The UK national debt is the total amount of money the British government owes to the private sector and other purchasers of UK gilts (e.g. Bank of England).

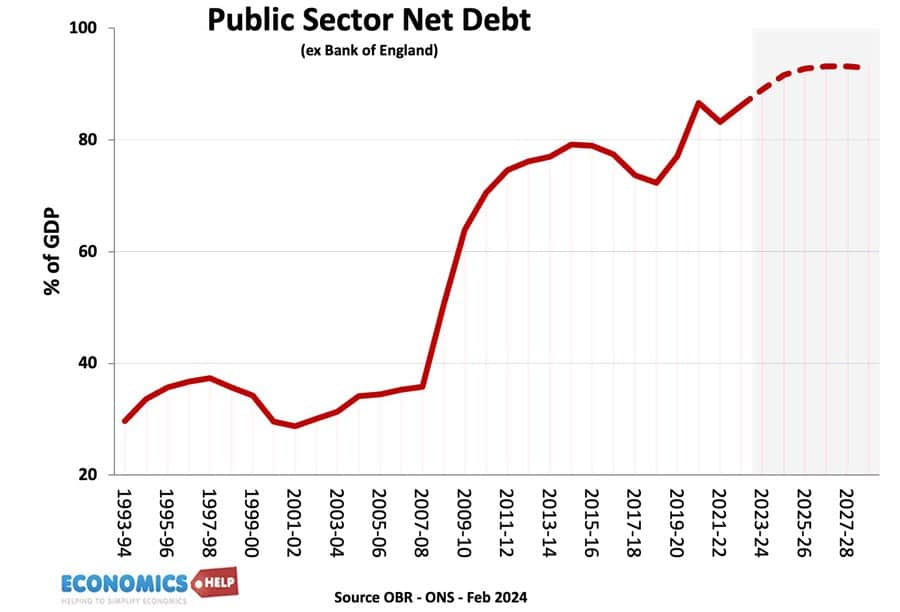

- UK public sector net debt (ex public sector banks) was £2,685.6 billion or 98.1% of GDP (20 Dec 2024).

- The OBR have forecast substantial rises in UK debt over the coming decade because of demographic factors, putting strain on UK spending.

- Source: [1. ONS public sector finances,- HF6X] (page updated 20 Jan 2024)

Source: ONS debt as % of GDP – HF6X | PUSF – public sector finances at ONS

Reasons for National debt

- Enables the government to spend more during periods of national crisis, e.g wars, pandemics, and recessions.

- In a recession, the government will automatically receive lower tax revenues (less VAT and income tax) and will have to spend more on benefits (e.g. more unemployment benefits) This causes a cyclical rise in debt.

- Extra government borrowing during a recession can help provide fiscal stimulus to promote economic recovery. By borrowing and then spending more, the government is injecting demand into the economy and this can help to reduce unemployment. This is known as fiscal policy and was advocated by J.M. Keynes.

- Strong market demand for government debt. Private investors buy gilts because they are seen as risk-free investments and there is also an annual dividend from the bond yield. Since 2009, there has been strong demand despite very low-interest rates, meaning the government can borrow very cheaply.

- Finance investment. The government could borrow to finance public investment projects that can lead to higher growth in the future.

- Political convenience. There is usually political pressure to cut taxes and increase government spending. Allowing debt to rise can be a way for the government to avoid difficult choices.

Forecast for the National debt?

Source: Fiscal risks and sustainability – OBR – Economic and Fiscal Outlook Oct 2024

