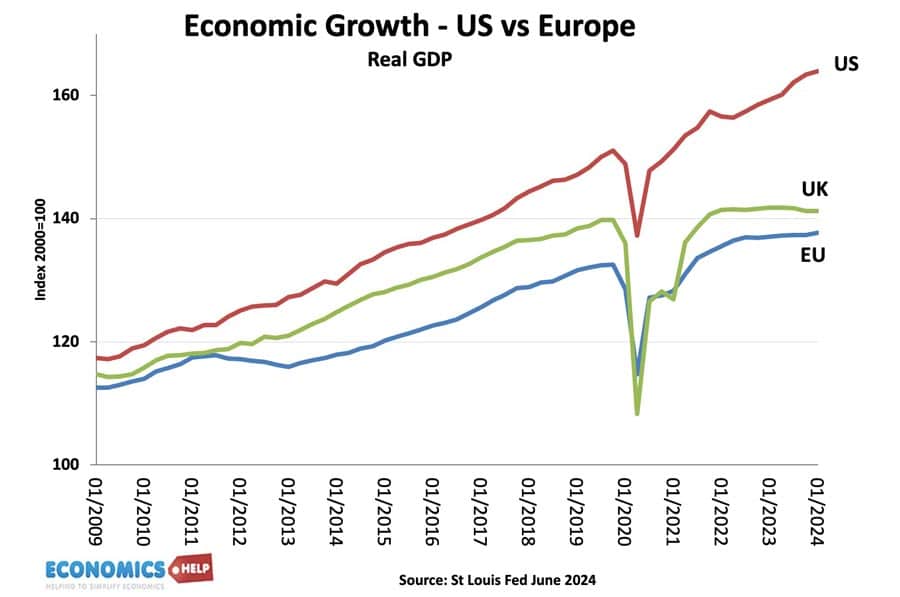

Defying predictions of recession and political turmoil, the US economy has grown noticeably faster than its competitors. Led by fiscal expansion and higher consumer spending, the US economy appears to be the global economic dynamo. Green subsidies led to a boom in construction investment and rising employment.

Is the economy finally heading for a hard landing or are there still reasons for optimism.

A curious feature of the US is that despite seemingly good economic data, falling inflation rate, high growth, consumers report pessimism about the state of the economy. This has a certain partisan bias with republicans most likely to believe the US is in recession. Now the US is definitely not in recession, but things are not as rosy as they first appear.

