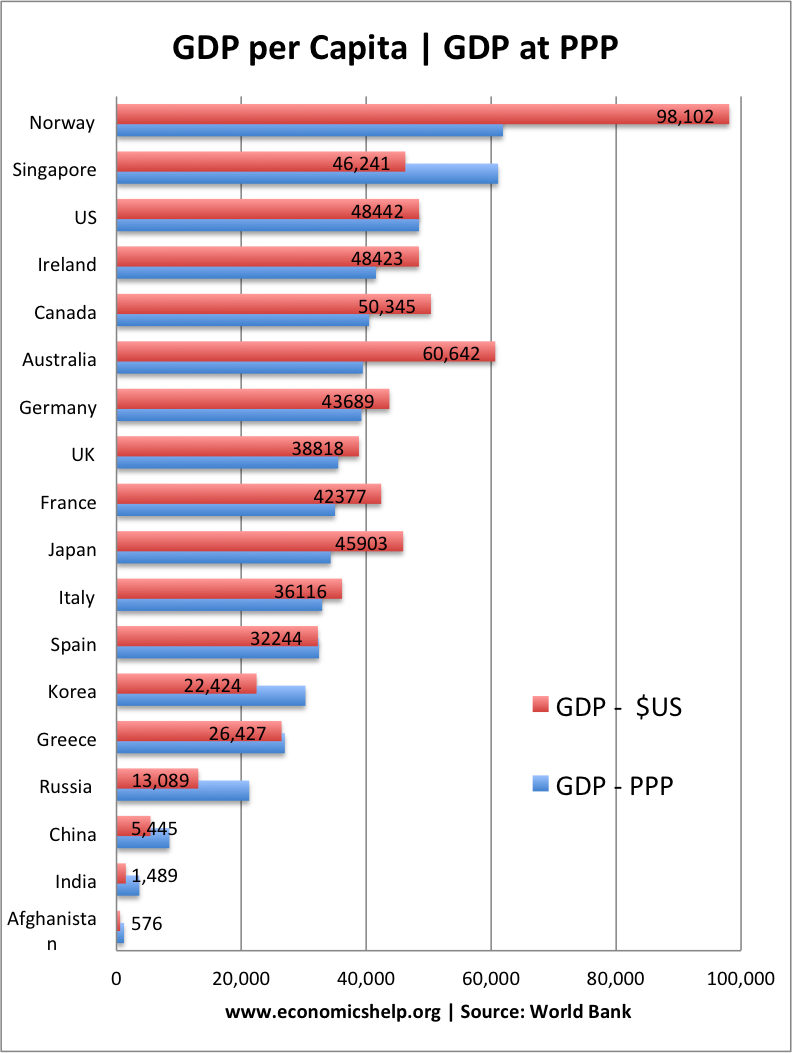

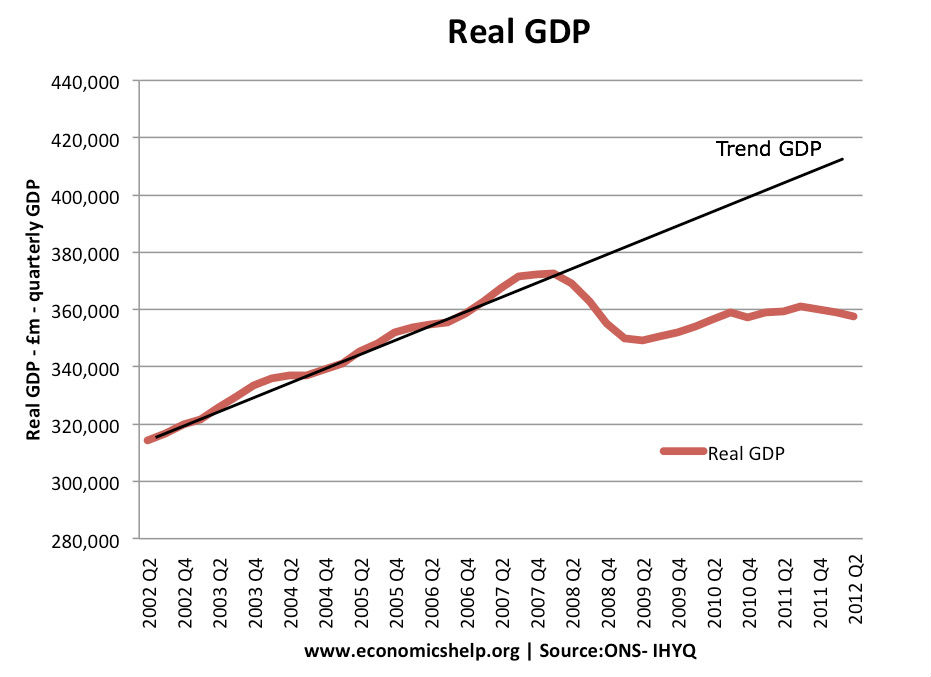

By any standards, 2012 has been a dismal year for the UK economy. Despite a temporary Olympic bounce, GDP remains below 2008 levels, and the Bank of England is as pessimistic as it’s ever been. Unemployment might be lower than other European economies, but with 1 million underemployed – official statistics perhaps mask the wasted resources in the economy.

GDP is 3.1% below where it was when the recession began 18 quarters ago in early 2008.

The Chancellor has a lot of bad news to contend with.

- He will miss his deficit reduction plans.

- His forecasts for economic recovery proved overly optimistic. Instead Britain has entered into the first double dip recession since the 1970s. It is quite possible, we might see first triple dip recession in 2013.

