The UK national debt is the total amount of money the British government owes to the private sector and other purchasers of UK gilts (e.g. Bank of England).

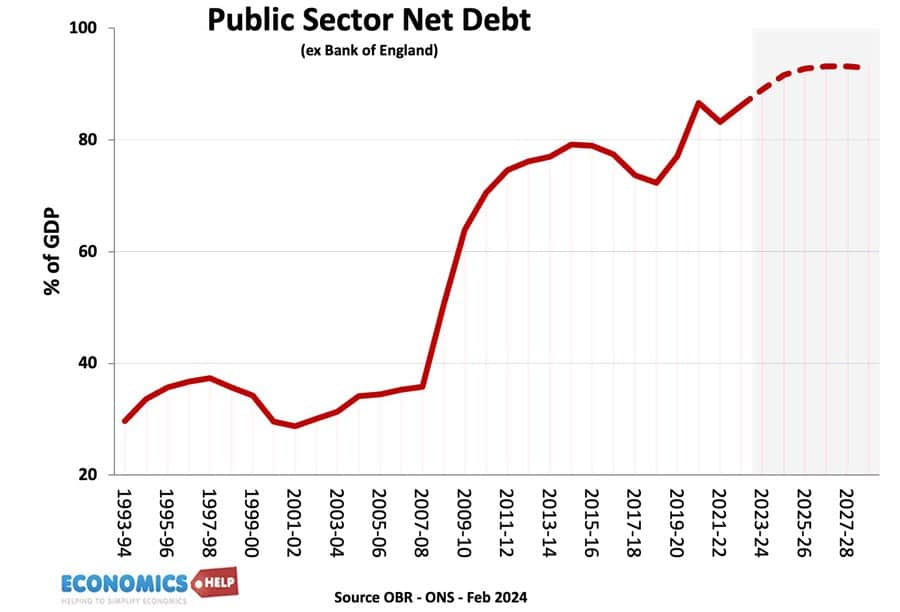

- UK public sector net debt (ex public sector banks) was £2,685.6 billion or 98.1% of GDP (20 Dec 2024).

- The OBR have forecast substantial rises in UK debt over the coming decade because of demographic factors, putting strain on UK spending.

- Source: [1. ONS public sector finances,- HF6X] (page updated 20 Jan 2024)

Source: ONS debt as % of GDP – HF6X | PUSF – public sector finances at ONS

Reasons for National debt

- Enables the government to spend more during periods of national crisis, e.g wars, pandemics, and recessions.

- In a recession, the government will automatically receive lower tax revenues (less VAT and income tax) and will have to spend more on benefits (e.g. more unemployment benefits) This causes a cyclical rise in debt.

- Extra government borrowing during a recession can help provide fiscal stimulus to promote economic recovery. By borrowing and then spending more, the government is injecting demand into the economy and this can help to reduce unemployment. This is known as fiscal policy and was advocated by J.M. Keynes.

- Strong market demand for government debt. Private investors buy gilts because they are seen as risk-free investments and there is also an annual dividend from the bond yield. Since 2009, there has been strong demand despite very low-interest rates, meaning the government can borrow very cheaply.

- Finance investment. The government could borrow to finance public investment projects that can lead to higher growth in the future.

- Political convenience. There is usually political pressure to cut taxes and increase government spending. Allowing debt to rise can be a way for the government to avoid difficult choices.

Forecast for the National debt?

Source: Fiscal risks and sustainability – OBR – Economic and Fiscal Outlook Oct 2024

