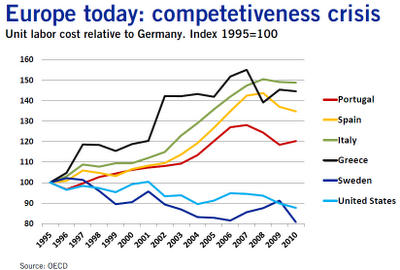

The ILO recently produced their growth and wages report for 2012/13. This suggested that across the developing world, labour markets are being characterised by falling real wages and a decline in labour’s share of national income. In particular:

- Real wage growth has been flat – even negative in the past few years.

- There is an increasing gap between productivity growth and wage growth. Wages are not rising along with productivity.

- Wages are becoming a smaller share of national income.

- In 16 developed economies, labour took a 75% share of national income in the mid-1970s, but this has dropped to 65% in 2007. It rose in 2008 and 2009 – but only because national income itself shrank in those years – before resuming its downward course. (Wages in developed world shrink at Guardian)

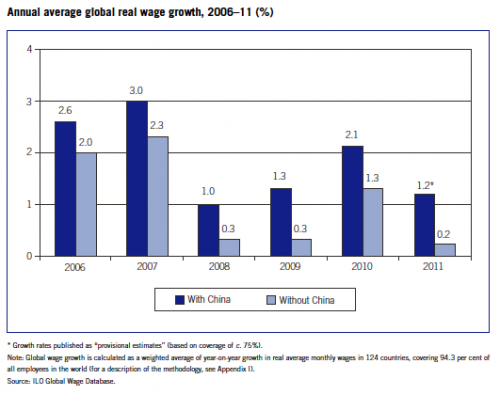

Real Wage Growth

It is common to refer to the low wages of China, but wages in China have roughly tripled in the past decade – meaning China has one of best wage growth rates in the world.

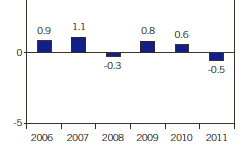

However, if we look at just developed economies, we see even lower wage growth.

Real Wage Growth – developed economies

The global credit crisis has also resulted in increased inequality. Wage income is declining as a share of overall national output. Improvements in labour productivity are not being matched by real wage growth. This graph below shows the increased divergence between wage growth and productivity.