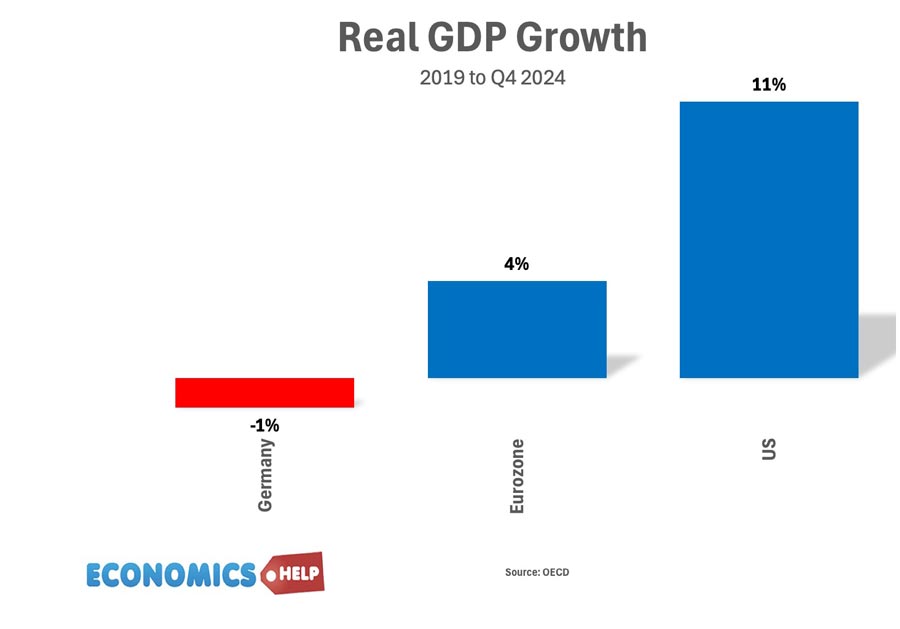

It’s been a bad few years for the European economy – inflation, energy crisis, falling real wages and a stagnant economy – losing ground to China in the east and the US in the west. Whilst US GDP booms, Western Europe seems stuck in stagnation.

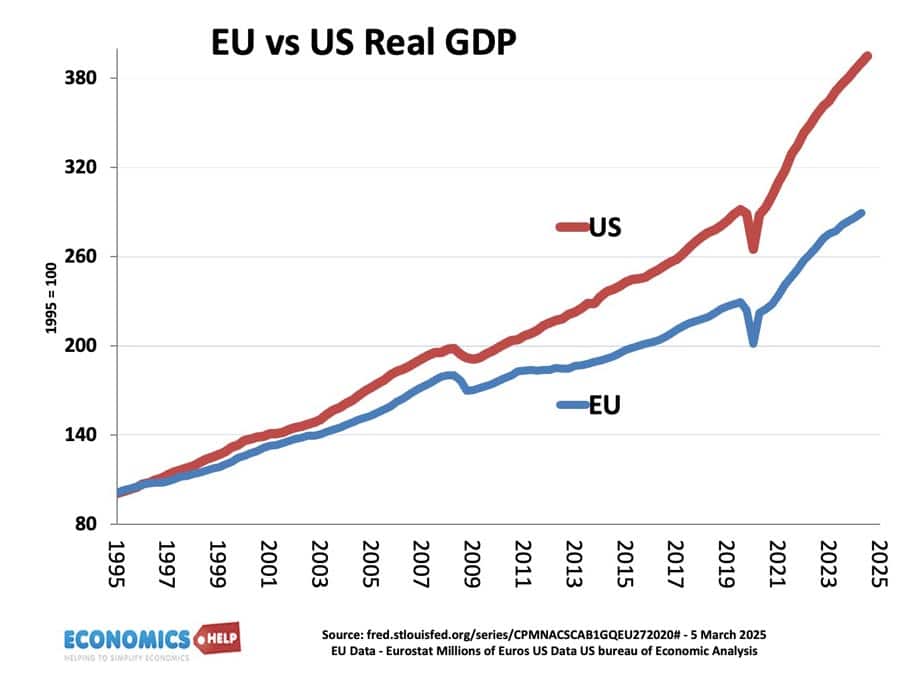

Since 1995, the US economy has grown 35% more than Europe. Over-regulated, obsessed with deficits and falling behind in big tech, electric cars and innovation.