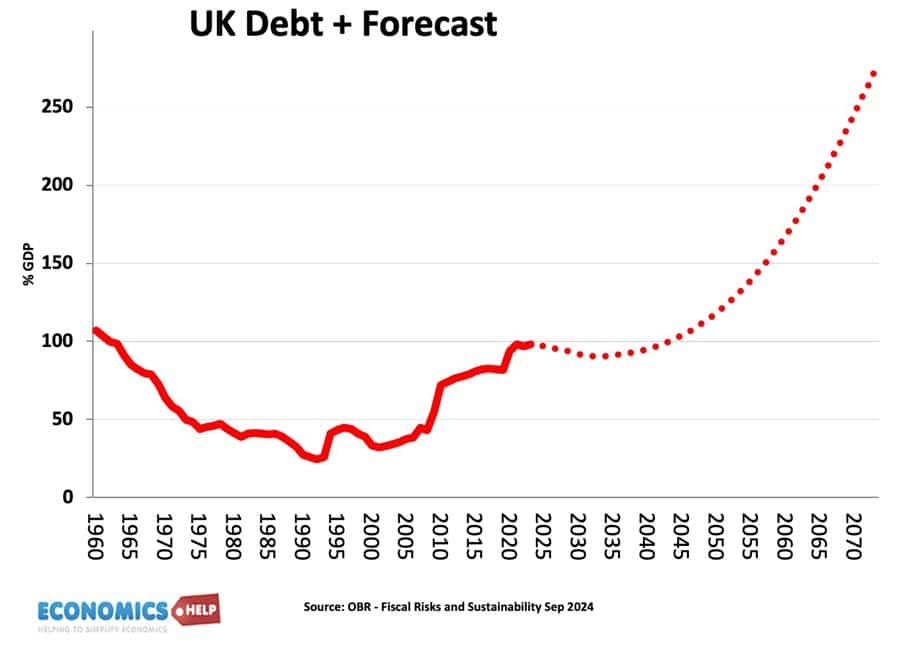

The OBR have forecast that, on our given trajectory, UK public sector debt could reach 350% of GDP within 50 years. The pessimistic outlook for national debt is made because

- An ageing population and demographic changes will put increased pressure on government spending, notably health care and pension spending.

- A smaller working population will limit UK’s productive capacity.

- Stress on finances from geopolitical events, such as frostier relations with China, Russia and the Middle East.

- Higher energy prices

- Costs of climate change.

- Declining tax revenues from petrol in a decarbonising economy.

- Low productivity growth of UK since the financial crash of 2009

- Recent boost to debt from the financial crisis and one-off cost of Coronovirus pandemic, which cut tax revenues and required government support for lockdown measures.

UK debt in context

Predicting debt for the next 50 years is difficult since we don’t know what kind of productivity improvements may come, e.g. continued gains in renewable energy may reduce the burden of higher oil and gas prices. Equally, the costs of environmental change could be worse.