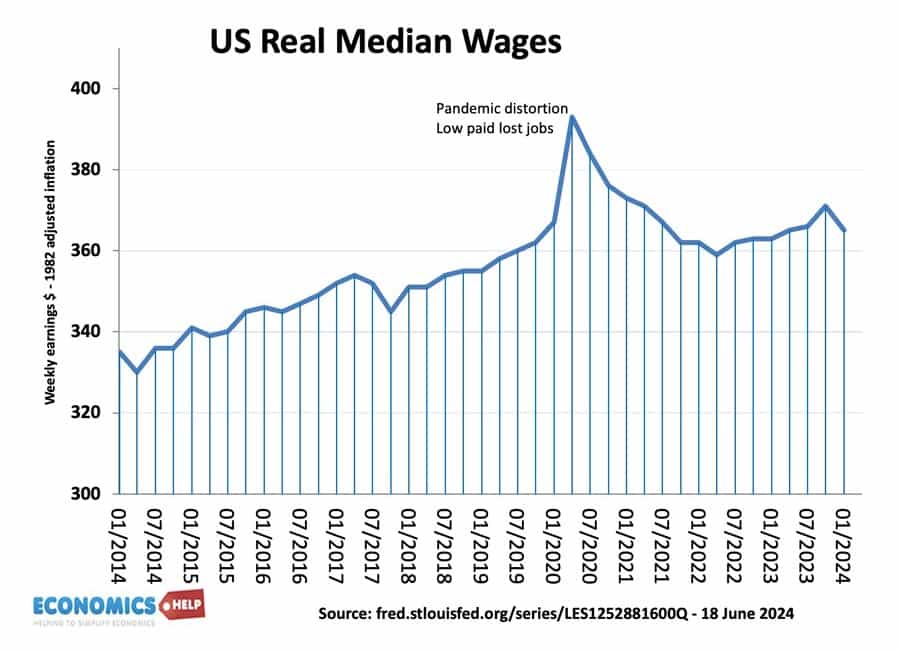

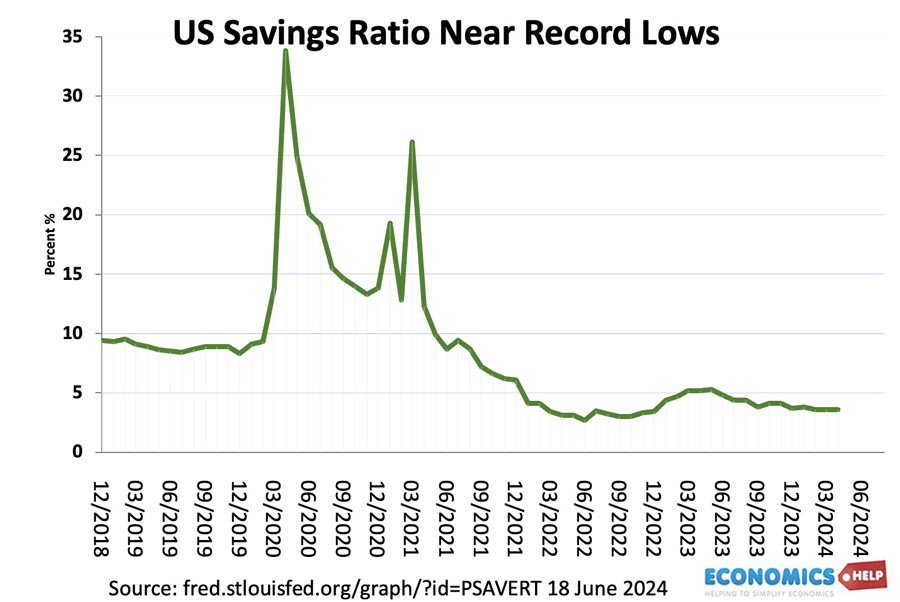

US real median wages are rising, but barely above pre-pandemic levels. Income was boosted by one off government checks and this enabled temporarily higher savings. But, since 2022, US consumers have been keeping afloat, by running down these savings.

The household saving rate is reaching a record low as consumers are stretched. Now one thing about the American economy is that there are really two speed economies. There are high income homeowners perhaps with a fixed rate mortgage. This group has significant assets and savings. The other America is the America with no savings, living pay cheque to pay cheque. And it is this group which has struggled with rising rents and higher interest rates. And it is now starting to take its toll, real consumer spending fell in April, with big firms like McDonalds warning that American consumers are holding back.

Rising Interest Rates

Since the credit crunch, the American mortgage market shifted towards 30 year long mortgage terms. It means many homeowners have been insulated from the very sharp rise in interest rates since 2022. However, the other America which relies on pay-day loans, credit cards has been much more affected by rising interest rates. As a share of income, loan repayments have soared.

