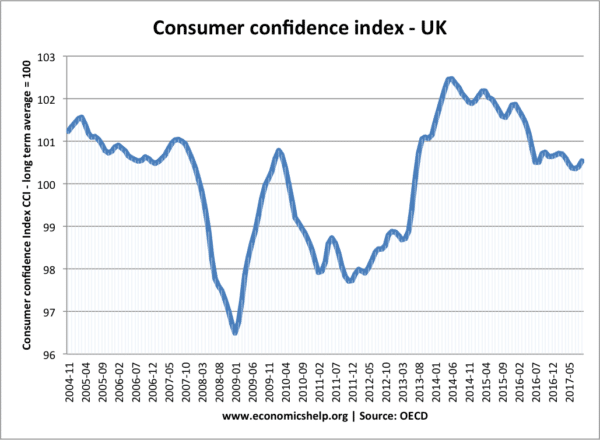

Consumer confidence is the outlook that consumers have towards the economy and their own personal financial situation. This outlook can be optimistic (high consumer confidence) or pessimistic (low consumer confidence)

The level of consumer confidence will be an important factor that determines the willingness of consumers to spend, borrow and save. A high level of consumer confidence will encourage a higher marginal propensity to consume. A fall in levels of consumer confidence is often an indicator of an economic downturn.

This measure uses 100 as the long-term average for confidence. Therefore, a stat above 100 indicates consumer confidence is higher than average. A value below 100 indicates below average confidence.

