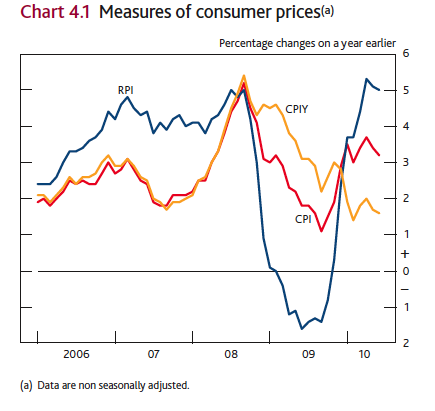

CPIY = CPI – indirect taxes such as VAT, stamp duty and excise duty. This gives a guide to underlying inflation, stripping away the distortionary impact of indirect taxes. This suggests underlying inflation is lower than the headline rate.(CPIY statistics.gov)

A big issue for the UK economy is the existence of inflation when theoretically, there should be much spare capacity in the economy. In the Bank of England’s latest inflation report, they examine why inflation is above target and the prospects for future inflation. See also: Inflation and the Recession

This graph plots three measures of Inflation. RPI (includes housing costs and mortgage interest Payments)

CPI (excludes mortgage interest payments)

(There is also a CPI-CT which holds indirect taxes rates constant at the rate prevailing at the start of the year)

One issue is whether the high inflation rate (above target) changes inflation expectations and therefore actually increases the underlying trend rate. In other words, people become accustomed to the higher CPI rate, so when tax rises expire, inflationary expectations become hard to shift leading to higher inflation.

Related

2 thoughts on “CPIY and Inflation”

Comments are closed.