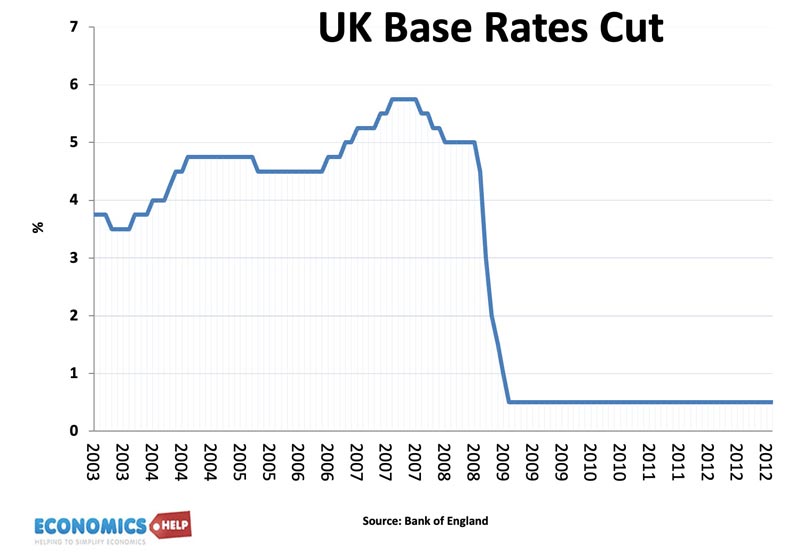

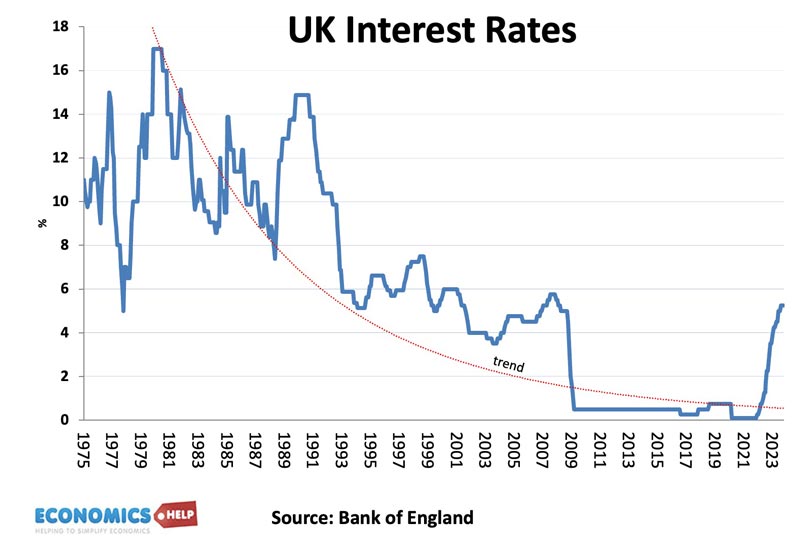

In 2009, Central Banks around the world cut interest rates dramatically to 0%.

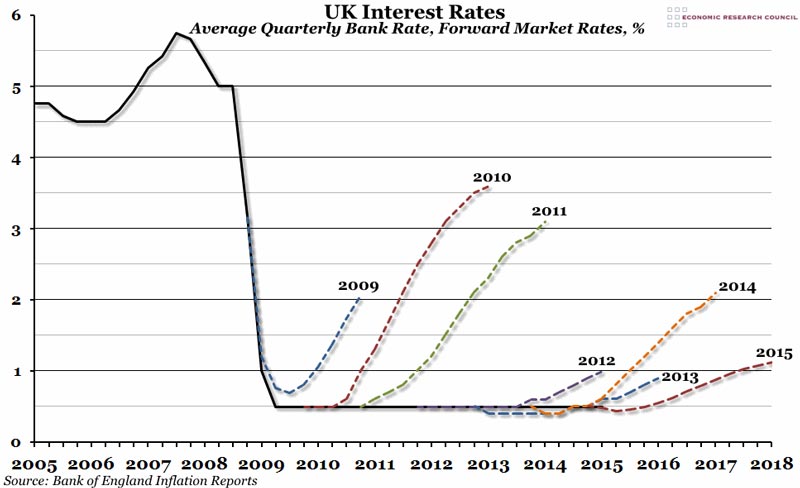

It was supposed to be a temporary reaction to a short-term crisis. Markets and experts all predicted interest rates would soon rise. But for 13 years, interest rates defied predictions staying close to zero.

