Readers Question: Why is it, that some countries e.g USA, UK, Japan etc can electronically create money whereas India, Germany, Euro etc have to work, trade and manufacture exports and growth to keep pace with the above mentioned ?

Any country could electronically create money if they wanted to. To summarise, the only good time to create money is when the economy is in a liquidity trap – a deep recession where even low interest rates fail to close the output gap.

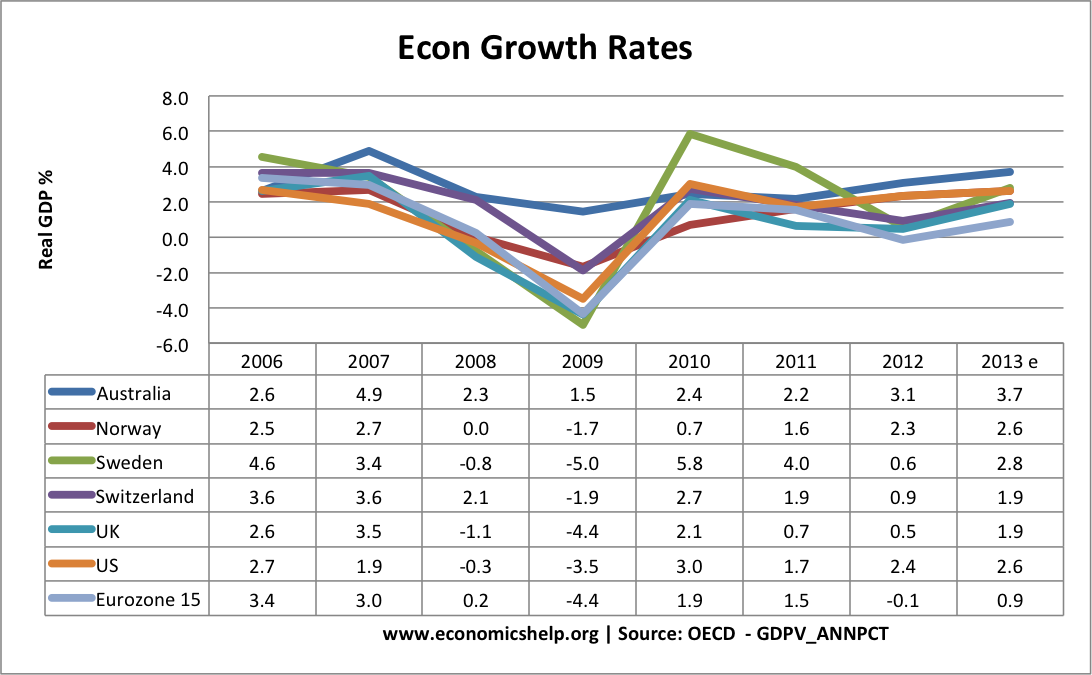

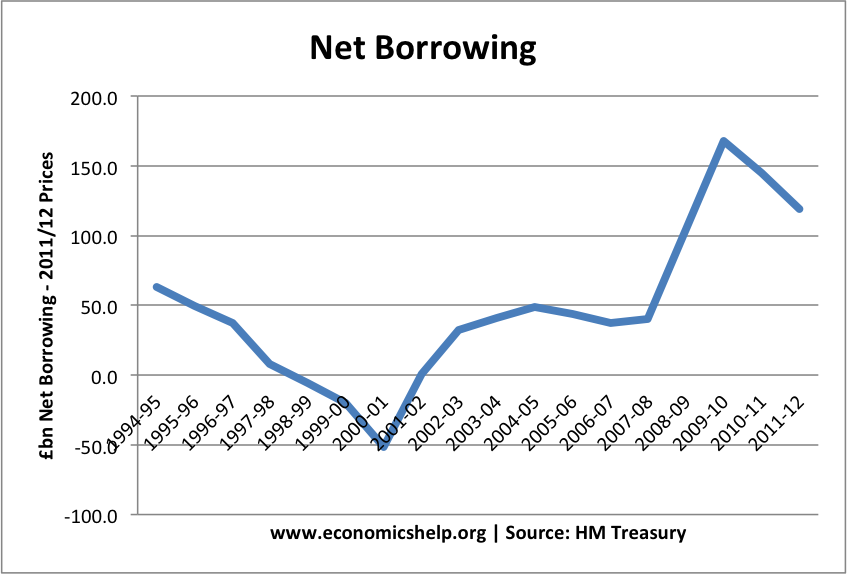

The US, UK and Japan have pursued quantitative easing because the recession of 2008-12 was very deep and conventional monetary policy seemed ineffective in ending the recession.

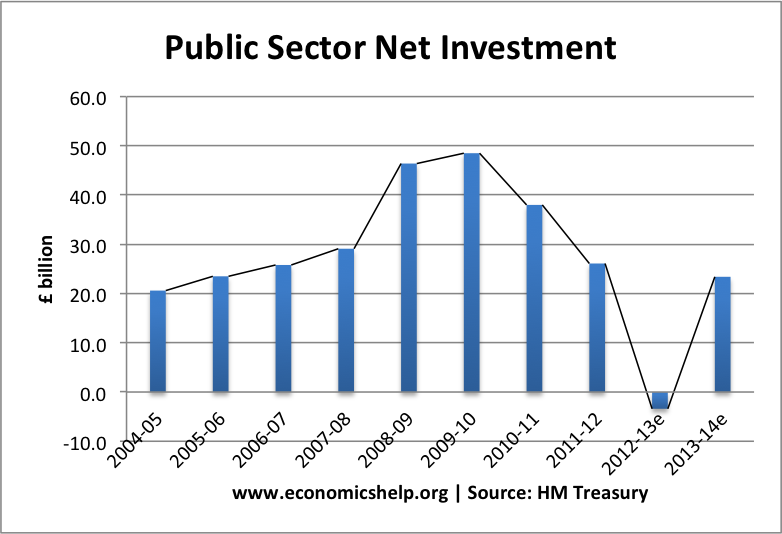

Arguably, Quantitative easing would have been more successful in UK and US if it had been combined with expansionary fiscal policy or giving to consumers directly. But, the hope was creating money electronically (quantitative easing) would lower long term interest rates, increase bank lending and promote economic recovery.

It is important to bear in mind, creating money doesn’t create any actual output. It’s purpose is to increase demand and help unemployed resources to become better utilized.

Why doesn’t the Eurozone create money electronically?

The ECB is much more reluctant to create money. In the past, they have argued that constitutionally they cannot (though this has become somewhat more blurred recently) . The big fear that Europe (and Germany especially) have is that creating money will cause inflation. Therefore, the ECB have been reluctant to pursue quantitative easing to help the economic malaise.

Read more