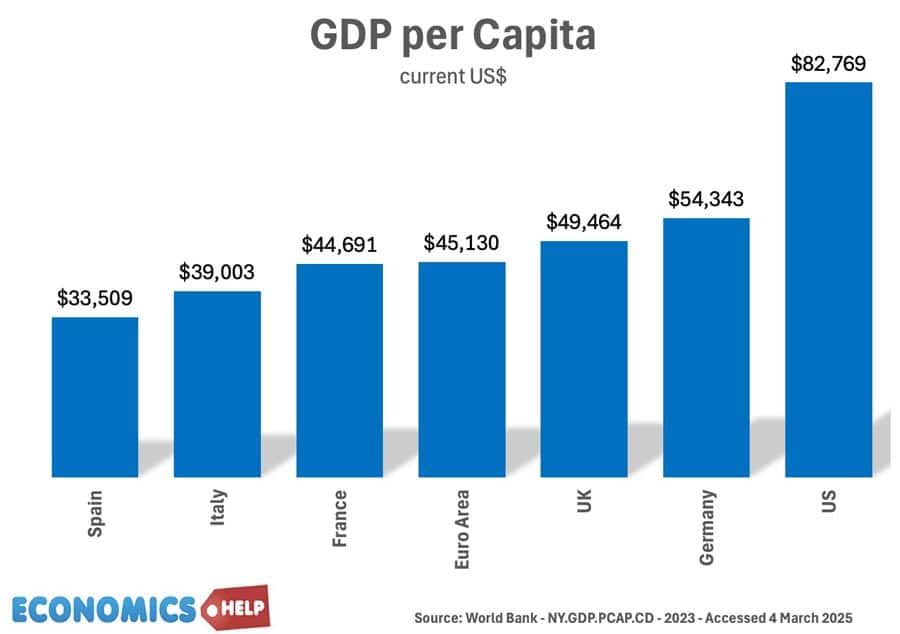

US GDP per capita is now 40% higher than even the once mighty Germany. Yet, whilst there are many very real problems with the European economy, there are signs it could be ready to try and revitalise its economy.

Firstly, the US economy has definitely done better in the past few years, but many statistics which compare in dollar terms are misleading. The dollar has been rising for 20 years and is now overvalued.

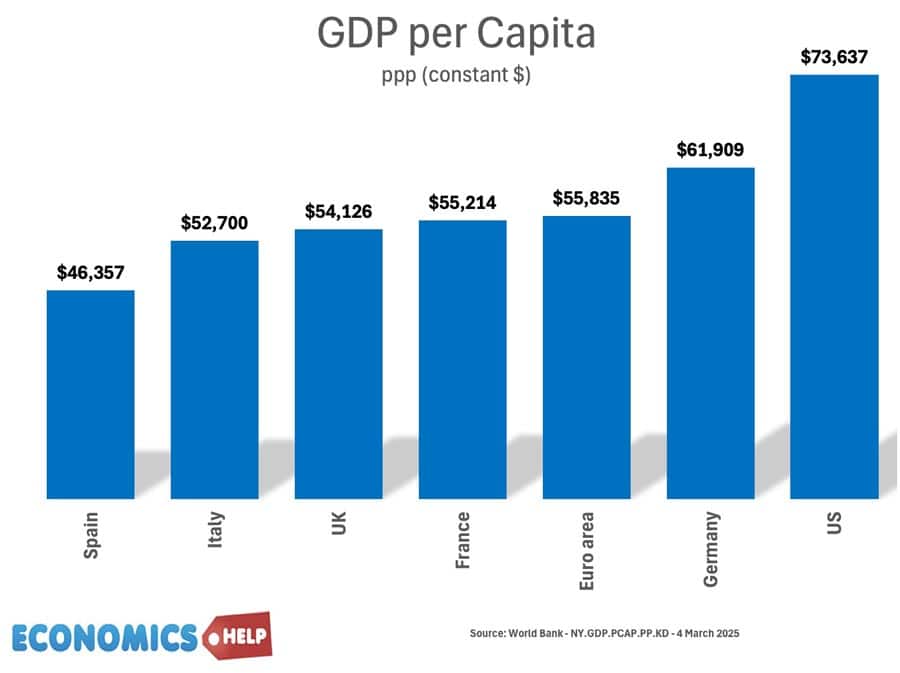

If we look at purchasing power parity, the gap between US and Europe is smaller. Ignoring the strength of dollar, US GDP per capita is only 20% higher. Also, when we compare GDP and average incomes, this is only part of the story. The US has much higher levels of inequality than Europe. In terms of income, the top 1% gain 20% of total income, this is much higher than European levels. It is the same with wealth, the US is an outlier. The top 10% own 71% of wealth compared to European countries where it is less than 60%.