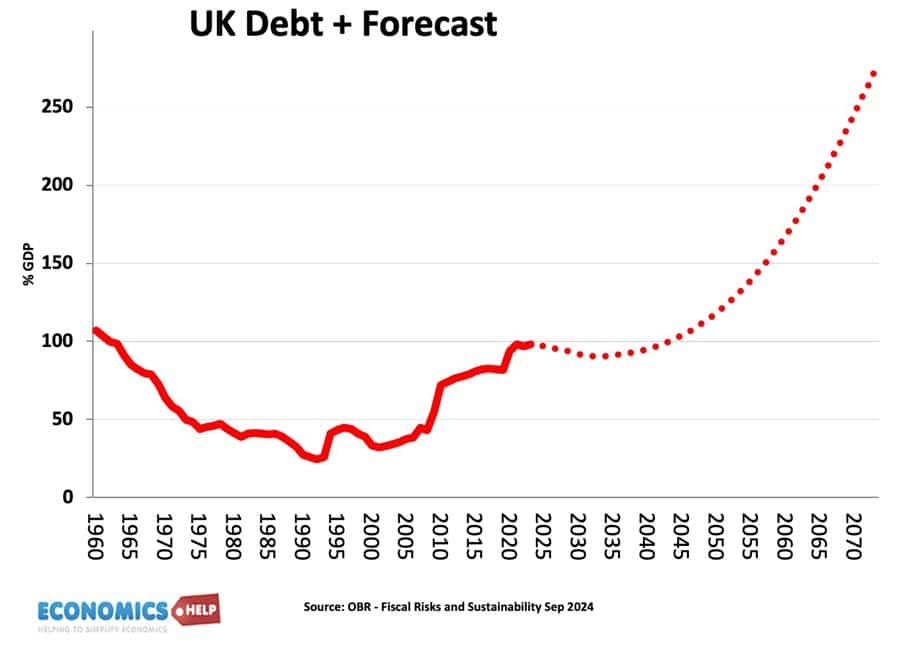

The OBR have forecast that, on our given trajectory, UK public sector debt could reach 350% of GDP within 50 years. The pessimistic outlook for national debt is made because

- An ageing population and demographic changes will put increased pressure on government spending, notably health care and pension spending.

- A smaller working population will limit UK’s productive capacity.

- Stress on finances from geopolitical events, such as frostier relations with China, Russia and the Middle East.

- Higher energy prices

- Costs of climate change.

- Declining tax revenues from petrol in a decarbonising economy.

- Low productivity growth of UK since the financial crash of 2009

- Recent boost to debt from the financial crisis and one-off cost of Coronovirus pandemic, which cut tax revenues and required government support for lockdown measures.

UK debt in context

Predicting debt for the next 50 years is difficult since we don’t know what kind of productivity improvements may come, e.g. continued gains in renewable energy may reduce the burden of higher oil and gas prices. Equally, the costs of environmental change could be worse.