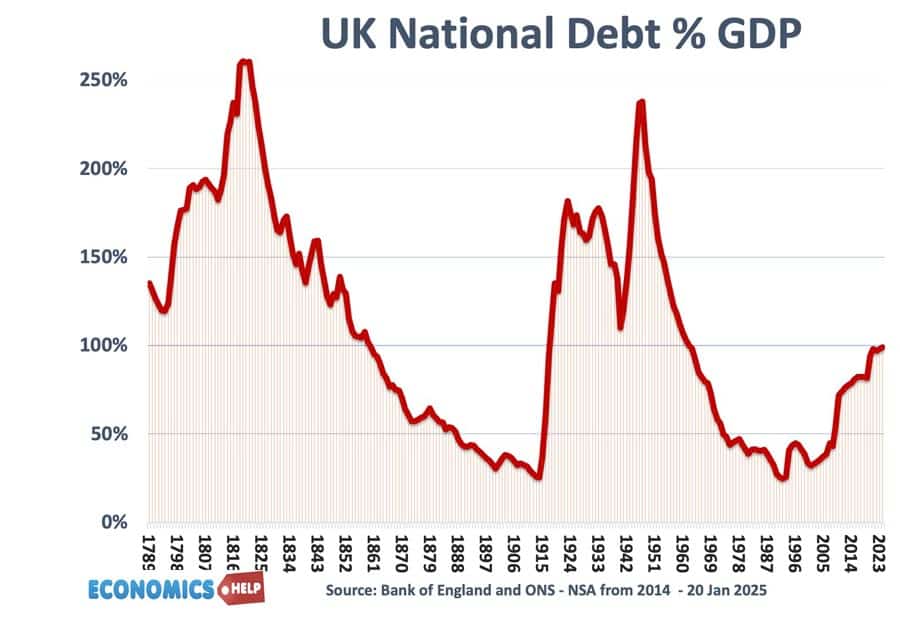

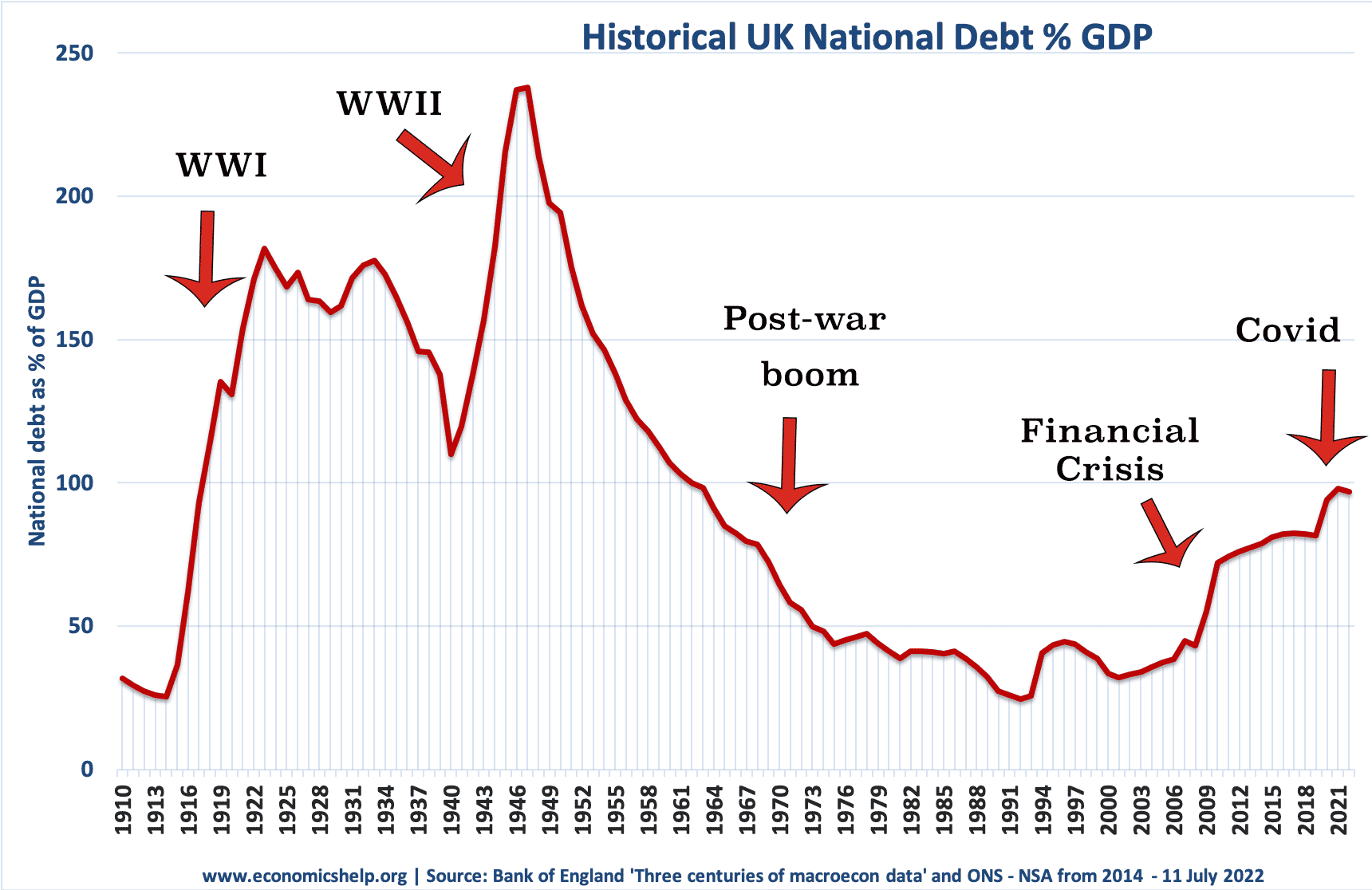

History of the national debt

Main article: History of UK national debt

UK national debt since 1900

Source: Reinhart, Camen M. and Kenneth S. Rogoff, “From Financial Crash to Debt Crisis,” NBER Working Paper 15795, March 2010. and OBR from 2010.

These graphs show that government debt as a % of GDP has been much higher in the past. Notably in the aftermath of the two world wars. This suggests that current UK debt is manageable compared to the early 1950s. (note, even with a national debt of 200% of GDP in the 1950s, UK avoided default and even managed to set up the welfare state and NHS.

Debt reduction and growth

The post-war levels of national debt suggest that high debt levels are not incompatible with rising living standards and high economic growth.

- The reduction in debt as a % of GDP 1950-1980 was primarily due to a prolonged period of economic growth. See: how the UK reduced debt in the post-war period

- This contrasts with the experience of the UK in the 1920s when in the post First World War, the UK adopted austerity policies (and high exchange rate) but failed to reduce debt to GDP. Debt in Post-First World War period.

