Readers Question: Could you comment on This BBC programme on Q.E.

The programme highlights several criticisms of Quantitative Easing, especially the Q.E. adopted by the Bank of England.

Since 2009, the Bank of England’s balance sheet has quadrupled, and now a third of all government bonds are now held by Bank of England. The programme fears this is storing up future inflation and a possible loss of confidence in the bond market.

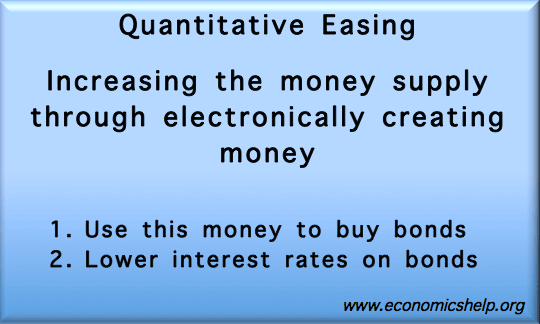

Firstly, just to recap:

Quantitative easing involves

- Central Bank creating money electronically

- Using this electronic money to purchase bonds (mostly government bonds)

The effect of quantitative easing has been

- To reduce bond yields on government debt.

- Increase money supply and bank reserves of commercial banks.

Drawbacks of quantitative easing

- The new inflow of money into commercial banks from quantitative easing has encouraged banks to use this extra money through greater risk-taking. Some argue that Q.E. has increased the risk-taking nature of banks (a problem behind 2008 crisis)

- Bond traders have benefited from making large profits out of the Bank of England by manipulating the bond market.

- Because government debt is being financed by quantitative easing, the government has less market discipline to think about reducing fiscal deficits and tackle the underlying problem of UK public sector debt rising to 100% of GDP by 2016.

- Quantitative easing has been a stealth method of reducing the value of the Pound and Dollar – and therefore making UK exports cheaper. Some commentators call this currency manipulation (or currency wars). They argue this is unfair on emerging markets who are seeing their exports become less competitive.

- The increase in money supply has led to an unexpected rise in commodity prices, such as oil. This is unusual when the Western economies are in recession; rising oil prices have led to cost-push inflation.

- By depressing interest rates, quantitative easing has wiped out people’s return on savings (though share price rises have compensated to a certain extent.)

- Quantitative easing is causing inflation in the UK. (Inflation has frequently been above the government’s target of 2%, and when the velocity of circulation rises, these extra bank balances will be lent – causing a possible inflationary surge.

- The scale of quantitative easing could make it impossible to sell bonds back to the market and this will damage the UK’s ability to borrow in the future. If the UK’s ability to borrow is constrained, this will lead to higher interest rates and reduce economic growth.

- Evidence in the US suggests even raising the possibility of tapering could cause damage to the bond market, and higher interest rates. These higher interest rates could reduce economic growth.

Potential benefits of Q.E.

- Low bank lending. There is no real evidence that there has been a surge in risky bank lending. In fact, the opposite has been the main concern over the past few years. – A more potent criticism of Q.E. is perhaps that it did so little to increase commercial bank lending. Bank lending is still very low compared to pre-crisis trends.

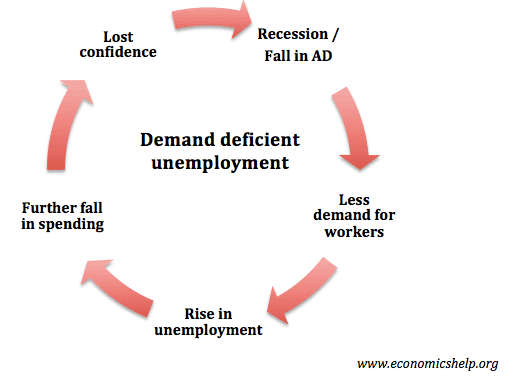

- We need fiscal expansion, not austerity. It is a very good thing if Quantitative easing has reduced the need for austerity and immediate measures to cut budget deficits. If the UK has pursued Greek or Spanish style austerity, the UK recovery would have been much weaker or non-existent. A recession is not the time to tackle the public sector debt. The important thing is to promote economic growth; this will enable debt to be tackled in the long term when the economy can better absorb spending cuts and tax rises.

source

source