History of the national debt

Main article: History of UK national debt

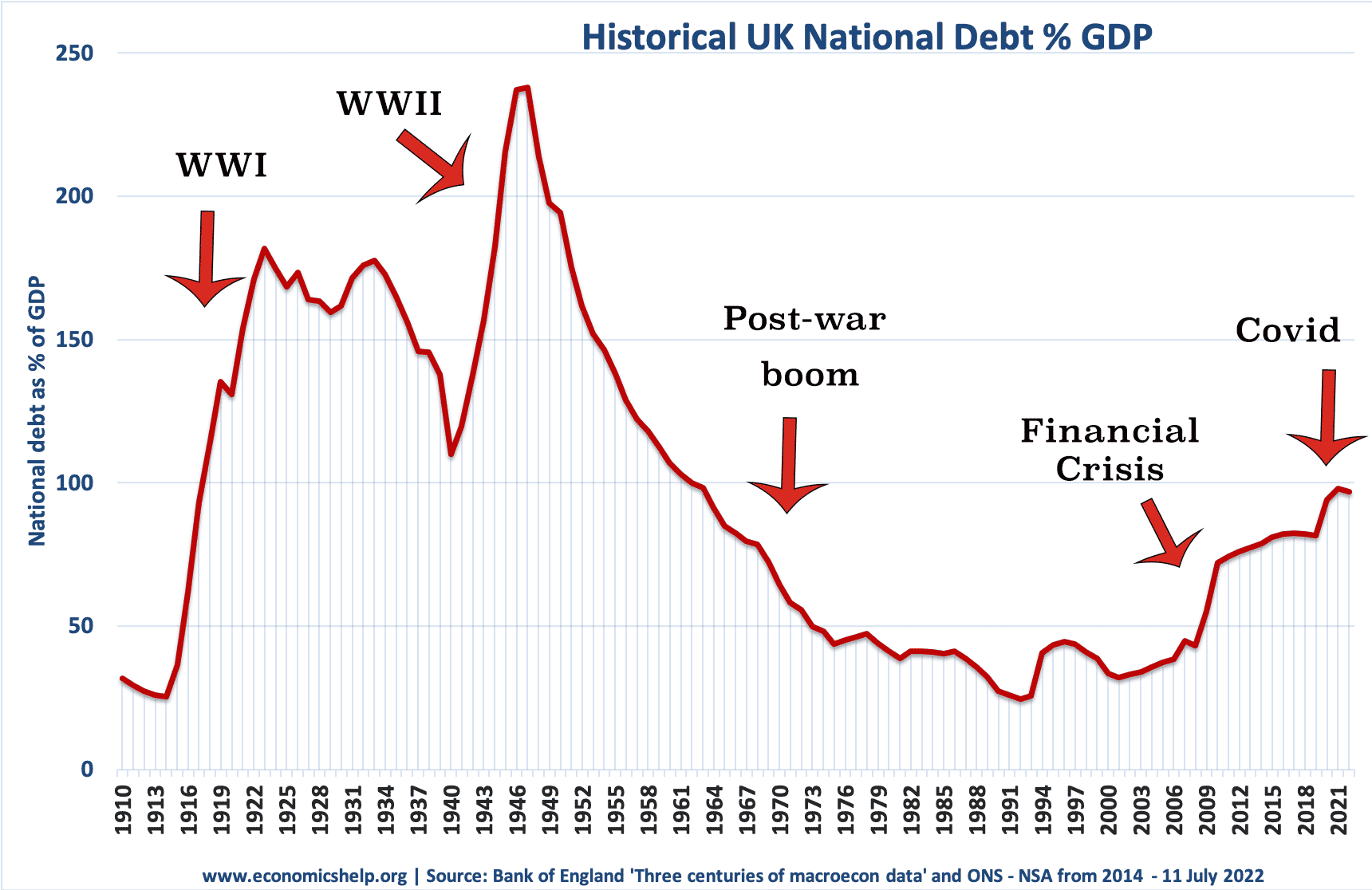

UK national debt since 1900

Source: Reinhart, Camen M. and Kenneth S. Rogoff, “From Financial Crash to Debt Crisis,” NBER Working Paper 15795, March 2010. and OBR from 2010.

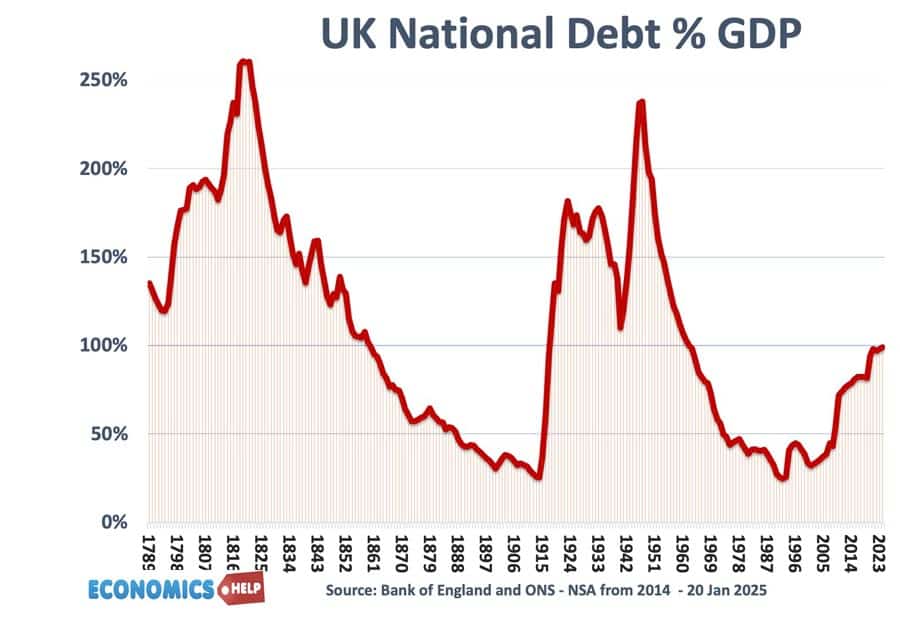

These graphs show that government debt as a % of GDP has been much higher in the past. Notably in the aftermath of the two world wars. This suggests that current UK debt is manageable compared to the early 1950s. (note, even with a national debt of 200% of GDP in the 1950s, UK avoided default and even managed to set up the welfare state and NHS.

Debt reduction and growth

The post-war levels of national debt suggest that high debt levels are not incompatible with rising living standards and high economic growth.

- The reduction in debt as a % of GDP 1950-1980 was primarily due to a prolonged period of economic growth. See: how the UK reduced debt in the post-war period

- This contrasts with the experience of the UK in the 1920s when in the post First World War, the UK adopted austerity policies (and high exchange rate) but failed to reduce debt to GDP. Debt in Post-First World War period.

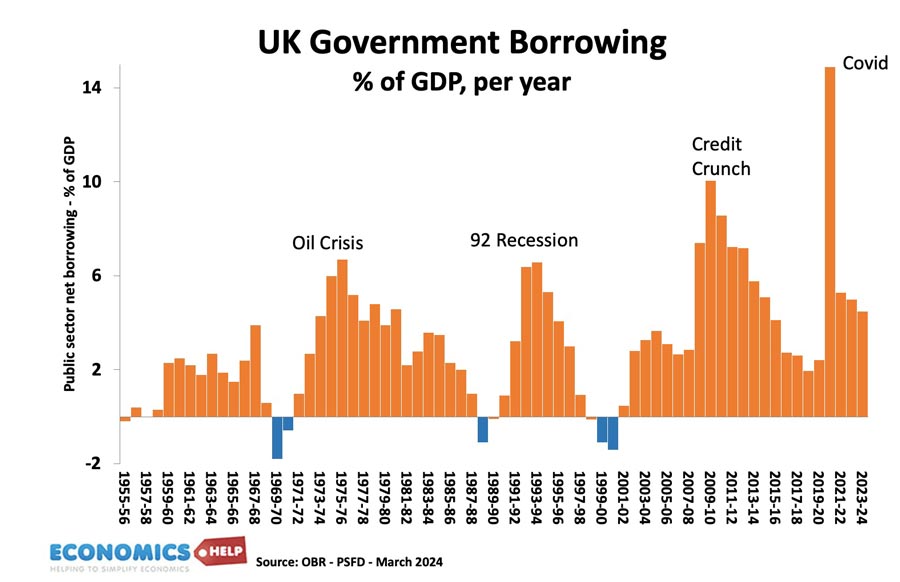

Budget deficit – annual borrowing

This is the amount the government has to borrow per year.