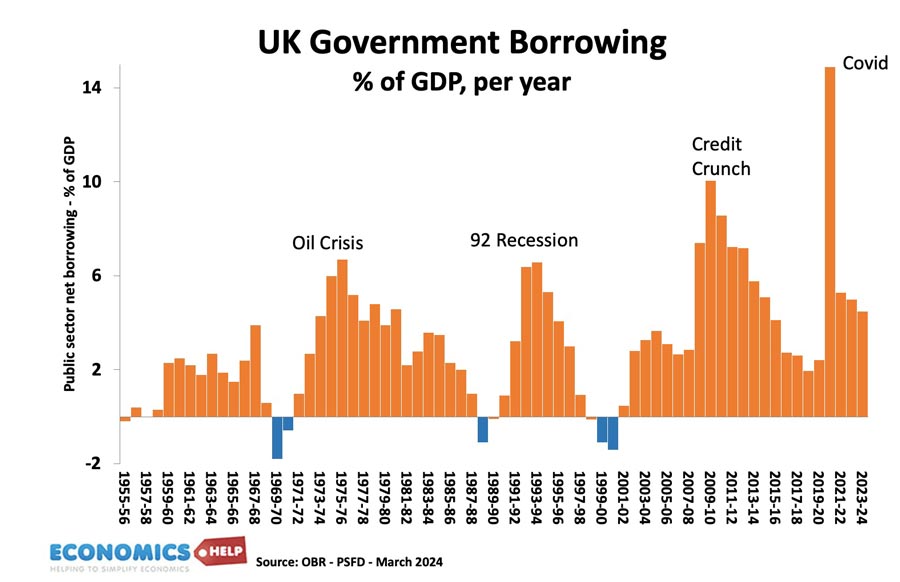

Budget deficit – annual borrowing

This is the amount the government has to borrow per year.

- Government

- borrowing in the financial year to December 2024 was £129.9

Annual borrowing since 1950. Figures for 2023-24 are forecasts (and rather optimistic!)

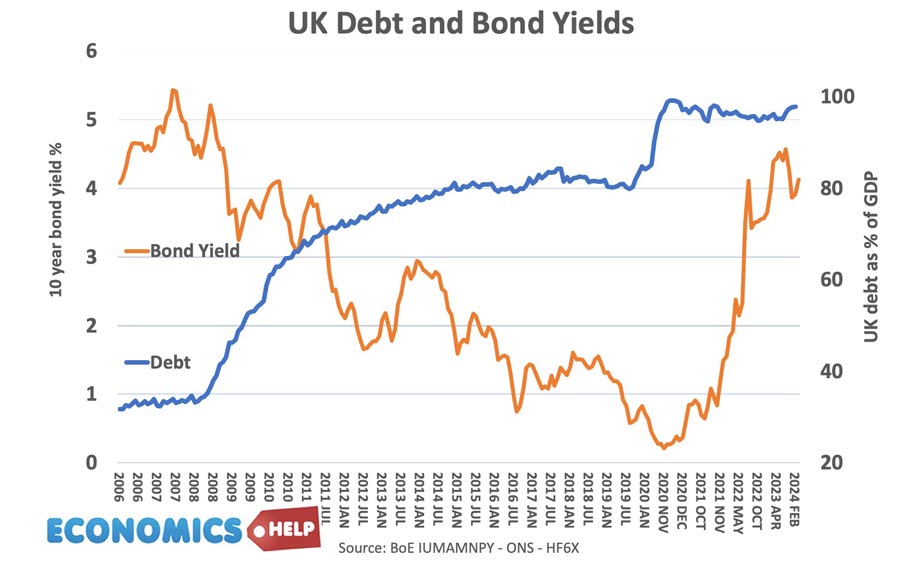

Debt and bond yields

Bond yields a the interest that the government pay bond/gilt holders. It reflects the cost of borrowing for the government. Lower bond yields reduce the cost of government borrowing.

Between 2007 and 2020, UK bond yields fell. Countries in the Eurozone with similar debt levels saw a sharp rise in bond yields putting greater pressure on their government to cut spending quickly. However, being outside the Euro with an independent Central Bank (willing to act as lender of last resort to the government) means markets don’t fear a liquidity crisis in the UK; Euro members who don’t have a Central Bank willing to buy bonds during a liquidity crisis have been more at risk to rising bond yields and fears over government debt.

See also: Bond yields on European debt | (reasons for falling UK bond yields)

