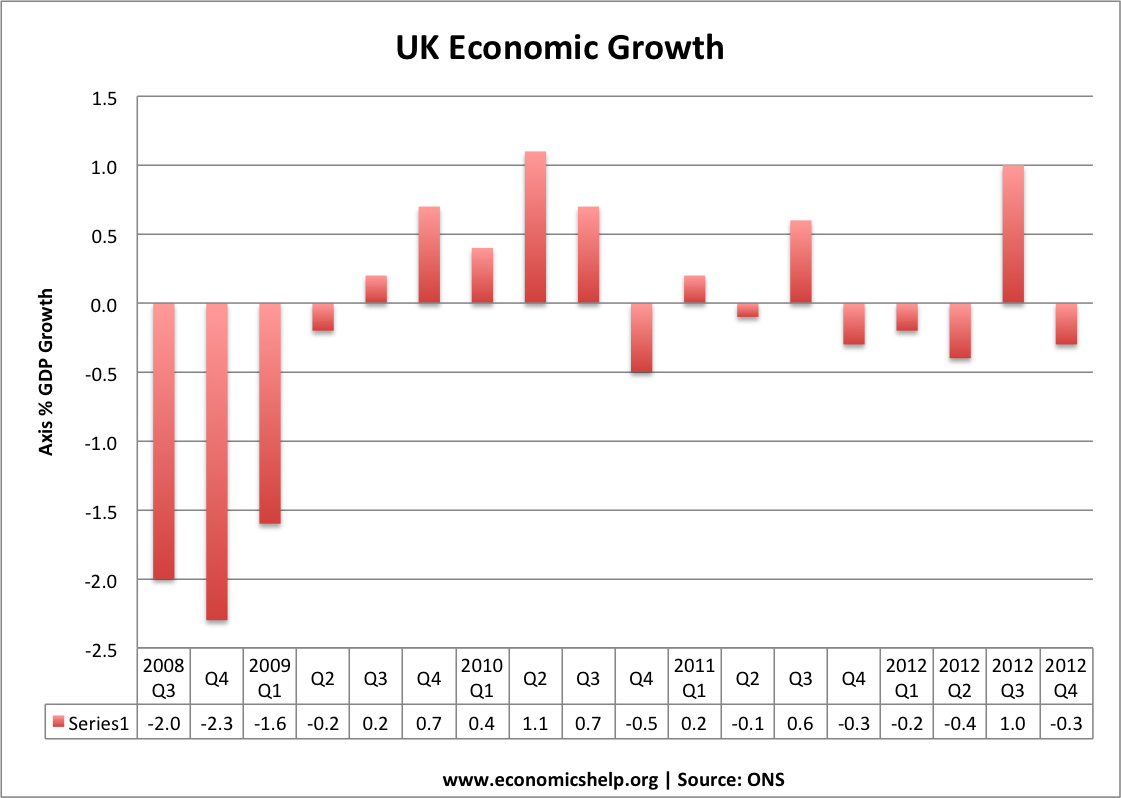

The Prime Minister has got into a bit of pickle by trying to maintain the view that deficit reduction policies have not reduced economic growth, and in fact have had the opposite effect.

“They (are) absolutely clear that the deficit reduction plan is not responsible (for low growth); in fact, quite the opposite.” (link)

There is an economic logic to arguing that given the size of the UK budget deficit, the government need to consider policies to reduce it. Economists will disagree over the timing of deficit reduction. Some economists argue that the deficit shouldn’t be reduced whilst we are still in a recession. Others may argue, we have no luxury of waiting.

I favour the former view that recovery should come before austerity. But, I can at least understand the argument that we should cut the deficit now. However, what I can’t understand is the belief that if you cut public spending in the middle of a recession, that it will have not have some negative impact on economic growth – and in fact spending cuts will have the opposite effect in boosting economic growth. It is really a bizarre logic to hope that cutting spending at the present time will increase economic growth. With falling output, falling construction output there is no evidence of any ‘crowding in’ in the UK economy. There is however plenty of alternative evidence, e.g. IMF reports, that austerity has caused a negative multiplier effect and reduced growth.

I wonder if there are any economists who really believe that cutting government spending during a period of private sector deleveraging will actually increase economic growth? If David Cameron wrote an A-level essay on ‘discuss the impact of a fall in government spending’ – he would really struggle to get an E grade, and would probably fail.

Has the UK responded to news of public sector wage freezes and lower government spending by rejoicing at the planned reduction in the budget deficit and gone on a spending spree to celebrate?

The impact on confidence has been the opposite. Relatively minor spending cuts have created pessimistic expectations. There has been no confidence fairy miracle. As you would expect spending cuts in an already depressed economy have further reduced real GDP.