- Government

- borrowing in the financial year to December 2024 was £129.9

Annual borrowing since 1950. Figures for 2023-24 are forecasts (and rather optimistic!)

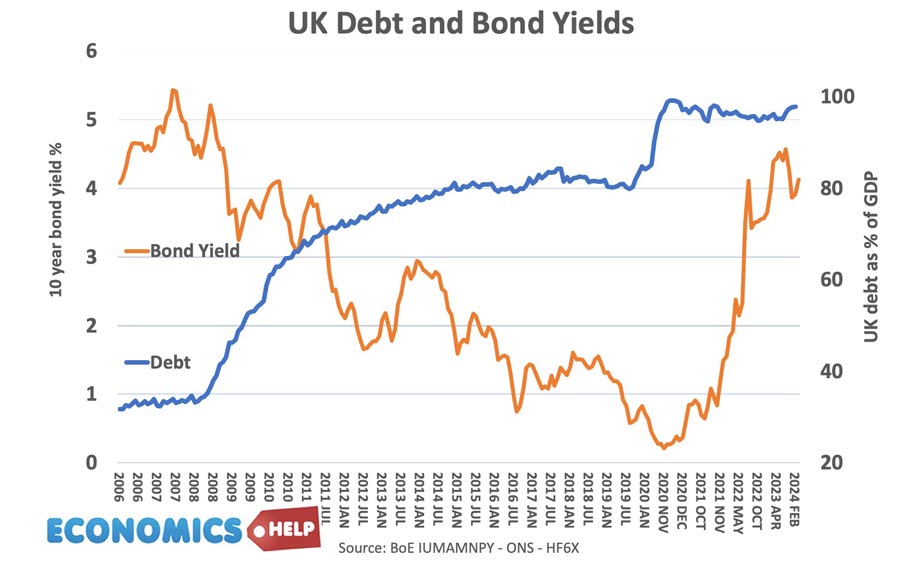

Debt and bond yields

Bond yields a the interest that the government pay bond/gilt holders. It reflects the cost of borrowing for the government. Lower bond yields reduce the cost of government borrowing.

Between 2007 and 2020, UK bond yields fell. Countries in the Eurozone with similar debt levels saw a sharp rise in bond yields putting greater pressure on their government to cut spending quickly. However, being outside the Euro with an independent Central Bank (willing to act as lender of last resort to the government) means markets don’t fear a liquidity crisis in the UK; Euro members who don’t have a Central Bank willing to buy bonds during a liquidity crisis have been more at risk to rising bond yields and fears over government debt.

See also: Bond yields on European debt | (reasons for falling UK bond yields)

