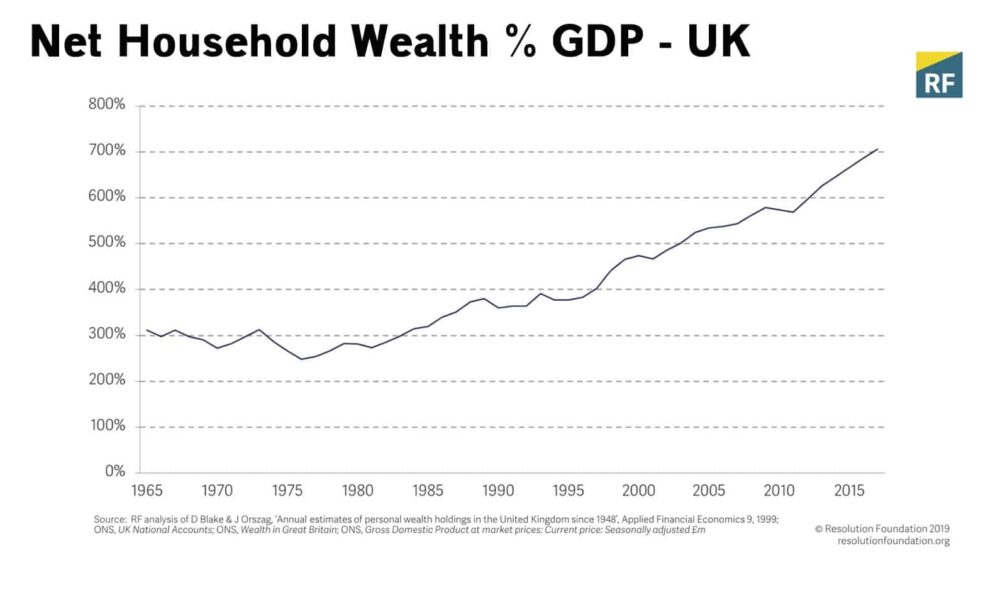

In the past two decades, average wages have stagnated and government debt has risen. It seems to be an era of austerity. But, it’s not all bad news. UK household wealth has reached a record £13.6 trillion – over six times national income up from 3 times national income in 1980. But, this gain in wealth is remarkably unequal. Whilst the middle 50 decile have zero net wealth, the top 10% have net wealth of £1.1 million. Some people ask, Is Britain broke? But by the size of household wealth, the answer is no

Furthermo,,e because of the hotpotch nature of the taxation system, the very wealthy who make income from investments and capital gains, can end up paying a lower effective tax rate than ordinary workers. So is the solution a wealth tax? Partiotic millionaires say Tax the wealthy to fund public services. But critics argue higher tax on the wealthy will lead to millionaires fleeing and even lower levels of investment and economic growth. But, are these fears realistic? It was claimed VAT on school fees would lead to an exodus to the public sector, but this has not materialised so far. The 1960s, was often seen as a golden era for the UK, but it was also a golden era for the tax man, with some marginal tax rates at the highest part of the tax schedule around 90%. And whilst a wealth tax may cause some millionaires may flee to Dubai or Monaco, a well-designed tax system could also make Britain a more attractive and equal place to live in in the long run.

The idea of a wealth tax is certainly popular. According to Yougov 78% support a 1% wealth tax on wealth above £10 million. There is a smaller but still positive margin of support for raising capital gains to the same level as income tax rate. And it’s not just a populist movement. There is support for some form of wealth taxes coming from economists like Joseph Stiglitz to the IMF, Even the Conservative -aligned think tank Bright Blue, suggest shifting the burden from tax on work to more wealth based taxes would benefit the economy and improve distribution.