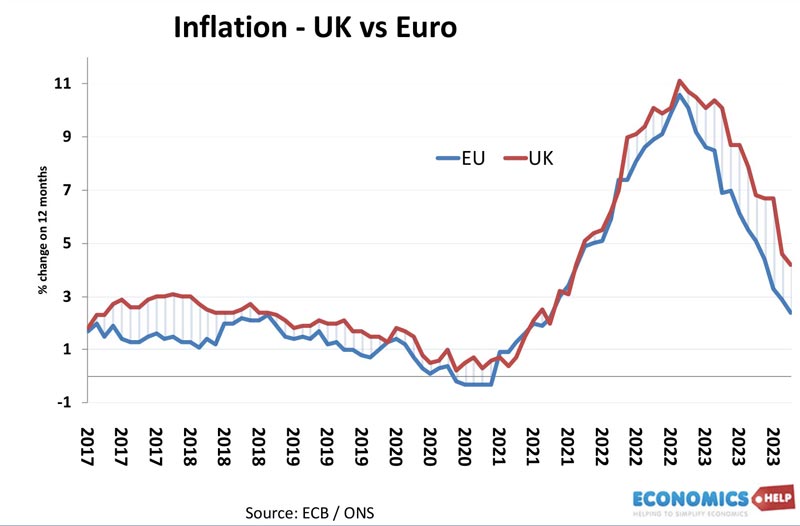

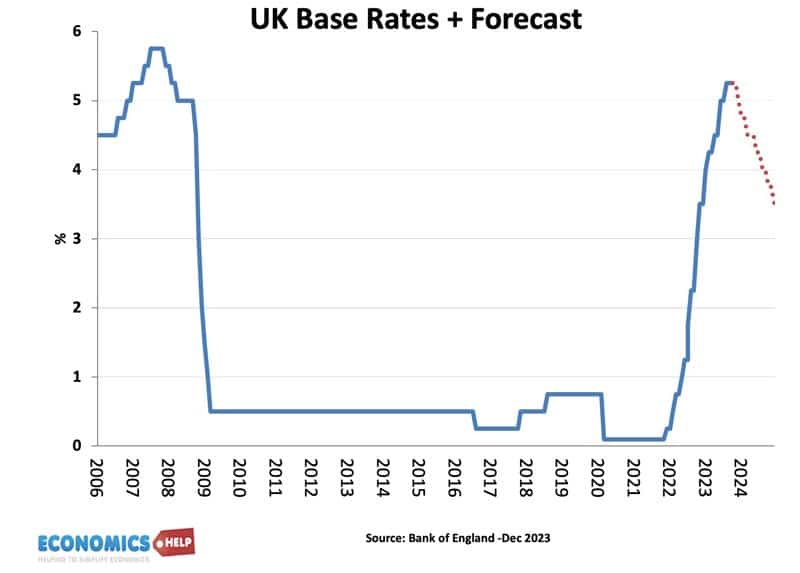

But, just as zero interest rates appeared to be the new normal, the 2022 inflation shock sent interest rates soaring. Inflation proved worse than feared and interest rate rose beyond many expectations.

But, then towards the end of 2023, inflation started to fall quicker than expected. So the really interesting question is will the economic forces which kept interest rates at zero for a decade return, or is the new normal now higher inflation and higher interest rates?

The long-term trend is for interest rates to fall, and since the 1970s, average interest rates have fallen considerably.

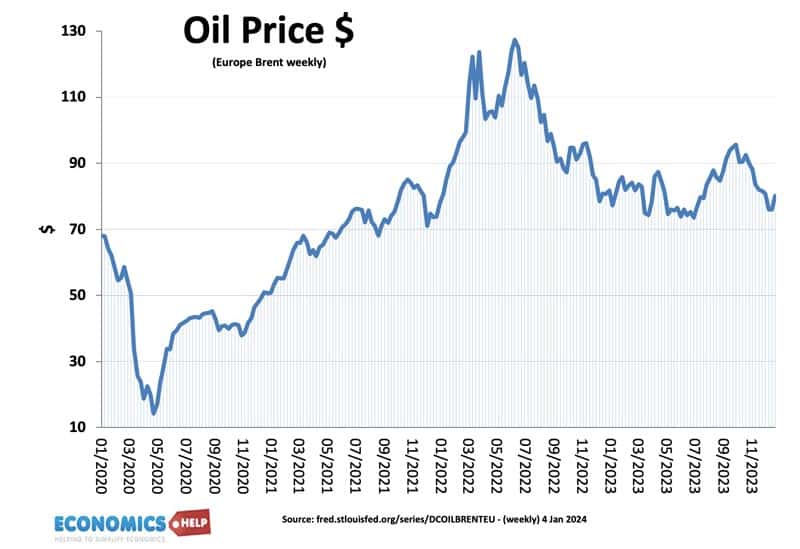

In the short-term, there are reasons to be optimistic that inflation will continue to fall. Oil and gas prices have fallen, food prices have fallen and the Covid-induced supply constraints have eased.