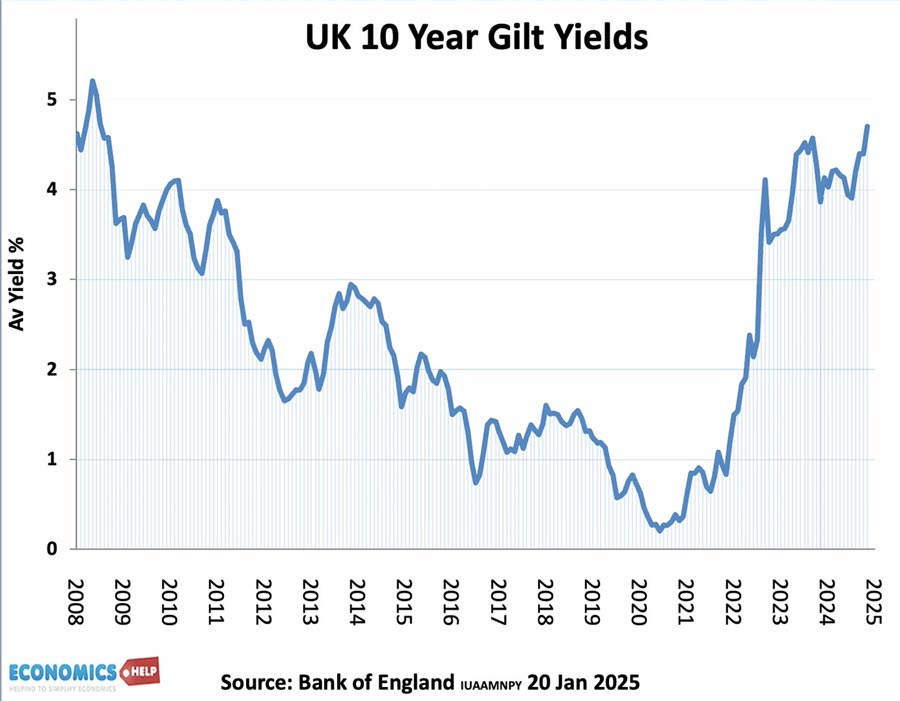

Since 2021, bond yields have risen due to pick up in inflation

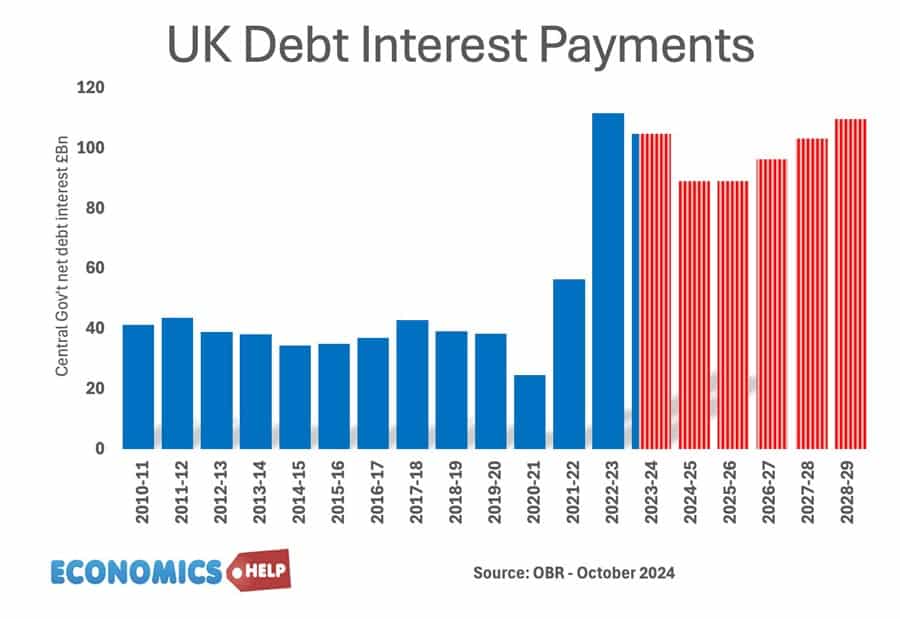

Cost of Interest Payments on National Debt

The cost of National debt is the interest the government has to pay on the bonds and gilts it sells. According to the OBR in 2023-24, debt interest payments will be £108 billion. (3.2% of GDP) or 5.2% of total spending. It is lower than in previous decades because of lower bond yields.

See also: UK Debt interest payments

The era of low interest rates post 1992 helped to reduce UK debt interest payments as a ratio of government revenue. However, with interest rates and borrowing increasing – debt interest cost have increased significantly.

Potential problems of National Debt

- Interest payments. The cost of paying interest on the government’s debt is very high. In 2011 debt interest payments will be £48 billion a year (est 3% of GDP). Public sector debt interest payments will be the 4th highest department after social security, health and education. Debt interest payments could rise close to £70bn given the forecast rise in national debt.

- Higher taxes / lower spending in the future.

- Crowding out of private sector investment/spending.

- The structural deficit will only get worse as an ageing population places greater strain on the UK’s pension liabilities. (demographic time bomb)

- Potential negative impact on the exchange rate (link)

- Potential of rising interest rates as markets become more reluctant to lend to the UK government.

However, government borrowing is not always as bad as people fear.

- Borrowing in a recession helps to offset a rise in private sector saving. Government borrowing helps maintain aggregate demand and prevents a fall in spending.

- In a liquidity trap and zero interest rates, governments can often borrow at very low rates for a long time (e.g. Japan and the UK) This is because people want to save and buy government bonds.

- Austerity measures (e.g. cutting spending and raising taxes) can lead to a decrease in economic growth and cause the deficit to remain the same % of GDP. Austerity measures and the economy | Timing of austerity

Who owns UK Debt?

The majority of UK debt used to be held by the UK private sector, in particular, UK insurance and pension funds. In recent years, the Bank of England has bought gilts taking its holding to 25% of UK public sector debt.

Source: DMO Debt Management Report 2022/23

- Overseas investors own about 28% of UK gilts (2022).

- The Asset Purchase Facility is purchases by the Bank of England as part of quantitive easing. This accounts for 26% of gilt holdings.

Total UK Debt – government + private

- Another way to examine UK debt is to look at both government debt and private debt combined.