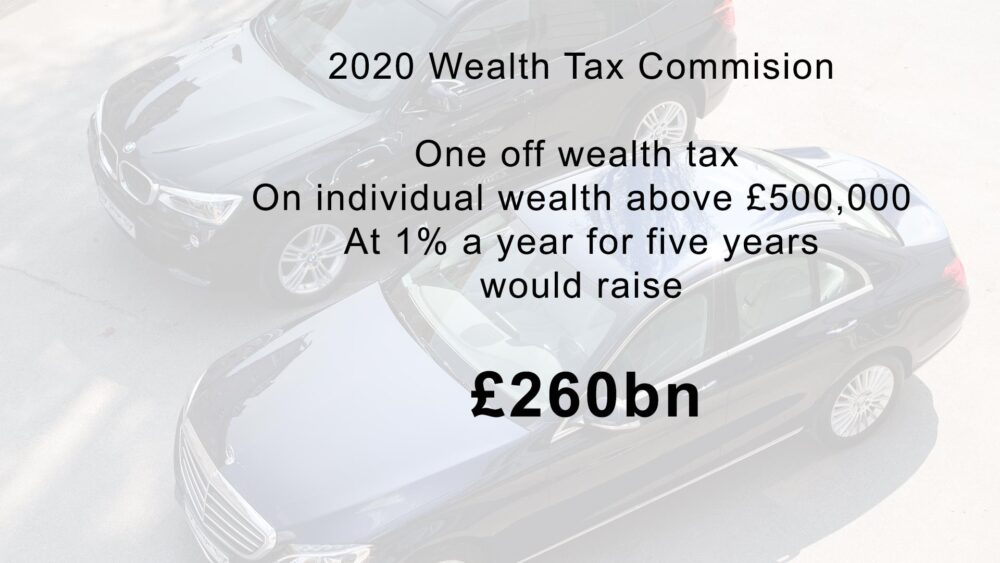

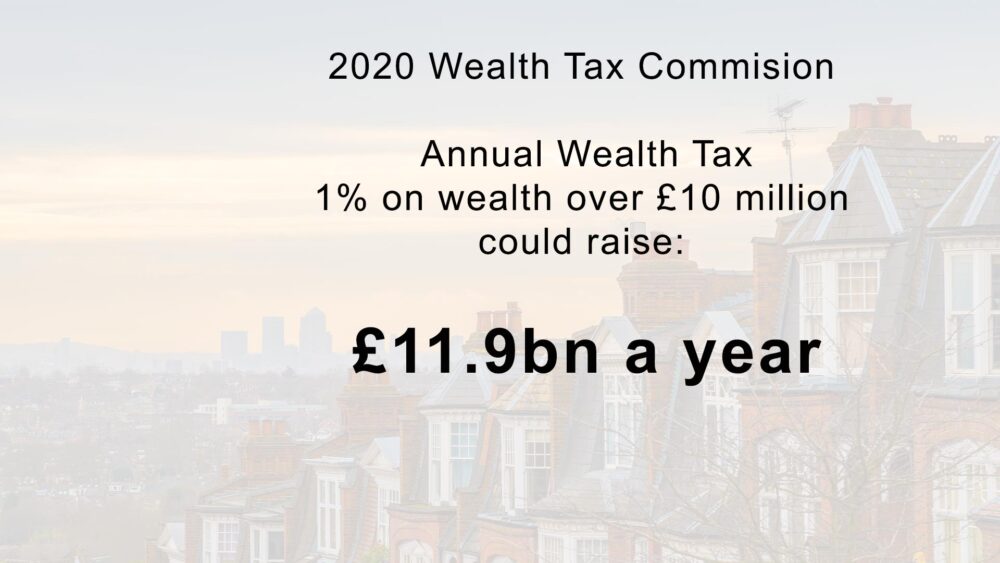

Supporters claim the rewards are potentially high. In 2020, a wealth tax commision claimed a one off wealth tax payable by all individual wealth above £500,000 and charged at just 1% a year for five years would raise £260bn. This is the same tax revenue has increasing the basic rate of income tax from 20p to 29p. Alternatively an annual wealth tax of 1% on wealth over £10 million could, in theory raise £11.9bn a year.

Yet, if wealth taxes raise money from the rich, and are very popular with the public, why do so few countries have them? Why is the current government reluctant to go there? In the 1990s, 12 OECD countries had wealth taxes, but today,y only three have retained them. And the amount raised is fairly trivial, less than 1% of tax revenues. France has had some form of wealth tax since 1981, but it would be hard to say it has been a huge success. A research group New World Wealth, claimed there was a net outflow of more than 60,000 French millionaires between 2000 and 2016. French economist Eric Pichet estimated that the French wealth tax lost more revenue than it gained. Yet, faced with a jump in military spending, the French Parliament recently voted in favour of a 2% wealth tax on those with assets to exceed €100m, primarily to fund more defence spending.

Would the Rich Leave Country?

But do high taxes on the rich really cause people to leave the country? In the aftermath of the Second World War, the UK, like other countries, significantly increased taxes on the rich. In 1948, the nominal marginal tax rate on incomes over £1m was 98%. Estate duties an earlier version of inheritance tax reached reaching a peak of 85% in 1969. This didn’t lead to a mass emigration of the rich and economic growth was much better than the current levels. Debt fell sharply. But is it comparable? Firstly, it was harder to move country in those days, secondly, the high tax rates were more of a global phenomenon. Thirdly, in this period of high taxes, there were tax avoidance programmes, such as gaining income through capital gains. And it was this tax avoidance which led to the introduction of capital gains tax in 1965.

Problems of wealth tax

Problems of a wealth tax include the incentive for wealthy to move to another country, the difficult of measuring wealth, liquidity constraints and perhaps most importantly the ability for the very rich to avoid wealth taxes through exemptions and holding wealth in off-shore accounts.

Wealth taxes are not easy to implement – it’s difficult to measure wealth, difficult to collect and perhaps most importantly, the very rich are usually most adept at holding wealth in offshore trusts. The IMF state that multinational firms have invested $12 trillion globally in off-shore tax havens, with $7 trillion of personal wealth. The Wealth Tax Commission suggested one way to raise money is a one-off wealth tax. It doesn’t change past incentives to and needs onlya single wealth assessment rather than ongoing assessment. Yet, it still has drawbacks. On a threshold of £1,000,000 it would still have administrative costs of £4bn.

