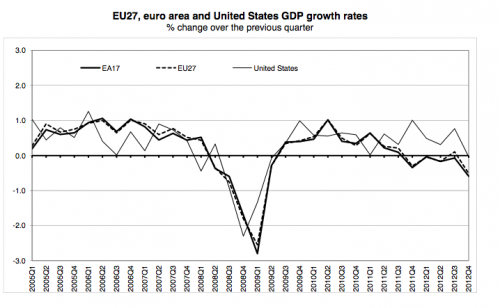

In the past five years, the UK has experienced an unprecedented period of stagnant economic growth. The fall in real GDP is longer than even the great depression. Given the unusually depressed nature of the economy, what policies could the UK pursue to boost economic growth and recovery? Here are eight possible policies with their pros and cons.

1. Government spending on infrastructure

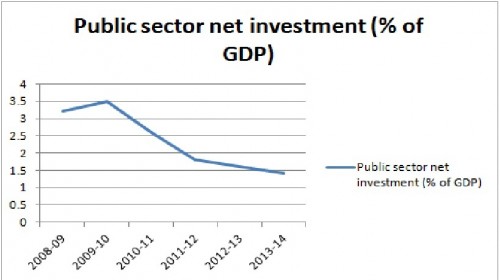

With low borrowing costs, the government should be increasing spending on public sector investment projects to provide an injection into the economy and help get unused resources active. Traditionally spending on infrastructure has a large multiplier effect (knock on benefits to related industries) so there could be a significant boost to economic growth from higher public sector investment.

Furthermore, government spending on public sector investment projects can help reduce business costs and boost productive capacity. This doesn’t necessarily have to be high profile projects like HS2, there are many smaller projects which can give a good rate of return (e.g. potholes in roads, need for more rail carriages e.t.c)

If the government announced a series of new investment projects it will also help improve consumer and business confidence. This would be better than concentrating on the need for austerity and ‘things will get worse’. High profile investment projects would create a greater sense of dynamism and hope. By contrast, the recent austerity measures caused a fall in consumer confidence.

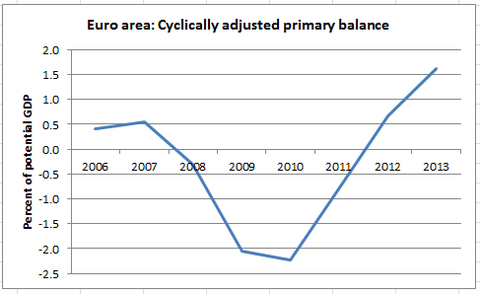

- Evaluation: Some say that given the size of UK budget deficit, we can’t afford to borrow any more. But, bond yields are very low and concerns over the UK debt are partly driven by lack of growth as much as the actual deficit. Counter cyclical spending to boost economic growth, could help reduce the cyclical deficit. At worst, spending on public investment could be financed by spending cuts which have less negative impact on growth.

2. Public Investment Bank

Despite low interest rates, bank lending in the UK has been very low since the credit crunch. Banks are seeking to improve their balance sheets and many firms struggle to gain finance for even moderate expansion plans. In the absence of normal commercial bank lending. A public investment bank could make greater lending facilities available to small and medium term firms. The UK is the only G8 country not to have a public investment institute. (see: case for public investment bank)

- Evaluation: Critics may argue that the government doesn’t have the expertise to evaluate whether loans are desirable, and it may lead to government failure. Also, in the short term, it would be costly if the government gave out loans.

Read more