China, which is still the world’s main manufacturer is experiencing deflation with a risk it could worsen as it property bubble bursts and threatens to derail the economy.

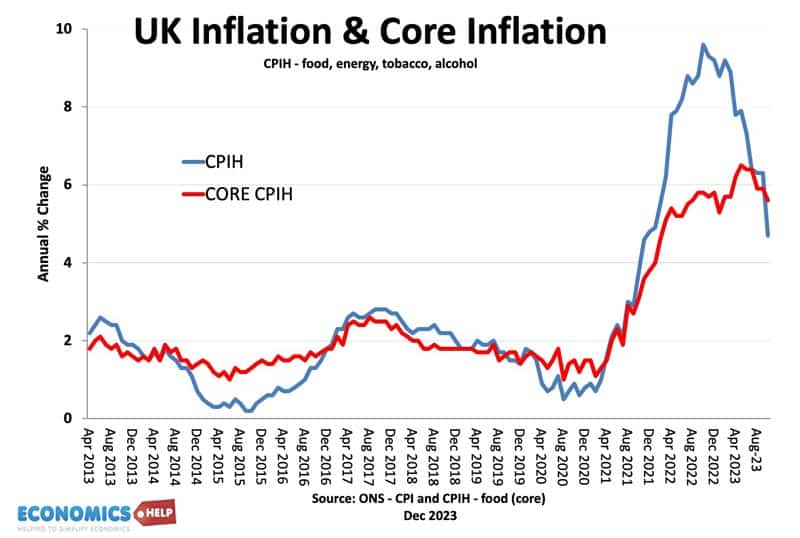

For many months, the UK had higher inflation than Europe. It was an outlier, particularly affected by gas prices and Brexit food shocks. But, the recent inflation data has brought the UK back inline with Europe and the US. Furthermore, UK inflation was never caused by strong economic growth. It was caused by cost-push inflationary pressures. And the past rises in interest rates from 0 to 5%, will have a large negative effect on demand, especially in 2024 as more people face higher mortgage rates. The former governor of the Bank of England Andy Haldane warns high interest rates are likely to push the UK into recession or at the very least prolonged stagnation, which will cause inflation to fall further.

Why Interest Rates stayed low for so long

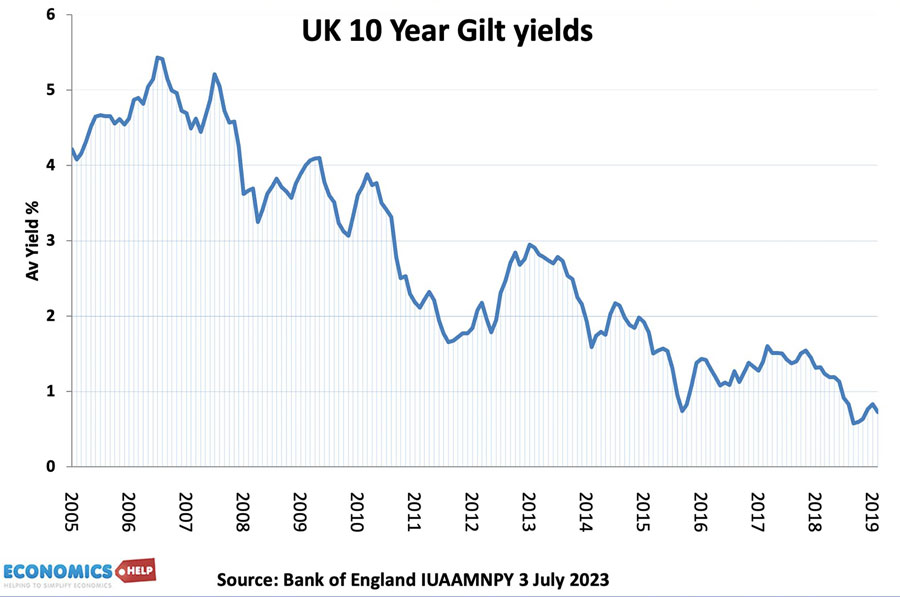

But going back in time, why did interest rates stay at zero for 13 years? Well, the 2008 credit crunch caused an unexpected drop in demand, fall in house prices, a deep recession and banks were so short of liquidity, they didn’t want to lend. Even interest rates of zero were not enough to promote economic recovery, causing Central Banks to pursue quantitative easing. In fact some argue the reason interest rates remained so low for so long was precisely because quantitative easing was artificially pushing down bond yields.