Rather than a new wealth tax a more practical solution may be to tax the wealth through existing tax structures. This avoids double taxation, costs of administration and could be implemented much sooner than a wealth tax. Here there are many options.

Inheritance Tax

Firstly, inheritance tax is increasingly important because of the level of inheritances. The FT estimates a total of £7 trillion will pass between generations in the next 30 years.. Yet, the current inheritance tax manages to be both very unpopular and raise only a very small share of revenue. One reason for its unpopularity is that the standard rate is 40%, yet in effect, the rate people pay is much less. Firstly, only 4% of estates currently pay it. Secondly, it is very easy to avoid. The very wealthy tend to gift their wealth to trusts before they die, so this is not taxed at all. An alternative is to scrap the inheritance tax and replace it with a lifetime receipts tax allowance. This doesn’t distinguish between income received on death and income throughout your life. In 2020, a rate of 20% on gifts above £500,000 throughout your life would bring in an estimated £11bn a year, double inheritance tax £6bn.

Lifetime gifts are a big deal. Buying a house has become increasingly dependent on whether your parents can give help with a deposit. But this is creating unfairness in the housing market.

In his taxing wealth report 2024 Richard Murphy suggests restricting tax relief on pension contributions to the basic rate rather than higher rate of 40 or 45% could save an estimated £14.5 billion. Another suggestion is extending VAT to financial services, mostly bought by higher earners, which he claims could raise £8.7bn of extra tax. Currently VAT is regressive with the poorest 10% paying 12% while the richest 10% pay just 3%. But, it would also make the UK an outlier with the EU and most countries not levying VAT on financial services.

Another solution is to equalise capital gains tax and income tax, or at least get closer. Currently there is an incentive for the wealthy to invest in more speculative trusts which offer capital gains, these are taxed at lower rates. According to research and University of Warwick, equalisaing capital gains tax with income could raise £16.7bn. Dan Neidle in an IFS podcats claimed it would be closer to £8bn. Tax forecasts are can differ.

Another solution is to extend national insurance to more forms of income, like investment income. This could raise £10bn. Extend NI to pensioners for income from work or from investment, but not their pension income. Could raise 1.7 to 3.8bn. This could be seen as way to fund social care.

A final idea is replacing property taxes such as stamp duty and council tax with some form of a land value tax which places greater pressure on investors to make use of land rather than holding onto land and planning permissions. This would also make it easier to move house, with high stamp duties increasing cost of buying and moving. The one advantage of a land value tax, is that it doesn’t create disincentives to create land. Land is fixed whatever the tax. Capital gains tax may well reduce investment to some extent. Land tax in theory, encourages better use of land, a big

A good tax system treats individuals equally. But at moment, people can pay less by getting income from investments. Secondly, there should be a degree of progressivity. Income tax is highly progressive, but becausethe wealthy often get other sources of income, so overall tax system is less progressive than it may first appear. Thirdly a good tax system should be efficient, i.e minimise distortions and disincentives. Generally corporation tax is considered the most damaging to economic growth because it discourages investment. Taxing inheritance, land ownership and gifts, can be relatively efficient because it is from good luck rather than hard work. A tax system also needs to be simple, this is one of the downfalls of wealth taxes; it’s not easy and when people have to do wealth self-assessments its popularity may fall. Fifthly ,there needs to be certainty and predictability. Many rich don’t mind pay tax, if they feel it is fair, clear and predictable. Sixthly, it needs to be relatively easy to collect. This is another downside of a wealth tax. However, whilst a wealth tax may not be the answer, there are ways to increase taxes on the wealthy without creating too many negative distortions on the economy. This video explains why tax may have to rise and given the bulk is from rising pensions, there is a case for higher tax from wealthy pensioners.

Sources

https://www.resolutionfoundation.org/publications/whats-up/

https://www.ukwealth.tax/

https://arunadvani.com/taxreform.html

https://equalitytrust.org.uk/evidence-base/billionaire-britain-0/

https://warwick.ac.uk/fac/soc/economics/research/centres/cage/manage/publications/bn27.2020.pdf

https://www.ehs.org.uk/dotAsset/8706c2fa-8c55-4d40-bfa5-75177223df68.pdf

https://ifs.org.uk/articles/how-tax-rich

https://www.investorschronicle.co.uk/content/c2a0a5ab-11a8-50a3-a098-240f320fc795

https://www.telegraph.co.uk/money/tax/france-tax-super-wealthy-fund-defence-bill-britain-next/

https://equalitytrust.org.uk/news/press-release/uk-still-taxes-the-poorest-more-than-the-richest/

https://www.resolutionfoundation.org/publications/wealth-on-the-eve-of-a-crisis/