My Q: can you see any reason the ECB can’t do a version of QE for Greece? Not necessarily the US/UK way of buying bank bonds and hoping; there may be other ways? But if they could do it somehow, interest-free, so that the new money gets out into the economy, with the proviso that the money will slowly be paid back, but only after Greece finally reaches some positive economic level? Wouldn’t that be more palatable for Greece than having to *borrow* from the ECB at impossible rates? (It seems that the liquidity trap will avoid any runaway inflation.)

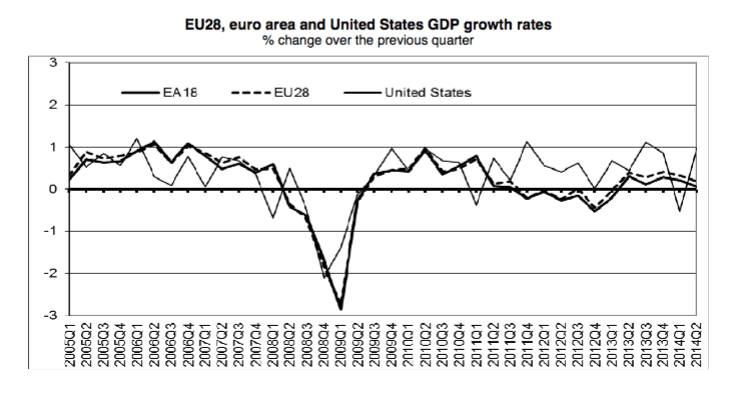

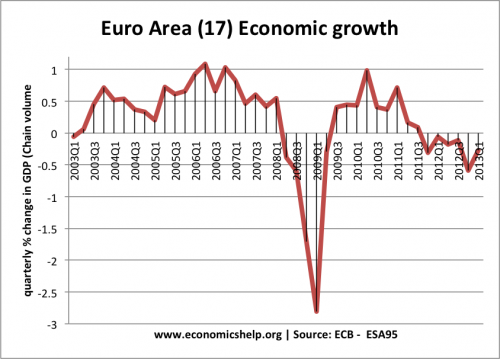

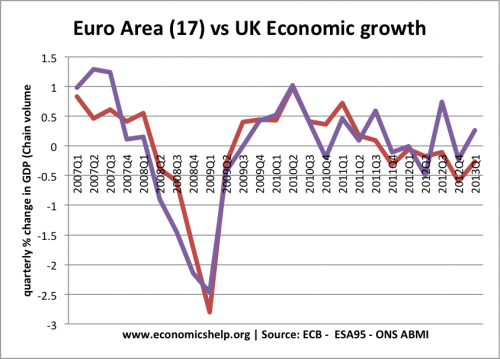

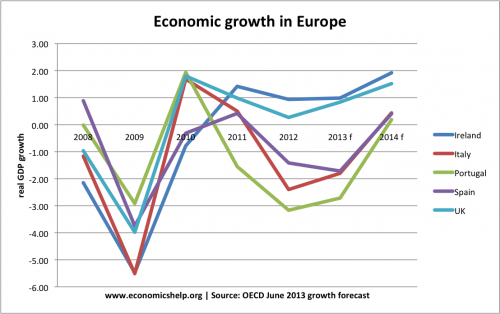

Countries like Greece, Italy and Spain desperately need some form of monetary easing. Increasing the money supply (through some form of quantitative easing) should help to alleviate some of the problems associated with deflation and falling nominal GDP. (Greece recorded an inflation rate of -0.4% in June 2013) Amongst other things, they need an increase in the money supply to try and target higher nominal GDP. At the moment, several Euro countries are caught in a deflationary trap with falling GDP and simultaneously seeing an increase in their debt to GDP burden.

If a country like Greece was not in the Euro, but had their own currency – then the Greek Central Bank could decide to create money and purchase bonds. They could buy government bonds or corporate bonds; the important thing is that it would increase the money supply, reduce bond yields and help to reduce deflationary pressures and stem the fall in nominal GDP. (It would also cause a large depreciation in the Greek currency, which is something they needed to restore competitiveness)

However, Greece does not have its own currency, it is in the Euro. Therefore, it is up to the European Central Bank. Many of the reasons to prevent Q.E. have been political and related to the set up of the Euro.

(I should point out my knowledge of ECB rules on Q.E. and printing money is somewhat shaky – partly because it is undergoing a process of constant change, and different people in the EU/ ECB have different views)

Firstly, the ECB used to have something in its charter prohibiting the creation of money. To some extent, Draghi’s put has circumscribed this. The ECB can now buy bonds with a 3 year or less maturity.

However, any extension of this decision to pursue a policy of quantitative easing needs to be approved by European Central Bank body. It relies on political support. Others in the EU may veto a plan for quantitative easing over deeply held fears of:

- Increasing money supply causing inflation.

- Rewarding fiscal profligacy through printing money and inflating away debts. There is a fear of moral hazard, and that it would encourage other countries to allow debts to rise.

In the case of Greece, Quantitative easing would not be a panacea. Greece is well beyond the situation of having liquidity shortages, it is fundamentally broke. However, quantitative easing to keep bond yields low, would give countries like Italy and Spain more time to deal with fiscal deficits – rather than the deeply counter-productive austerity measures we’ve seen in recent years.

Wouldn’t that be more palatable for Greece than having to *borrow* from the ECB at impossible rates?

It is a big problem that countries like Italy are running primary budget surpluses (but because of relatively high interest rates, it is insufficient to reduce debt to GDP ratios. It is estimated Italy will have to run a primary budget surplus of 5% of GDP to reduce long-term debt burden. But, this size of a primary deficit is highly contractionary. Quantitative easing to reduce bond yields would reduce the necessity of deep austerity measures.

Read more