2025 Change?

But, despite this the US economy has undoubtedly done better in recent years, at least in terms of GDP, but since the start of the year, there has been a sea change in US policy. Higher tariffs, on long-term allies like Canada and probably the European Union could start to see the US economic hegemony slowly unwind, especially combined with changing US geopolitical attitudes. It is a wake-up call for Europe, how will it respond? According to the IMF, currently the dollar accounts for 57 per cent of global official reserves, whereas the Euro is just 20%. But, as the FT reports this could start to change. The Euro has the potential to become more of a reserve currency. The Covid emergency fund showed there was huge appetite for EU wide debt issuance, an expansion of this could see investors buy more EU rather than US bonds. This, in theory, gives Europe opportunities, currently enjoyed by the US.

Weak Demand

One reason for the EU’s poorer economic record since 2009 has been to persistenly tolerate weak demand. A focus on balancing the budget debt, especially in the aftermath of the Euro debt crisis means that domestic demand as a share of GDP is near the bottom for advanced economies. Since 2009, the US injected €14tn into the economy from primary deficits, compared to €2.5 Tn in the EU. A more unified fiscal policy could help the EU economy grow faster. And the recent German government budget was a massive turn around from past caution with the debt rule exceeded for defence spending and an extra €500bn 10-year fund for public investment. This is a real sea change and it is causing German stocks to rise.

But, the EU’s current weakness is more than just demand. As Mario Draghi reported, the EU has effectively put tariffs on itself through internal barriers and regulations – especially on services. The IMF estimate Europe’s internal barriers are effectively like tariffs of 110% on services, this shrinks the Europen market, trade across EU countries is less than half the trade across US states. If the EU can tackle this there are real gains to be made.

This helps to explain why in terms of big tech, US firms completely dominate the market, with the big 7 US tech giants dwarfing European counterparts. The US dominance is due to better access to capital which fund start ups. Looser regulation, a culture of entrepreneurship, and US military support for funding innovations like GPS and AI. Also, in recent years, US companies have benefited from surging stock values with allowed them to buy up smaller start-ups. The EU has fallen behind, but it could change. Since the start of the year, the Germany stock market has soared in comparison to the US stock market.