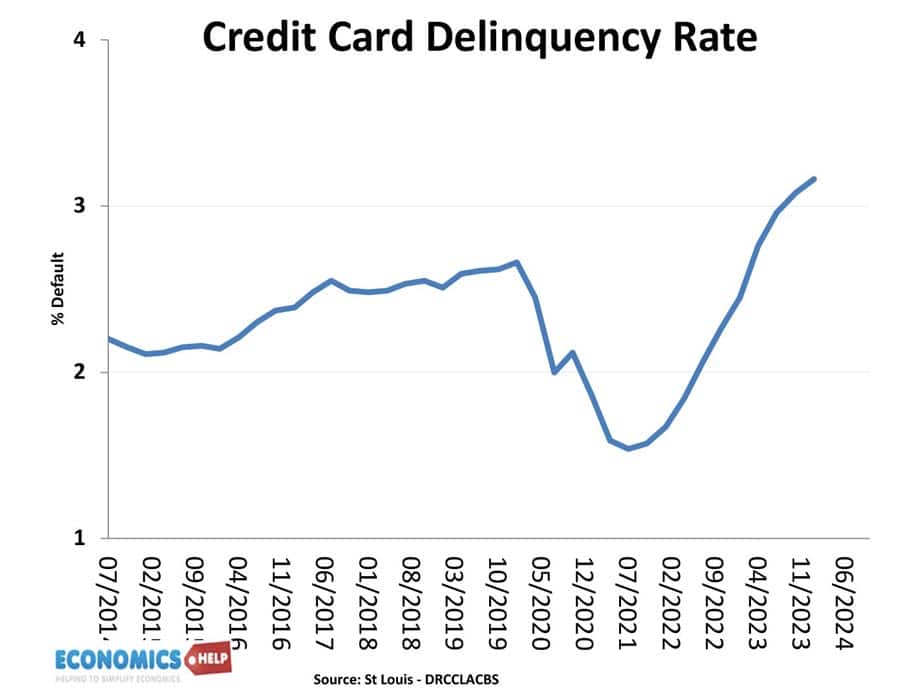

The US has seen a worrying doubling of credit card delinquency as cost of living pressures bite. The fall in the inflation rate has not changed the fact that many households are still adjusting to the unexpected rise in prices.

Job Losses

In the past two years, the economy has created record levels of jobs, but the recent employment picture was more concerning, the economy added only 175,000 jobs in April, 50% lower than March and below predictions. Citi chief U.S. economist Andrew Hollenhorst who rejected predictions of recession last year, now doubles down on his contrarian position by predicting a hard landing this year. He cites a weakening labour market and particular weakness amongst small firms which are the the first to notice a decline in economic activity. and more firms reporting layoffs.