- Total UK debt includes household sector debt, business sector debt, financial sector debt and government debt. This is over 500% of GDP. Total UK Debt

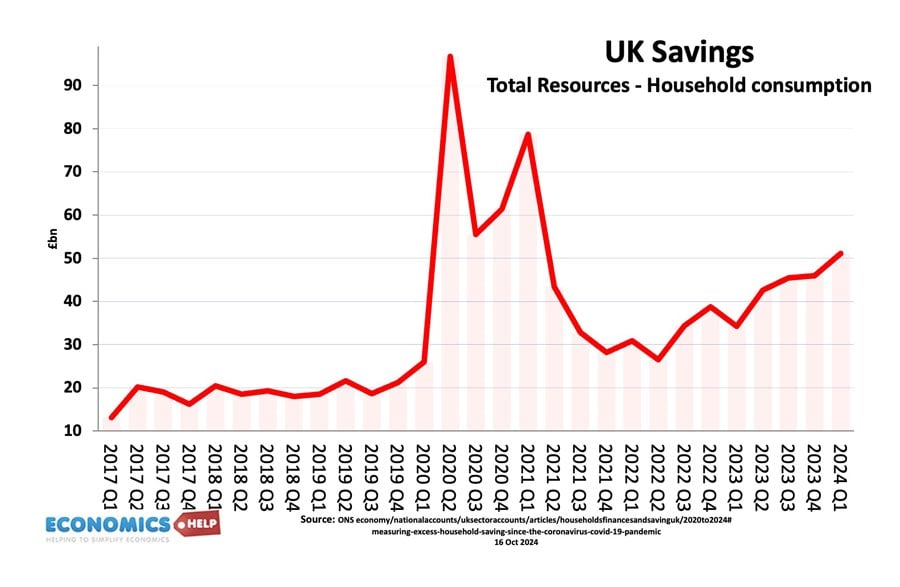

Private sector savings

When considering government borrowing, it is important to place it in context. From 2007 to 2012, we have seen a sharp rise in private sector saving (UK savings ratio). The private sector has been seeking to reduce their debt levels and increase savings (e.g. buying government bonds). This increase in savings led to a sharp fall in private sector spending and investment. The increase in government borrowing is making use of this steep increase in private sector savings and helping to offset the fall in AD. see: Private and public sector borrowing

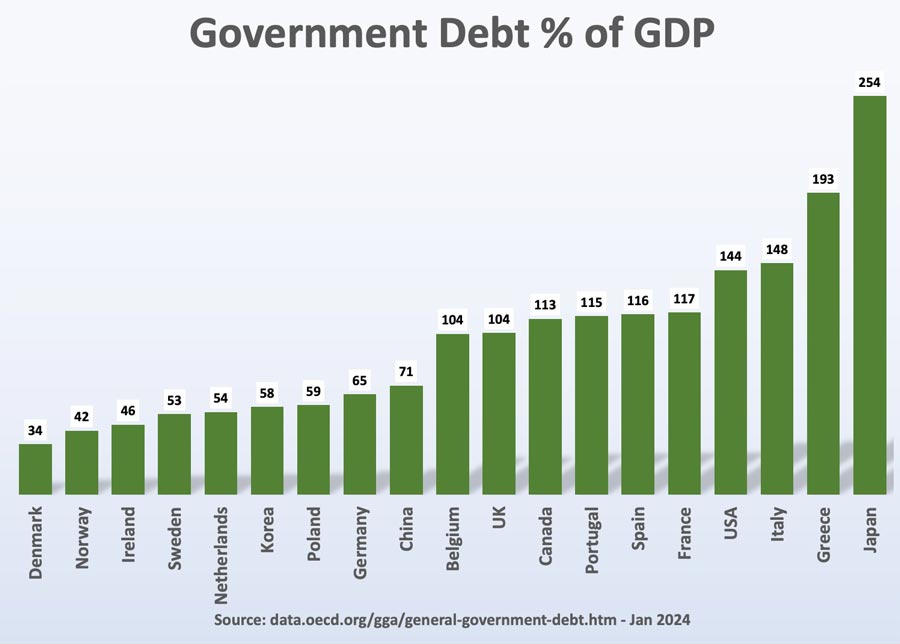

Comparison with other countries

Although 107% of GDP is high by recent UK standards, it is worth bearing in mind that other countries have a much bigger problem. Japan, for example, has a National debt of 256%, Italy is over 157%. The US national debt is over 132% of GDP. [See other countries debt].

How to reduce the debt to GDP ratio?

- Economic expansion which improves tax revenues and reduces spending on benefits like Job Seekers Allowance. The economic slowdown which has occurred since 2010 has pushed the UK into a period of slow economic growth – especially if we consider GDP per capita growth. Therefore the further squeeze on tax revenues has led to deficit-reduction targets being missed.

- Government spending cuts and tax increases (e.g. VAT) which improve public finances and deal with the structural deficit. The difficulty is the extent to which these spending cuts could reduce economic growth and hamper attempts to improve tax revenues. Some economists feel the timing of deficit consolidation is very important, and growth should come before fiscal consolidation.

- See: practical solutions to reducing debt without harming growth

Other countries debt

See also:

I simply don’t get the government’s stance on this. Reducing the annual deficit shold certainly be the priority, but it has to be a plan to reduce it for the long term. Cutting deficit without ensuring there’s an earning infrastructure to keep it down is just short term electioneering.