But, this doesn’t explain why Central Banks kept base rates at zero. If quantitative easing had done its job in increasing economic growth, we would have seen some inflationary pressures and the Central Bank would have increased interest rates back to more normal levels. It was only in 2022 QE started to be inflationary.

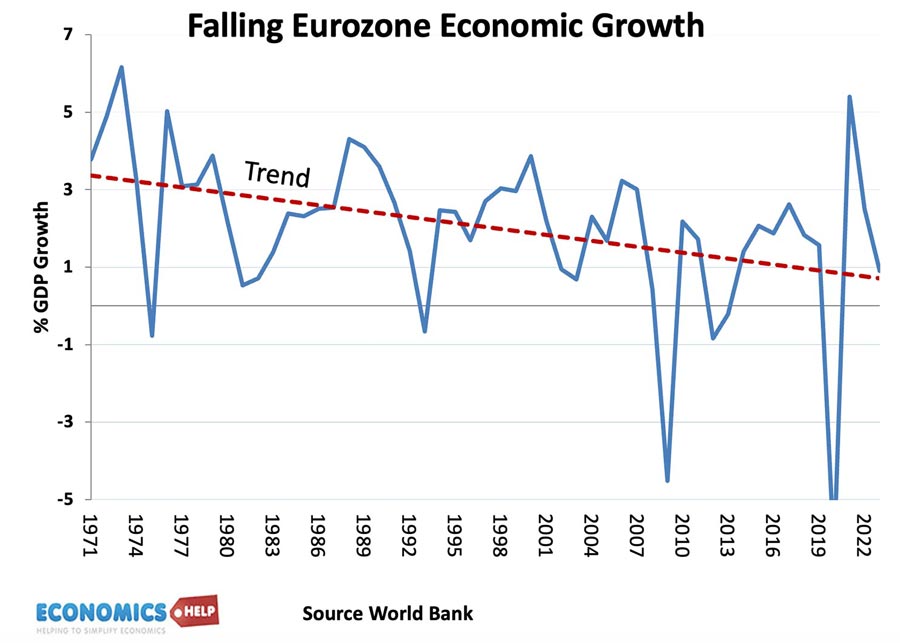

Secular Stagnation

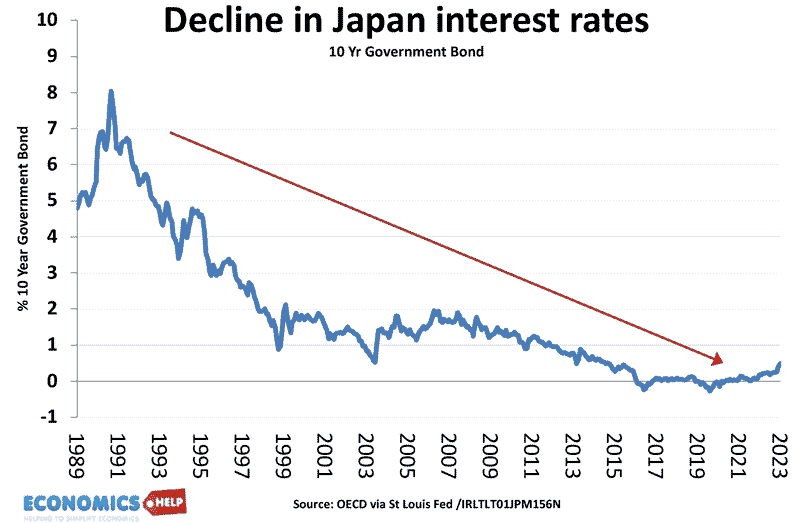

One theory for the recent period of ultra low interest rates is that of secular stagnation. The argument goes that advanced economies, with an ageing population, no longer see the same levels of investment and economic growth. Growth has slowed down across the world – be it, Japan, Europe or America. There is a persistent lack of demand in the economy that is leading to low inflation. In this environment of low growth, Central Banks try to stimulate investment and economic growth. The pioneer of secular stagnation is Japan, with over two decades of near zero interest rates.