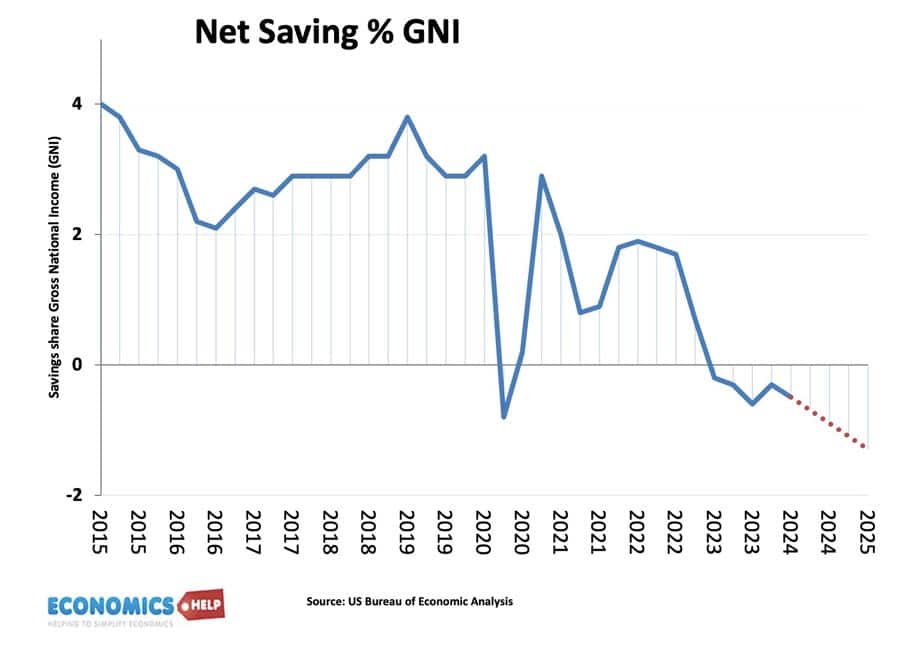

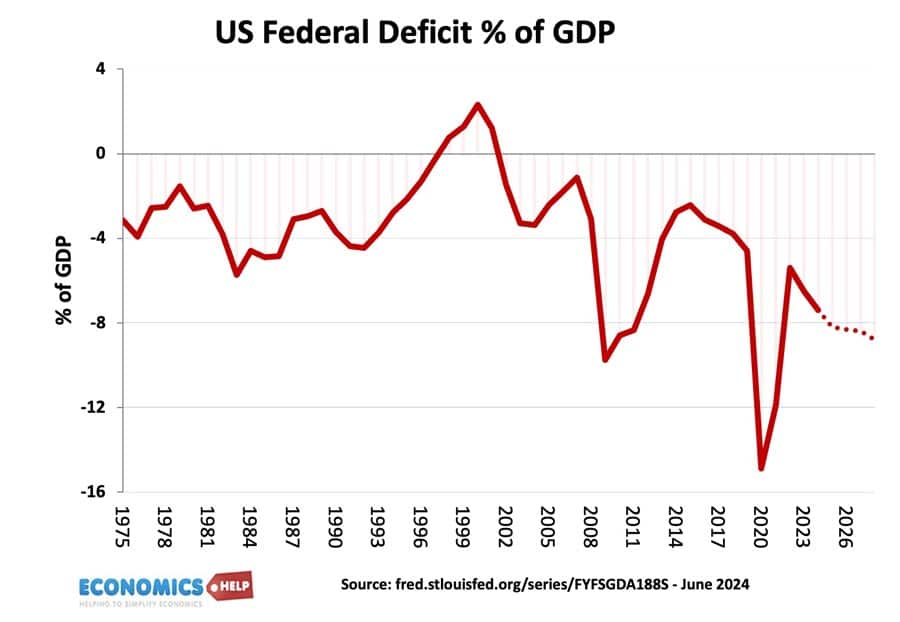

If real wage growth has been relatively weak, where has the economic growth come from? One answer is that the government have pursued an unprecedented expansionary fiscal policy. The US Inflation Reduction Act involved over $400bn of subsidies for green investment. It was effective in spurring a surge in manufacturing and construction investment. However, its success has meant the federal deficit has widened and is forecast to keep widening in the coming years. US debt is steadily ticking up as a share of GDP. Now on the one hand, the US has a large capacity to absorb extra debt, and there is high global demand for US treasuries, but despite this, there is a limit to how much you can rely on government spending to prop up economic growth.

Another cloud on the US economy is the upcoming election. A Trump election would likely lead to large tax cuts and an escalation of the trade war. Tax cuts can boost spending in the short-term. But with the federal deficit already at 7.4%, the US economy needs higher taxes rather than lower taxes. There is a limit to how much you can prop up an economy by fiscal expansion. High growth should be a period of reducing fiscal deficit, not increasing it. Another reason for strong growth in the US economy is high levels of immigration, this has increased labour supply and possibly helped moderate wage inflation. A sharp cut in immigration would have a large effect on output and firms who are used to tapping into this labour supply. So far the US has shrugged off the trade war with China, but a massive escalation of a trade war would create winners and losers and negatively affect the economy. Also, so far the US economy has brushed off political turmoil, but the extreme polarisation in US politics does always raise the prospect of institutional decay, and wrangling over the debt limit. There is even a greater cloud of uncertainty over the peaceful transfer of power.

The final point is that past interest rate rises have still not affected the economy because of the lengthy time lags involved. But, interest rates are significantly higher than three years ago and firms and households will be increasingly be affected by higher rates.

Nevertheless, despite these warning signs, there are also reasons for optimism. Inflationary pressures defied predictions of gloom and have fallen considerably, without the forecast hard landing. In fact, the 2023 US recession was the most eagerly anticipated recession which never materialised. Despite some real weaknesses, there are also long-term sources of optimism. Productivity growth has outstripped other countries, and the manufacturing investment has helped long-term capacity of the economy. Also, the baby boomer generation are now retiring with record assets. This is helping to maintain strong growth in the service sector, which for all the political focus of manufacturing is still the biggest sector of the US economy. Also, whilst real wages grew slowly, profits soared in the pandemic, firms have done well and taken a bigger share of GDP. In fact, this helps to explain why despite good economic statistics, many Americans don’t see the economy ths way. This video looks at why many Americans feel they are poor.

Related