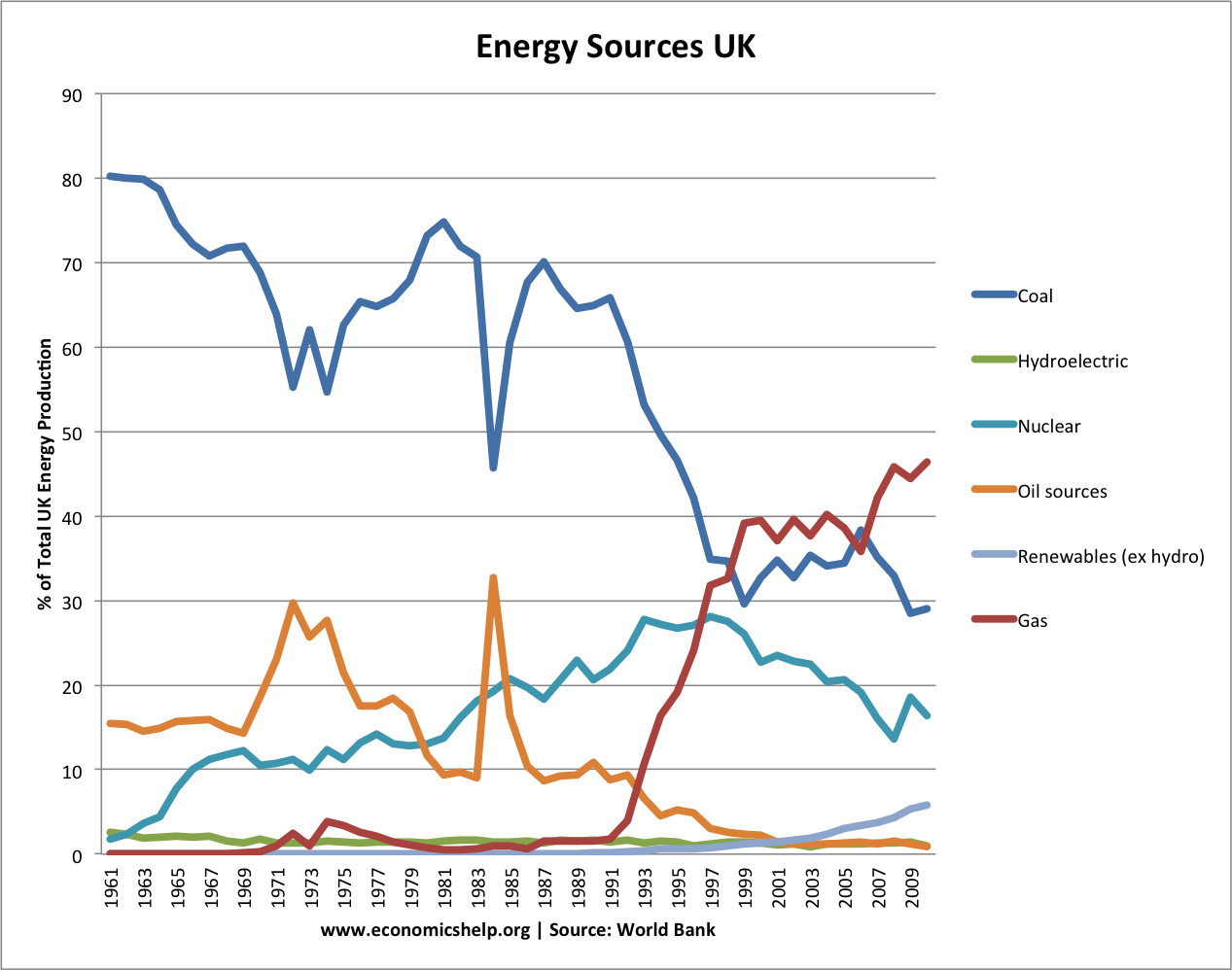

A look at the changing profile of energy production in the UK.

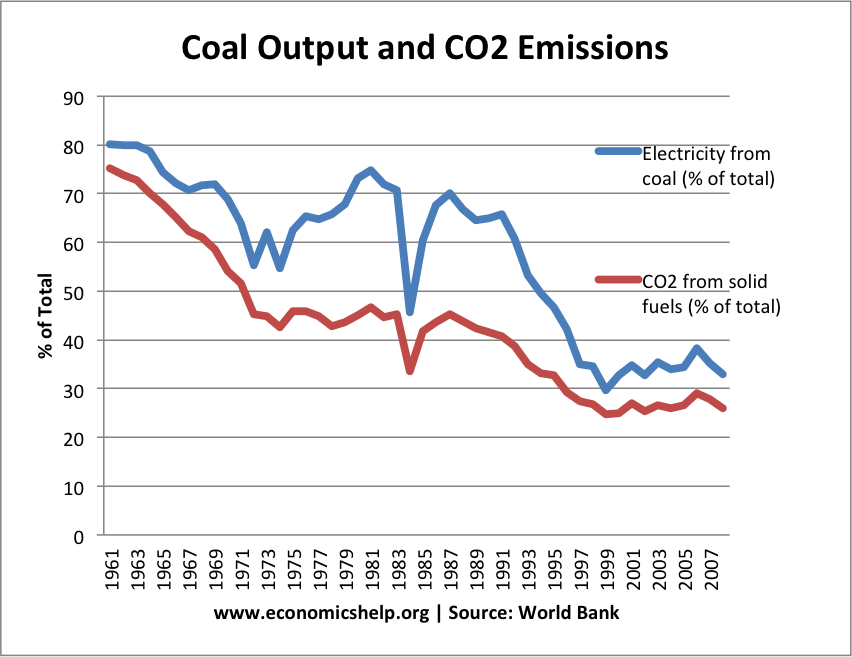

In the early 1960s, coal provided 81% of UK energy needs By 2010, this had fallen to 30%. At peak times in cold winters, coal use can increase to 40% of the UK’s electricity production. Despite a revival in coal production in the last year. A third of our current coal power stations are expected to close by 2016 so that they meet EU air quality legislation.

The % of electricity from coal has continued to fall. (The big drop in 1984 was the coal miners strike.)