– The model of only allowing private industry from making profits and then taxing it is inefficient. Allow public organisations (including government depts) to bid for contracts. That’ll drive efficiencies, puts people in jobs, and directly put the savings into the coffers.

– skip 67, and go straight to 70 for a retirement age for anyone currently under 45 (adding a little gray area to help the change through). Give it 15 years and we’ll be doing it anyway.

– stop fiddling around with public service pension contributions. It’s essentially a cut from their earnings that deters the good, younger public servants from staying for the long term, and doesn’t raise a substantial amount anyway. The problem with these pensions is the retirement age, not the contributions.

– private industry employees need to be given comparative pensions to public servants now. If we’re all scared of the future, we need to be planning for the future. Otherwise, the burden will fall the state.

– some hard decisions need to be made in terms of existing commitments. We’re in deep doo doo anyway, so buying our way out of existing PFI deals would hardly make things worse.

– do we really need to fund an invasive force in the british military and all the equipment that goes with it? Pull the british army out and provide men and resources to UN forces instead. Reducing duplication of roles and equipment would provide large savings.

– we need a publicly managed bank to forge effective competition to the existing companies. If there’s an organisation that’s cheaper to bank with, and a profitless making bank should be that, then the others will have to follow.

– Close the tax loop holes and stop the silly HMRC tax write offs for big businesses. Instead, as someone else suggested, offer transparent discounts to big businesses if they pay their tax up front.

– we need to move away from globalisation and back to low-mileage captialism. By that I mean to, where ever possible, buy local and ensure that the money stays in circulation instead of going offshore.

– fuel duty has gone beyond being a useful tool for discouraging car use. It’s hitting the poorest drivers the most and taking useful spending cash out of peoples pockets.

– there needs to be some agreement to enforce a controlled lowering of property values because this is the long term debt that’ll really stop the public spending. They’re still artificially high and so most of those mortgages out there that contribute to the overall debt are really negative equity in everything but practice. In return for the government bail out, banks should revalue existing mortgaged properties downwards and write off the relative amount of the mortgage.

Still i don`t get it.

My question is who are this lenders ?From where the government is borrowing ?I mean is there any specific entity that we can point our finger kind of countries like china or USA.

Call me idiot because i don`t have any clue on economics .I see it from this perspective

If i have to take a loan from lender the lender obviously will need some warrant otherwise is not giving anyone just like that.If i have a good credit rate the lender will carry on lend

me.

Alex,

This is the golden question. In US the federal reserve, privately owned, creates money out of nothing then charges the American People interest!

Most people think that Federal means elected government owned…. It’s no more government owned than Fed-Ex!

Look for who controls the money supply and who’s best interests are being protected.

It’s more than dull economics it’s liberty that’s at stake.

Best to all.

Jaz

You’re not supposed to understand, otherwise the scam would then be laid bare for all to see.

We could print this money that we Borrow, ideally, Govt would behave sensibly and pring less than we borrow to reiggn in inflation.

BUT nyway, if we printed this money, as opposed to borrowing it from rich bankers, there would be no Govt borrowing, hence no Government debt hence no need fot you to pay taxes.

Bankers are stealing your money, in order to do this, they have to put in place politicians in the leadership of all the major political parties who will ensure instead of coining our own money as a sovereign nation, we borrow it from Bankers. JFK tried to issue his own currency via executive order 11110 look it up on youtube, so they killed him.

It is perhaps simpler to understand government borrowing in terms of a credit card loan .

a) You borrow on your card-card 1

b) You only pay the interest on the loan

When finally the credit card company insists that you clear the debt –you simply open a 2nd credit card account with another provider.

Borrow sufficient to pay off credit card 1 and repeat b)

it can however become a little tricky when B) is a higher value than your income.

The hope is that you will in time and get a higher paying job.

If you don’t you become’ Greece’

“However, these pension liabilities are not things the government are actually spending now. Therefore, there is no need to borrow for them yet. It is more of a guide to future public sector debt. I don’t accept the fact that future pension liabilities should be counted as public sector debt. ”

But it is only current borrowing that is “actually spending now”. Accumulated debt is an obligation to pay in the future, just like PFI and pensions and, at least in part, over a roughly similar time period.

However, such debts are not a burden on the economy as a whole, unless owed overseas. The repayments just mean a shuffling of spending power among UK citizens.

The tax implications may be politically significant. If PFI spending was not productive then the taxes will have to be taken from a lower GDP than there might have been (if the spending had been productive).

If the PFI’s were needed because the Government was spending tax revenues on other things than needed investment, then it can be argued the PFI effectively funded that spending.

