No one doubts the commitment of many in the EU to seeking a way to prevent the Euro breaking up. The Euro project is deeply embedded in the European establishment. But, are they fighting a lost cause? Are the structural problems with the single currency so severe, they would be better off pursuing an orderly break-up? Or would the break-up of the Eurozone lead to an even worse period of instability and economic crisis?

Reasons Why the Eurozone is heading for a Break-up

1. There has been no Economic Harmonisation

Harmonised competitive indicators in the EU (2011 Q1), source: ECB Stats based on unit labour costs indices for the total economy:

Since 1998, Germany (DE) has seen a reduction in labour costs of 18.5%. By contrast, Italy and Ireland have seen an increase of 6.6% and Greece of 9.7%.

The Eurozone is not an optimal currency area. There is a huge difference between northern European economies (Germany) and Southern European economies. This is not a difference in debt levels. It is a difference in productivity and relative wage costs.

In normal circumstances, this would not be a problem because the German currency would appreciate due to its hyper-competitiveness – and the exchange rate of Italy, Greece e.t.c. would devalue, but this has not happened because the Euro permanently locks in exchange rates. See also: (competitiveness in Europe) | Two Speed Europe

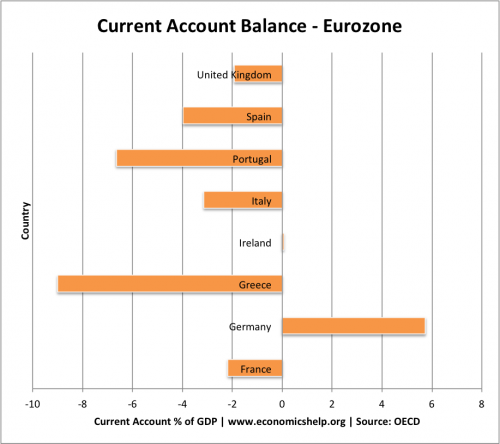

2. Current Account Deficit

- This divergence in labour costs, productivity and inflation is reflected in the current account statistics within the Eurozone. In particular, it shows that Germany has had a persistently large current account surplus, which is matched by a current account deficit in other Eurozone economies.

- With a fixed exchange rate, German goods have become more competitive in the Eurozone. Southern Eurozone goods have been uncompetitive. The exchange rate imbalance is a significant factor in the persistently low economic growth in Southern Europe.

- Without a mechanism for exchange rate adjustment within the Eurozone, the current account imbalances will persist.

- Furthermore, this issue rarely gets much attention. The EU and Germany frequently talk about the need for internal devaluation for countries to regain competitiveness. But, internal devaluation is causing economic misery of unemployment and falling GDP.

- Economic Imbalances in the Euro by Christian Schoder 2011