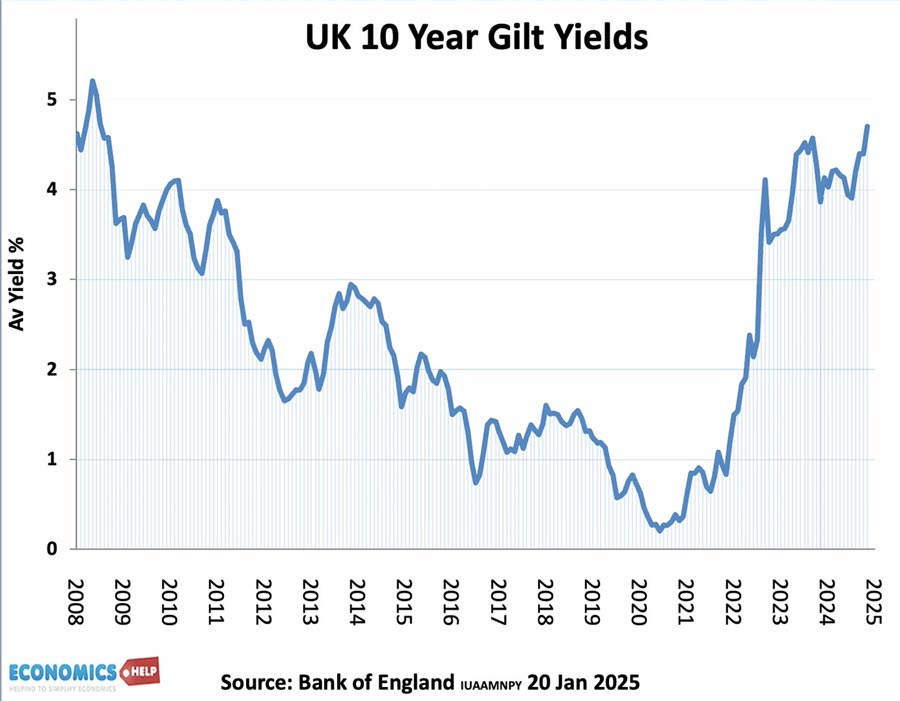

Since 2021, bond yields have risen due to pick up in inflation

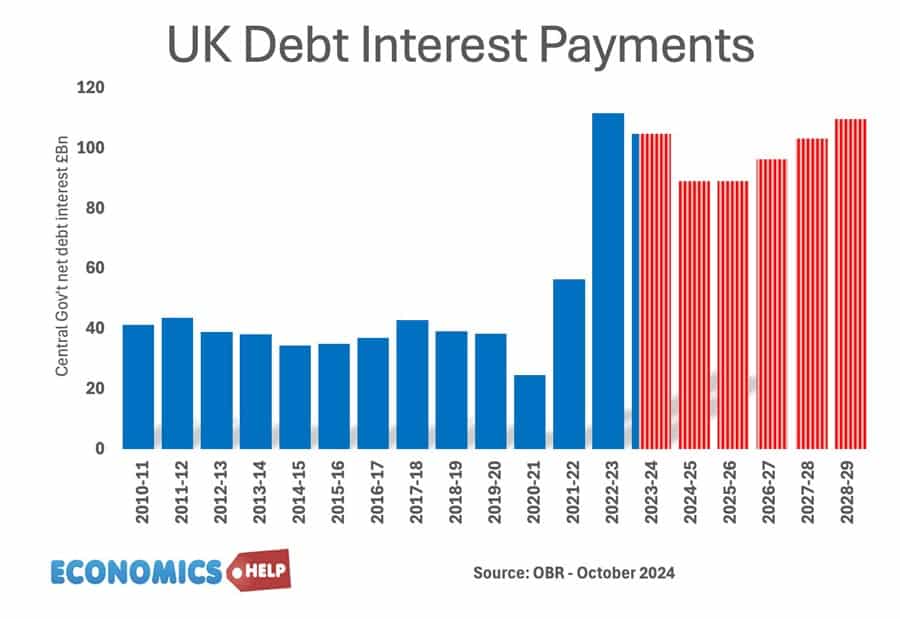

Cost of Interest Payments on National Debt

The cost of National debt is the interest the government has to pay on the bonds and gilts it sells. According to the OBR in 2023-24, debt interest payments will be £108 billion. (3.2% of GDP) or 5.2% of total spending. It is lower than in previous decades because of lower bond yields.

See also: UK Debt interest payments

The era of low interest rates post 1992 helped to reduce UK debt interest payments as a ratio of government revenue. However, with interest rates and borrowing increasing – debt interest cost have increased significantly.

Potential problems of National Debt

- Interest payments. The cost of paying interest on the government’s debt is very high. In 2011 debt interest payments will be £48 billion a year (est 3% of GDP). Public sector debt interest payments will be the 4th highest department after social security, health and education. Debt interest payments could rise close to £70bn given the forecast rise in national debt.

- Higher taxes / lower spending in the future.

- Crowding out of private sector investment/spending.

- The structural deficit will only get worse as an ageing population places greater strain on the UK’s pension liabilities. (demographic time bomb)

- Potential negative impact on the exchange rate (link)

- Potential of rising interest rates as markets become more reluctant to lend to the UK government.

However, government borrowing is not always as bad as people fear.

- Borrowing in a recession helps to offset a rise in private sector saving. Government borrowing helps maintain aggregate demand and prevents a fall in spending.

- In a liquidity trap and zero interest rates, governments can often borrow at very low rates for a long time (e.g. Japan and the UK) This is because people want to save and buy government bonds.

- Austerity measures (e.g. cutting spending and raising taxes) can lead to a decrease in economic growth and cause the deficit to remain the same % of GDP. Austerity measures and the economy | Timing of austerity

Who owns UK Debt?

The majority of UK debt used to be held by the UK private sector, in particular, UK insurance and pension funds. In recent years, the Bank of England has bought gilts taking its holding to 25% of UK public sector debt.