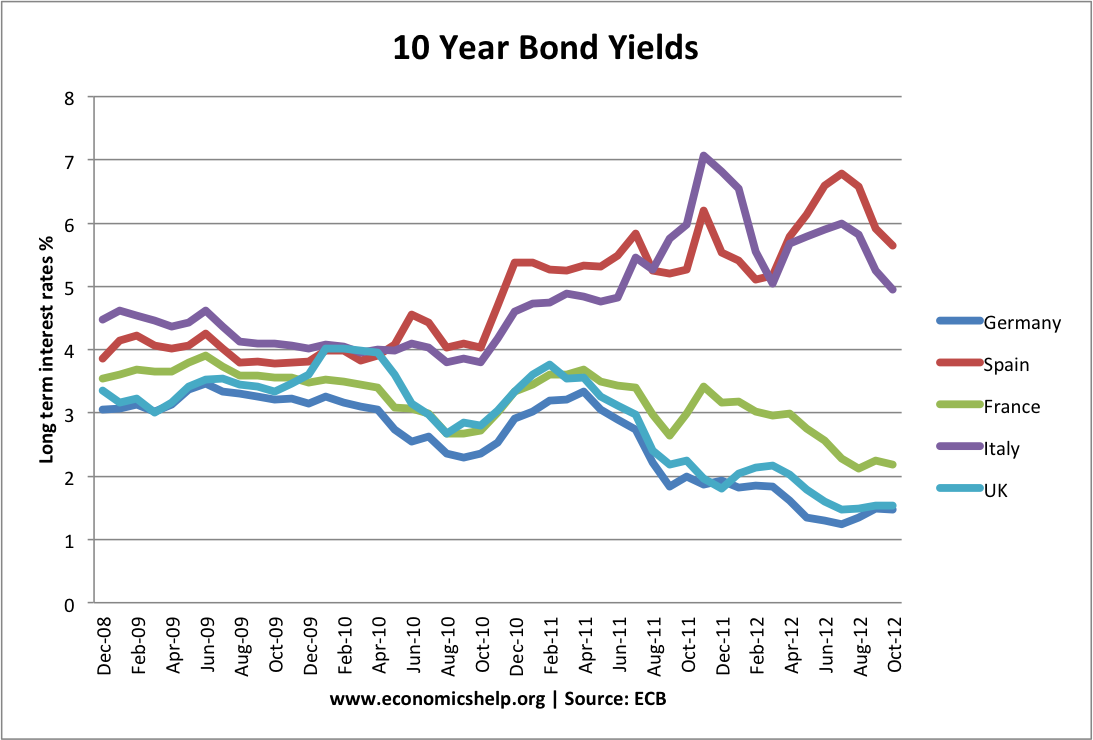

In his defence, you might point to the Eurocrisis and say it is inevitable the UK economy was harmed by the slowdown across the channel.. But, despite the recession in the Eurozone (which have problems relating to single currency), it is hard to avoid the fact that two and half years into the job, he has to take responsibility for the direction of the economy.

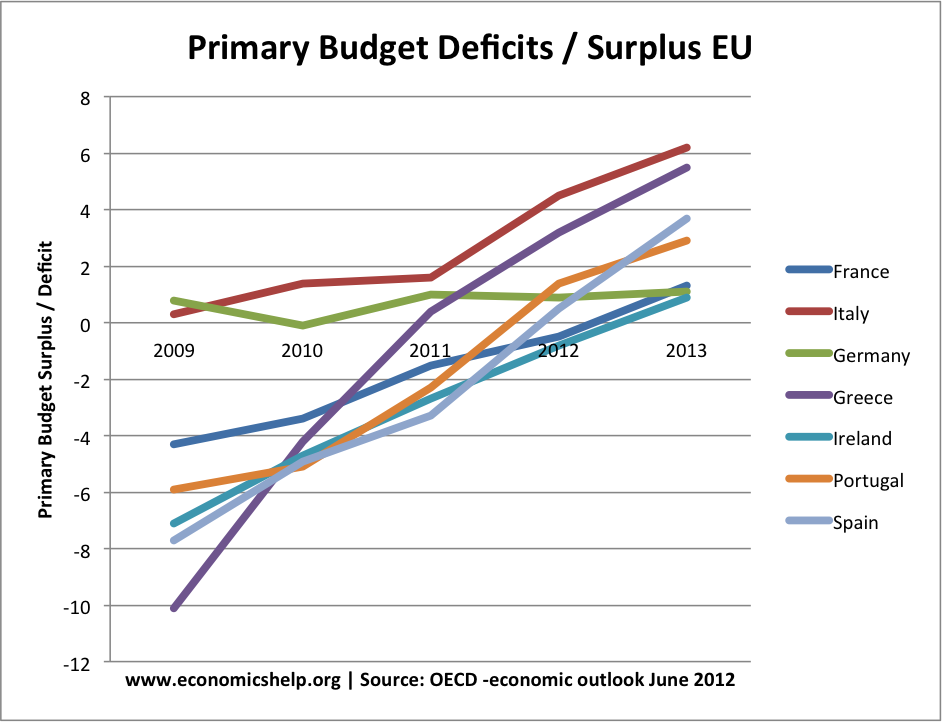

Essentially, Osborne started the job with great fanfare about reducing the deficit. Deficit reduction was sold as the most important objective – the implication was that without immediate cuts, the UK could end up like Greece or Italy.

But, unfortunately, the experience of the past two and half years is that fiscal consolidation during a recession tends to be counter-productive (austerity will increase deficit). Freezing public sector spending, whilst the private sector is still very fragile, has led to a large negative multiplier effect. It is hard to avoid the conclusion that the double dip recession is largely the fault of economic policy.