Eastern Europe Growth

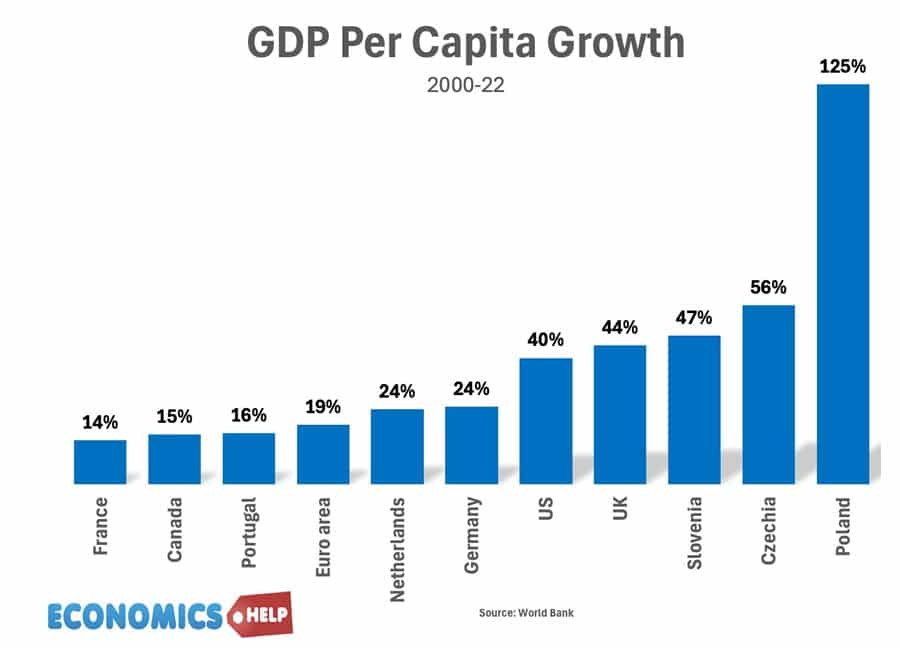

Also, big tech aside reports of the EU economy’s demise are over-exagerated. Firstly, the European Union has an excellent track record of helping low-income countries catch up with Western standards. Poland, Czech and Slovenia are examples of newly joined countries who have seen rapid growth in recent years. Whilst there has been much focus on German’s difficulties, the past few years have seen a remarkable turnaround for countries like Greece and Spain. In 2024, Spain’s booming economy has led it to be labelled “The best performing economy.” Away from big tech, the European economy still has areas of excellence. Novo Nordisk and the development of new wonder drug Ozempic is single handedly boosting the Danish economy. Interestingly Denmark enjoys a healthy trade surplus with the US – a big buyer of obesity drugs. The Swedish company Spotify is the leading in music streaming. Dutch company ASML produces the most advanced computer chips. It is true German industrial production may has fallen 17% in recent years, But, the Dax is up 20% since last November, it’s service sector giants like Deutch Telekom, Deutsche Bank, Allianz and Zallando are booming. Germany is becoming a service sector economy.

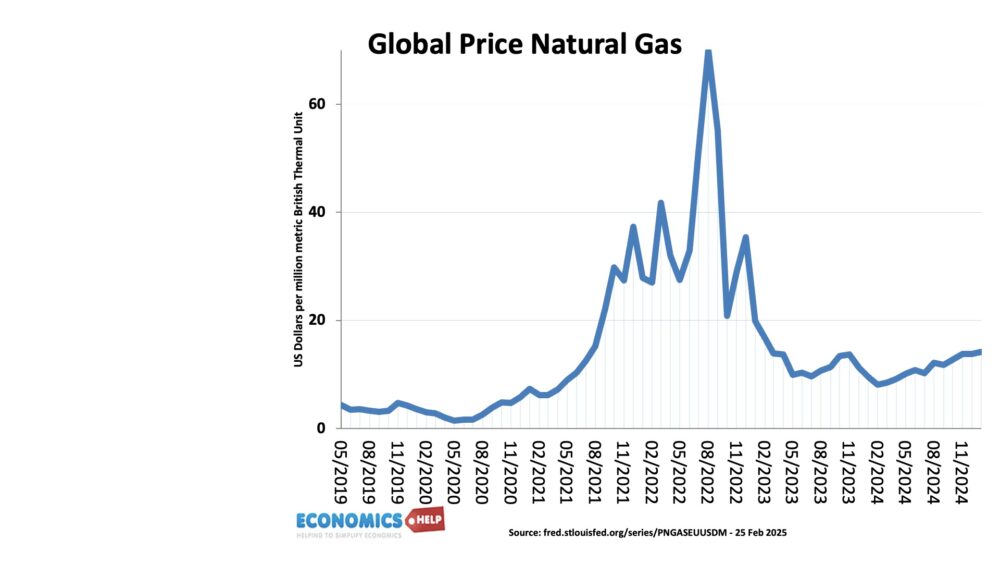

Gas Prices Lower

Also, the recent difficulties of European and German economy were closer related to the surge in gas prices. But, now gas and oil prices have fallen, this will help. But, it would be a mistake to just rely on lower gas prices. The EU is lagging behind US in terms of research and development, especially for new disruptive technologies. Effective innovation rates are lower in Europe, despite a strong scientific base. Studies claim the European Innovation Concil based in the EU Commission is dominated by civil servants with funding too bureaucratic and held back by rigid regulations. EU regulation may given better food and environmental standards, but at the same time, has become a burden for business. Finding a middle path may not be easy for a European Union, which has a tendency to move slowly in reform.

European Hopes

But, it’s not all doom and gloom, even the much beleaguered European car industry has hope of recovery, -relaxing of environmental rules has seen shares in Volkswagen boom. At least European car firms are doing better than the US based Tesla, which has seen sales in Europe plummet 45%.

