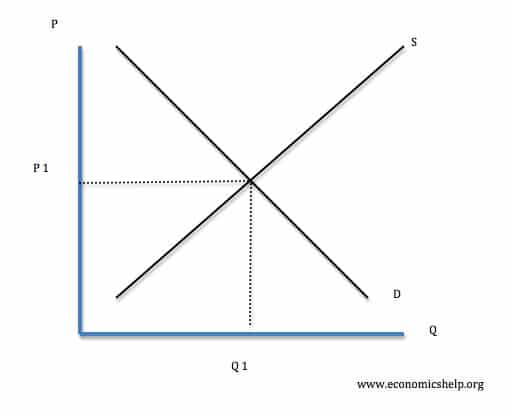

Currency substitution occurs when a country uses another currency without any official backing and without a Central Bank – instead of using its own currency.

For example, Panama uses the US Dollar as its currency. Even though it has no formal currency union with the UK. Jersey uses Sterling unofficially too.

The advantage is that a country like Panama gets to use a currency which has a stable value and international respect. The disadvantage is that it has little control over monetary policy and doesn’t have a Central Bank to act as lender of last resort to print money during periods of liquidity. Also, you lose the ability to devalue the exchange rate (which some may argue has advantages too)

Sterlingisation for Scotland

If Scotland vote for independence, Sterlingisation is seen as the best outcome for an independent Scotland. (Possibly as a precursor to a second stage where Scotland creates its own Central Bank and print its own ‘Scottish Pound’)

Sterlingisation would mean Scotland continues to use the Pound, but without a Central Bank as lender of last resort. It also means monetary policy would be set by the Bank of England.

Does it matter if Scotland doesn’t have a lender of last resort?

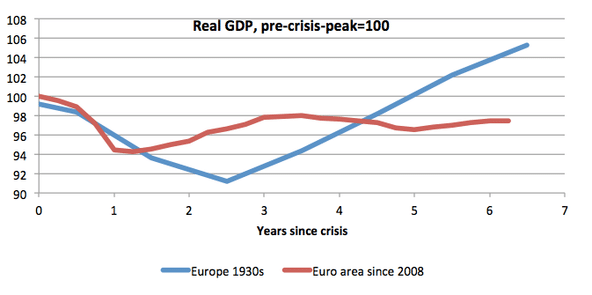

Given the problems of the Eurozone in recent years, there is an unfortunate precedent of countries being severely damaged by a lack of a Central Bank willing to act as a lender of last resort. However, there are two possible factors which could help Scotland.

- Firstly, some argue that having no Central Bank encourages banks to act more responsibly and avoid taking on excess risks. The Adam Smith Institute have produced a paper which is optimistic about the potential of ‘Adaptive Sterlingisation’ arguing that the period of free banking in Scotland in the eighteenth century was largely successful – with banks secured by shareholders. – How sterlingization and free banking could help Scotland flourish at Adam Smith – Institute.

- Would the Bank of England want to allow banks in the British Isles to fail? If Scotland gained independence, the Bank of England would have no compulsion to act as lender of last resort, but the UK banking systems is closely integrated; a collapse in confidence north of the border would have implications south of the border too. Would the Bank of England want to allow a failure of our near neighbour – when the financial and economic fortunes of the two countries are so closely tied together?