A few years ago, I wrote several posts about the need for a government to borrow in a recession. One thing I would have said is that when the economy recovers, tax receipts will automatically rise and the deficit will fall. You could almost say ‘solve unemployment and the deficit will take care of itself.’

The logic is that even if you keep tax rates the same, economic recovery will lead to higher tax revenues, for example,

- With greater consumer spending – VAT and Excise duty revenues will rise

- Rising incomes will lead to higher income tax and NICs.

- Greater profitability will lead to higher corporation tax.

- Recovery will help housing market and stockmarket lead to more stamp duty and capital gains.

However, one feature of this recovery is that tax revenues have proved disappointing. Tax revenues have increased by a small amount, but as a % of GDP, tax receipts are struggling to keep up. In particular, corporation tax and income tax have fallen behind schedule.

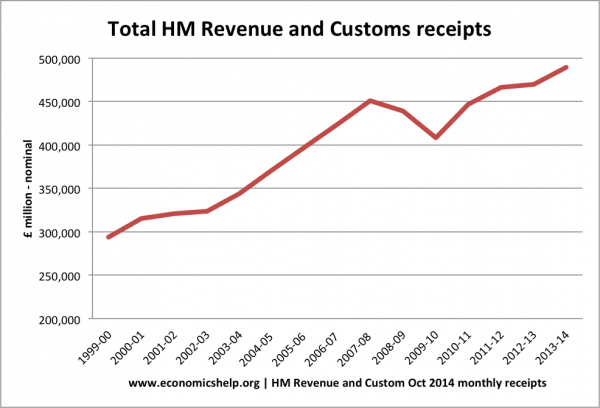

This shows overall nominal HM Revenue and Custom revenues. Not adjusted for inflation. (Note. This also excludes other sources of Government revenue) See Tax revenue sources for more detail.

- In 2007/08, tax receipts were £451 bn

- In 2013/14 tax receipts were £489 bn

This is very weak growth, when you remember these are nominal figures.