Source: DMO Debt Management Report 2022/23

- Overseas investors own about 28% of UK gilts (2022).

- The Asset Purchase Facility is purchases by the Bank of England as part of quantitive easing. This accounts for 26% of gilt holdings.

Total UK Debt – government + private

- Another way to examine UK debt is to look at both government debt and private debt combined.

- Total UK debt includes household sector debt, business sector debt, financial sector debt and government debt. This is over 500% of GDP. Total UK Debt

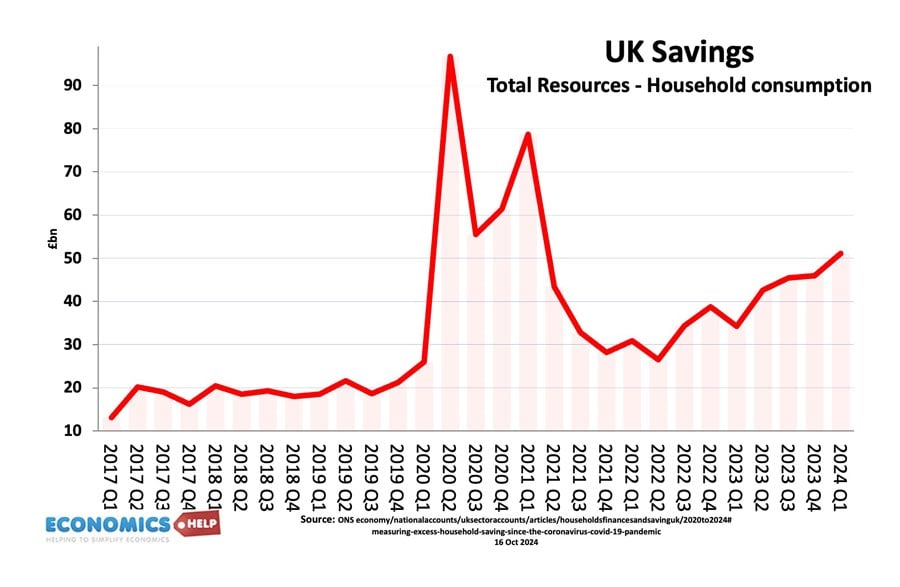

Private sector savings

When considering government borrowing, it is important to place it in context. From 2007 to 2012, we have seen a sharp rise in private sector saving (UK savings ratio). The private sector has been seeking to reduce their debt levels and increase savings (e.g. buying government bonds). This increase in savings led to a sharp fall in private sector spending and investment. The increase in government borrowing is making use of this steep increase in private sector savings and helping to offset the fall in AD. see: Private and public sector borrowing

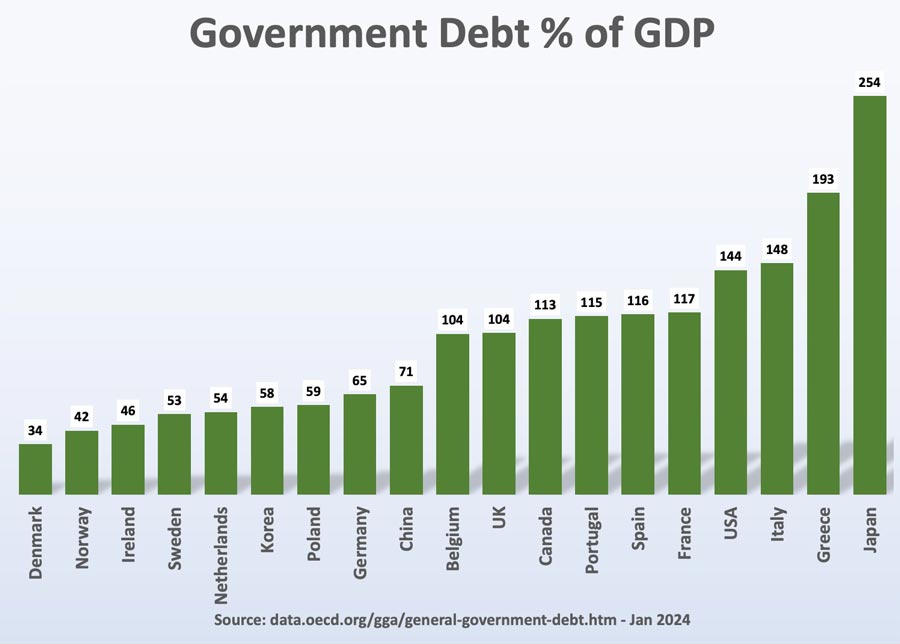

Comparison with other countries

Although 107% of GDP is high by recent UK standards, it is worth bearing in mind that other countries have a much bigger problem. Japan, for example, has a National debt of 256%, Italy is over 157%. The US national debt is over 132% of GDP. [See other countries debt].