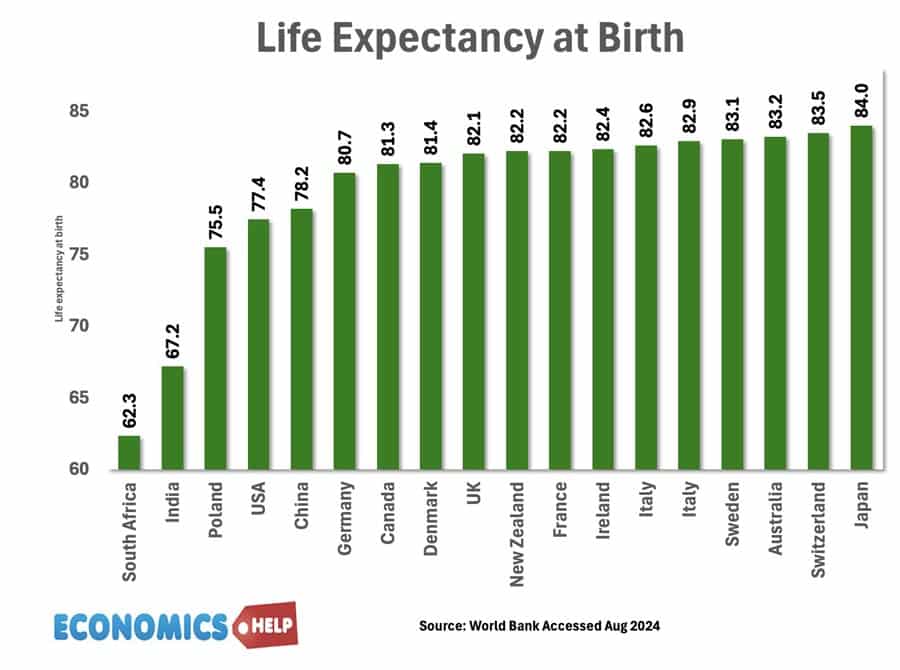

But, a bigger question is what do we mean by economic success? Europeans have a preference for less risk, more extensive welfare state. When I asked viewers best economy in terms of standard of living, a large majority chose Denmark, the US wasn’t seen as an attractive place. Tax rates in Europe are significantly higher than the US. But, it isn’t without compensation. Universal health care, better worker protection. For example, European countries offer more sick pay than the US, and European workers also get longer holidays. In fact, when you take into account hours worked and purchasing power parity of currency, German living standards are actually higher than the US. In the US the tax rate is low, but you have to pay for private health insurance. There is greater risk of going bankrupt from health costs, something unimaginable in Europe.

Despite spending a fortune on private health, the US has significantly lower life expectancy than in Europe. In other words, Europe offers a very different economic model to the US – maybe lower growth and less dynamism, but is higher GDP the point of economic growth? The US has seen GDP grow much faster than median wages. The wealthy are taking a bigger share of the economic pie.

The interesting question is it possible to combine the best of both worlds. European welfare state, long holidays and good working conditions combined with American-style private sector investment and innovation? Certainly, America has the wealth to provide say universal health care, if it has the desire, but currently has the preference for more tax cuts.

But the recent low growth in Europe is still a major problem, there is growing discontent about stagnant real wages and higher living costs. Europe needs to do better, the good news is that it has the foundation to potentially enable better economic growth. Already Poland, Denmark and Spain are examples of how European economies can thrive. Germany has had a torrid time, but has a skilled workforce and seems to have a new energy to invest.

Sources

https://www.ft.com/content/4ba5c22a-4cf7-4ece-9bbd-4f8df6bb0071

https://www.ssa.gov/OACT/COLA/central.html

https://cordis.europa.eu/article/id/24207-us-comes-out-on-top-in-euus-innovation-comparison

https://ec.europa.eu/newsroom/eismea/items/826237/en – innovation

https://www.ft.com/content/13a830ce-071a-477f-864c-e499ce9e6065

Average American wages are high, but this is skewed by the top 1%. Official stats show in 2023, average wages were $63,000, but median wages, the wages of a typical worker were $43,000. In fact, median wages in the US have grown very slowly since 1980.