Government actually does not help the economy, but rather, it destroys it. It’s rather simple… When the Government gets involved in business creation or provides federal loans of federally backed loans to businesses, they aren’t actually taking any direct risk except at the expense/risk of the tax payers (which are the people). As a result, these types of business loans provided by or backed by the government tend to go to less qualified individuals/businesses who are unable to qualify for private loans.. and for very good reasons. More likely than none, these businesses that rely on federal loans are usually unable to repay the loan back or file for bankruptcy because no one else saw value in this company and it wasn’t coming out of the government’s pocket. This means that with every failing business that the government forces the people to take a risk on (through taxes) the more money that has involuntary been taken out of my pocket or your pocket to buy other goods and services that other jobs have been created for.

In the same vein, when the Government pushes stimulus packages or job creations, they are actually creating short term solutions for long term problems. They basically say, ‘Here, you build this bridge, fix it up and make it look nice.’.. But they don’t see that there is no return of investment in that project and there will be no profit generated from such project. Sure the bridge will look nice but it won’t pay for little Jimmy’s shoes.

Government regulations also restrict business growth technologically as well as size in labor force. For example, let’s say I’m as a clothing manufacturer owner and I’d like to turn out as many products for my business with the least amount of resources. To do that, I will build 3 machines to take the place of 90 workers. I can now mass produce making clothes effectively and sell it at a much cheaper price. Now, I know what the pro-government thinkers are thinking.. ‘Well you just eliminated 90 jobs!” On the contrary, because I’m producing my products more effectively and selling hundreds more at a much faster rate, I decide to open 5 more stores nationally because I’m generating more profit and want to reinvest in my company. So I create 30 more jobs in terms of store managers and machine operators… but most importantly, I create products now hundreds more people can afford to purchase. I also have 15 machines working for me and I need those machines built and serviced, which creates even more jobs. Not only have my selling costs gone down but now it’s much cheaper for me to stay in business as well as easier for competitive businesses to start and challenge my products (either in quality or pricing).

On the flip side, if the government told me that I have to hire 5 workers for every machine I install then I’m actually losing money on an ineffective labor force with a very high potential to mark up costs of my products, send my manufacturer overseas or go out of business completely.

The contraction we saw last year is likely to be followed by a further decline in the current quarter. If we don’t deal with the debts, I think our problems will be worse.

well if the government , were a business they would not last for two days.. what a bunch of childish idiots .. i mean who needs that old crap of little boys and girls fighting in school … and more important what idiot would send lots of money to greece , etc.. when we are in the shite .ourselves.. RIP OFF BRITIAN .. we the poor pay for all the cockups made by the rich ,,, i hate my own country . WHY cos its run by tossers . (bring back enock..)

WE as 1 people Black White Asian or any other of the wonderfull representations of bipedal homonids need to see our selves as 1 people.

Not segregated into ethnic/religious groups to be manipulated, to be brought up to hate and point the finger at other neatly seperate groups. Blaming each other to cover our own ignorence of the true nature of WHY?

Why are there poor,hungry, disposseed peoples?

Why is there such a huge gap between those that have, and those that have nothing?

Why do religious/govermental leaders live in absolute opulence?

Why do religious leaders teach that anyone who does not believe what is in this version of this book is wrong?

Why do we live in a society that teaches/encorages us to covert wealth and status?

Why do we need a central bank, which loans money to other banks at interest, those other banks then lend to you at even higher interest.

Why do these same central banks (all the big western economies have one) print all the money for the country/ and sell it to the government of that country……

That people is where the huge country debts comes from people. Money is lent from the central bank at interest. the only money we have comes from the central bank, so we will always owe more money back that we will ever actually have.

This means logically and not in anyway fiction, that those who run these central banks are those that run the country. These people have the power to say to the leagal ellected government, WE CALL IN THE LOAN…. the country goes bankrupt and that leagl elected government is who the media tell us to point the finger at for mass unemployment, huge public spending cuts, schools and hospitals being run into the ground.

so why does the bigest question of all get asked.

WHY DO WE NEED A CENTRAL PRIVATELY OWNED BANK?

it seems this is the cause of all our problems and the solution is to get rid of this corrupt banking system

The Bank of England is owned by the Government.

i need to know how muck the uk own

also how much india own

I suppose it’s not as simple as just crossing off noughts.

UK like many countries waste energy

Progress technology has made the private sector rich.

Top 5% own UK wealth.

Economic cake not shared equally as it used to be give and take a bit.

Maybe it’s all down to simple idol worship; reaching for the stars.

Even rubbish is not what it used to be, we only had small house hold bins

What we didn’t throw away we would reuse or burn on the fire to keep warm

Take back empty bottles get 3p nice bit of pocket money for us children

These days the bins are twice the size and some houses want two or three of them

There is wealth in the United Kingdom, but it’s like blocked sewage water, stagnant!

Unfortunately it’s the elderly and disabled who pay the price they are ones left to suffer the worst. Tell me it’s not an evil government that we are rules by and I will tell you we are not a wicked people.