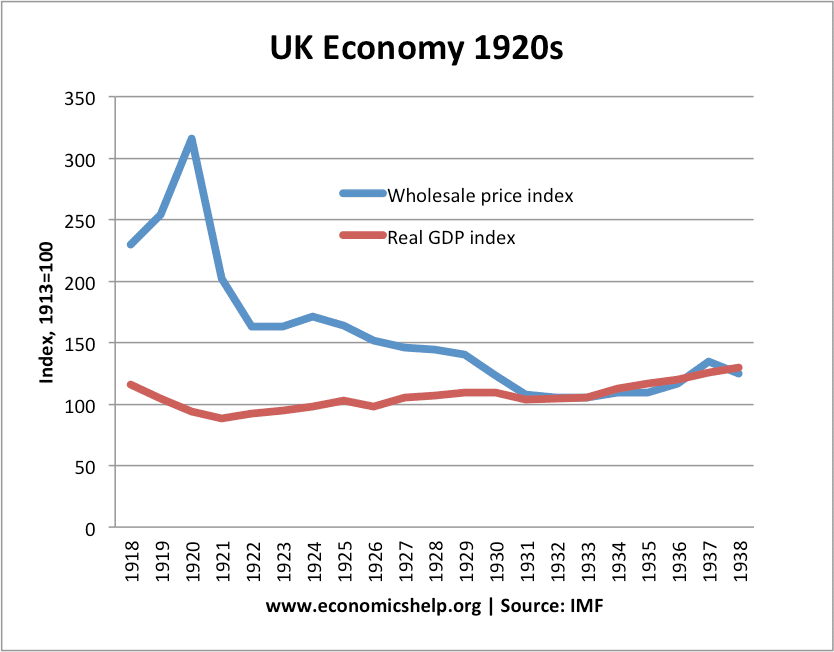

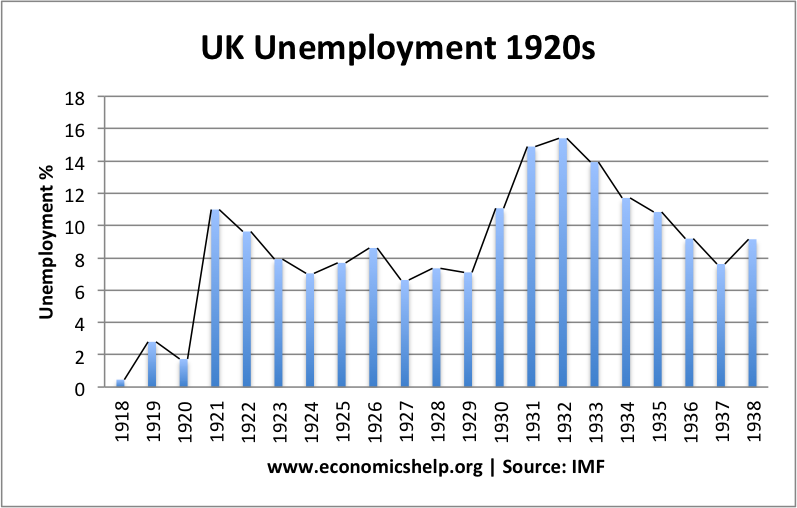

Consumer confidence often mirrors the state of the economy

Factors that affect consumer confidence

- House prices – Housing is the largest form of household wealth Falling prices reduce wealth and confidence. Rising house prices enable households to ‘re-mortgage’ and gain equity withdrawal.

- Economic news – Depressing statistics about the global and national economy will reduce confidence and encourage saving rather than spending.

- Uncertainty – a major political/economic change can lead to uncertainty which reduces confidence. For example, major terrorist attack, uncertainty over Brexit deal.

- Unemployment – The fear of rising unemployment will discourage consumers.

- Inflation and real wages. High inflation will reduce confidence. Stagnant and falling real wages will make people pessimistic.

- Personal debt levels. Rising debt levels will be a source of concern – especially if interest rates rise or the economy slows down.

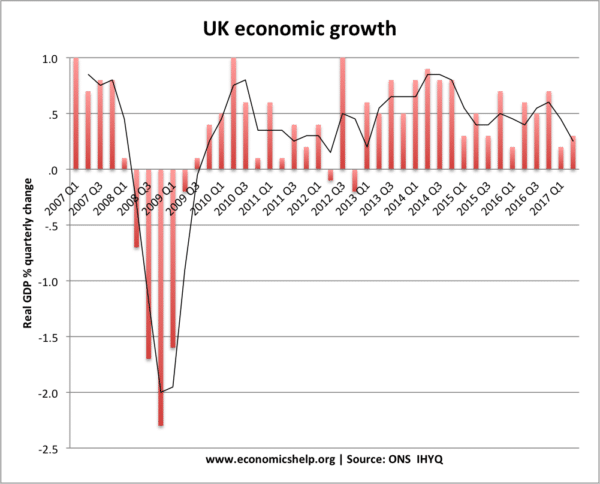

- Economic growth – A recession will invariably be associated with a fall in consumer confidence; positive economic growth tends to improve consumer confidence.

- Current economic situation. Expectations are largely based on the current economic situation and reported the news. News of job losses and falling house prices are amongst the key factors which influence consumer confidence.

Outlook for future UK consumer confidence

If I were a betting man, I would expect consumer confidence to deteriorate over the next 18 months.

- Squeeze in real wages is reducing spending power.

- Growing personal debt levels will make consumers vulnerable to higher interest rates or economic slowdown.

- Prospect of Brexit related uncertainty.

- Fall in unemployment but growing uncertainty of new jobs in the flexible labour market.

Measuring consumer confidence

Consumer confidence is based on qualitative surveys, where people carrying out research ask a sample of the population questions, such as:

- Do you feel confident about the general economic situation for next year?

- Do you feel confident about your personal economic situation for next year?

- Expectations regarding employment conditions six months hence

- Expectations regarding their total family income six months hence

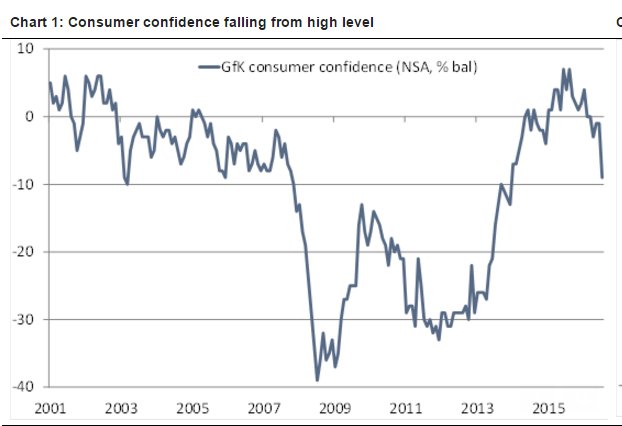

- Confidence indexes are often measured in terms of +/-. With a + of 10 meaning, there are a greater number of people optimistic than pessimistic about the future.