How to reduce the debt to GDP ratio?

- Economic expansion which improves tax revenues and reduces spending on benefits like Job Seekers Allowance. The economic slowdown which has occurred since 2010 has pushed the UK into a period of slow economic growth – especially if we consider GDP per capita growth. Therefore the further squeeze on tax revenues has led to deficit-reduction targets being missed.

- Government spending cuts and tax increases (e.g. VAT) which improve public finances and deal with the structural deficit. The difficulty is the extent to which these spending cuts could reduce economic growth and hamper attempts to improve tax revenues. Some economists feel the timing of deficit consolidation is very important, and growth should come before fiscal consolidation.

- See: practical solutions to reducing debt without harming growth

Other countries debt

See also:

All I’ve heard so far is how big the UK deficit is. With all the cuts and bills going down it would be helpful if we were told if the debt was starting to go down and by how much, it might actually start to put people’s minds at ease.

I agree. A web based measure of the UK debt which was widely publicised (BBC?) showing the trend as well as the actual level of debt could be very interesting and helpful for everyone. It is amazing that the government has a plan to reduce the debt and no visible measure of how we are doing. A thermometer like those outside churches could pull the rug from the anarchists who want to tear up the debt reduction plan. We could see that although painful, some progress is being made (or not?).

What we are doing now is not dissimilar to Roy Jenkins’ cuts in the late 60’s he brought us out of an £800m deficit into a £387m surplus, toughen up and let the economy settle

I agree with you in principal except your claim of a surplus of £387m as great as that would be does not match the graph above which shows a constant UK debt as % of GDP throughout. Either the graph is skewed and your source is right or the graph is right and your info is wrong ??

The surplus of £387m will relate to the annual budget deficit. The graph shows total national (public sector) debt. One years budget surplus only makes a small dint in the total debt outstanding.

When overhead costs are more than income and new loans are unavailable to cover the shortfall, most of us sell assets to raise the cash to pay down debt. A downside with tax is it takes buying/investment power from the pockets of the public and business… it impacts negatively on growth. The oil industry, for example, was recently hit with an additional Northsea tax, causing independent oil companies to retreat from investing in developing new marginal fields, because they moved from marginal to uneconomic – lost investment and jobs.

How about this for a not entirely thought through solution (no economist me) to pay off our £1+ trillion national debt and thus save £50 billion a year in interest payments: UK plc treat big business tax income as an asset e.g. 30+ years tax from the oil industry currently @ around £8 billion a year is worth £250 billion plus… let’s offer them say a 25% discount to pay this tax up front… boom, £200 billion. Let’s extend the offer to other sectors, like wind energy for example, to achieve the £1 billion+we need to cover the national debt – boom, £150 billion saved in interest payments over 30 years.

Yeah, I know it’s at a rough idea stage but there’s plenty of cash in the international marketplace for participating companies to attract the up-front cost, it just aint’ being invested at the moment. And such deals could stipulate that the 25% discount is invested in new field developments, creating jobs, building energy capability, etc., and earning good returns for organisations (pension funds et al) who provide the up-front capital.

One potential problem though, once we’ve wiped out the national debt, saved paying billions in interest payments, etc., this and successive governments will feel so flush they’ll no doubt rack up new debt with goodies for the public, to bribe voters to get them into power, and the banks will rejoice once again… with all that cash crossing their palms over and over.

.

In order to cut the deficit and the debt you must have growth as well as tax and cuts.

I suggest the following

Print a £100 billion and place it in Northern Rock which remains state owned, use Northern rock as a tool for direct credit to mortgage seekers and SME’s

Let the bankers set their bonus’s as long as their is a direct link to the dividend paid out to investors. With inverstors dividends increasing shares in banks will rise and the vaule of the banks will increase, the publics shares can be sold over a period of time at an increased value to pay down our debts

Up to £100 billion is the estimate of tax avoidence in the UK, close the loop holes and the gaps to claw back fair tax from companies who are not paying their fair share or investing in the UK. I see no reason why an owner of a clothes store can send out half a billion each year to his wife without any tax on it

A national building programme where every council gives up land freely at the first stage so builders can build cheaply for private purcahse and social housing, the demand is there. Councils receive money for the land in staged payments over the term of the mortgage, this will allow banks to lend well below the actual value of the property initially and allow first time buyers to purchase a home with the council holding a charge on the property until the land is paid for.

No tax for the self employed for the first £30k for 5 years encouraging people to start up their own business’s and invest

Investigate the wholesale energy markets for profit as the big six retailers own 85% of the wholesale market and are selling the energy to themselves, set a guaranteed price that they must sell to new competitors entering the market and hold it for 10 years with increases only sanctioned by the regulator, lets start the deregulation again but get ti right and create competition and lower bills

No tax on profits for companies investing in green energy for 10 years, there is money out there for companies to invest in other industries and if the profits that come back are tax free they will invest. The Russians sell the EU 25% of their gas and it forms 70% of their revenue, we cant go on being stitched up, renewable energy is the way forward.

It is estimated that there is over 1 and half million people in this country who shouldnt be here, pay finders fees to bounty hunters to find them, they are working within a huge black market where companies are not paying the tax they should and the illegal immigrants are using vital services without contributing

Work programmes for the long term unemployed. Councils are having to cut services due to costs, if the long term unemployed had work for their beneifits to help keep services going at a reduced cost, this will help the public and the unemployed as they gain dignity, experience and work ethic again

Freeze fuel duty on petrol and deisel to keep prices down at the pump, this is stopping people spending on retail

Invest heavily in manufacturing as it should replace some of the financial and service industry that will not survive and is heavily relied upon for tax receipts

FREE university places for certain subjects where industry has to look abroad for workers to fulfill poitions

stop buying US treasury bonds, a year ago it had risen to $511 Billion, how much the government had actually purchased is hidden under a clause which forbids the public to gain access to the information under the freedom of information act, we can only be funding that by selling sterling bonds at a cost to the tax payer as the US pay less interest than the UK

We also need to find a way to fund income tax so that no-one pays tax on the first £15k giving people money in their pockets to afford to live and spend in the retail sector which feels like its in recession

With so many brilliantly minded business types lending their 2 cents into this problem, we should be on a path to recovery by now!. Is it that the government is not listening or are we not shouting loud enough? A problem shared and all that. If the brilliant minds could form a collective and beat down the ‘hierachy’ until they listen then perhaps a way out can be found quicker and easier. On another note..I always said the Euro zone was a bad idea, how glad I am that we are not in it.

We have been bombed, terrorised and invaded and yet as a tiny Island we have fought back with such force that we remain an independent nation still to this day. Britain may be in the shit but it is NOT itself shit.

I’m not an economist by any measure, but it looks to me the chicken will soon becoming home to roost in blighty!

$8.9 Trillion in external debt? more than half of the united states external debt of $14.5 trillion? Am I missing something here?

let’s face it, property, property, and more property! The most obsessed nation on earth that likes to make money out of property at the expense of it’s own kith and kin. no wonder why we have $8.9 trillion to fund our crack cocaine property habit. People must realise bricks and mortar is DEBT.. period. You either print lots of money, borrow lots of money or make things to fund that debt. We make hardly anything lol!

At least the US own the internet which defines 21st century living, from google, to facebook, all motivated by very young people even before graduation. Germany makes things, and so does Japan. We make debt out of thin air in the square mile and that’s pretty much it folks! Oh by the way, here’s a way out… let’s go invade IRAN!

“$8.9 Trillion in external debt? more than half of the united states external debt of $14.5 trillion? Am I missing something here?”

Yes, you moron. Read the article. The first bullet point, three lines down, states;

“UK public sector net debt in September 2011 was £966.8 billion, equivalent to 62.6 per cent of GDP”

Where the hell did you get $8.9 trillion from?

“I’m not an economist by any measure”

http://tinyurl.com/6ndfbo4

kil_2k, it’s really not worth calling someone a moron. Robert seems to be referring to figures published on the web. For example:

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2079rank.html

http://www.gfmag.com/tools/global-database/economic-data/10403-total-debt-to-gdp.html

What’s the explanation for the discrepancy?

Who are we paying all this interest to?

The investors who buy the government bonds

people who hold bonds like pension funds and investment trusts

Very clearly explained. The debt problem in the UK is vast, and seeing public sector workers strike over their pensions shows that most people just dont get it.

There is a “Debt Charter” here that I have to agree with: http://www.cutthedebt.co.uk/our-debt-charter/

Mike,

Why should public sector workers, pay money out of their own salaries (which are already low compared to equivalent private sector) to reduce the debt that was causes by greedy bankers knowingly trading assets that had no value to get rich.

The rise in pension payments (double of what we currently pay) is to pay for this debt, NOT our own pensions.

Would you pay out of your own salary each month to reduce a debt caused by these bankers who take home bonuses of over £100,000?

Ben,

Public Sector wages are paid for by the Private Sector. Wages are nothing but recycled tax take, bumped up by the Private Sector. Treasury pays the wages of public sector and takes the taxes, only significantly less.

If this country stopped sending millions in benefits to eastern europe and paying benefits to people who do not deserve it money would be saved, why is it that Australia do not allow people in to their country without money in the bank because they cannot sponge of the country if they are out of work.