Because of an ageing population in Japan there is greater demand for saving and little investment. And it is this lack of demand for investment means there is downward pressure on interest rates.

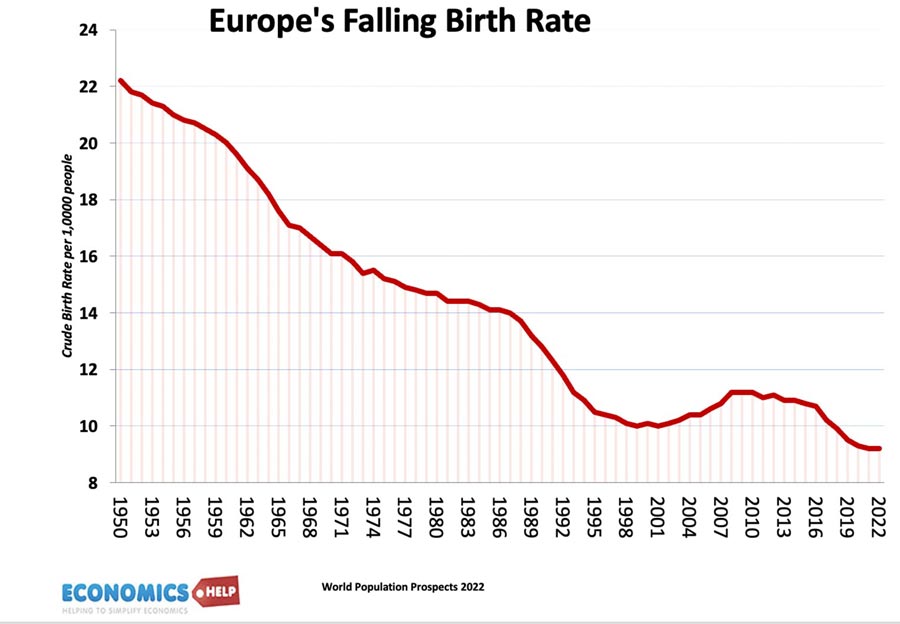

European economies, increasingly face the same demographic crunch that Japan has already started. The birth rate in Europe has dropped dramatically and the population is forecast to fall. With this kind of demographic change, there will be weak investment and growing domestic savings. If you agree with this theory of secular stagnation, there is no reason, we could not return to very low inflation, low growth and ultra low interest rates.

Reasons to be cautious on Inflation

Now, I agree this may all sound overly optimistic on inflation. If we look at underlying core inflation it is still close to 6% – three times higher than the government target. Nominal wage growth is running high as workers try to recoup lost real wages. People no longer have the same expectations of low inflation and low interest rates. The recent falls in commodity prices could very easily be reversed. Oil prices have been driven down by weak Chinese demand, but a new geo-political shock could easily see a new bout of inflation. There is still a long-way to go before inflation falls to the government target, let alone go below.

Secular stagnation could be wrong

Also, the theory of secular stagnation – the idea the West is stuck into a loop of low growth and low investment is challenged by many economists. They argue the 2010s was a reaction to the 2008, credit crunch. 2008 was an unusual recession – accompanied by a property crash, and widespread bank losses. It is something called a balance sheet recession. Despite some banks being exposed by higher interest rates, there is nothing like the same kind of financial armageddon we saw in 2008. Also, in the coming years, governments face pressure to borrow and invest in net zero green policies, building new houses or spending to deal with climate change. It is too simplistic to say an ageing population means weak investment. AI could also stimulate new investment opportunities. And finally as Central Banks reverse QE, that will also put upward pressure on bond yields.

Low Productivity growth increases inflationary pressures

The other factor which is important is productivity growth. If the economy experiences new technology and costs are falling, then the economy can growth without inflation. However, if productivity growth falls to zero, then even low economic growth can start to cause inflationary pressures. This is one reason, why UK had inflationary pressures despite very weak economic growth. It explains why the Bank of England increased interest rates in the teeth of a recession.

Prediction?

This video is not a prediction that interest rates are going to return to zero in the near or even medium term. But, if we had zero interest rates for 13 years, it is definitely a possibility that we could return to that climate. Inflation rose far higher than most economists forecasted, but in the second half of 2023, it also fell faster than predicted, especially in the UK. One thing I hope we learn from this video is that forecasting interest rates is really very difficult. In 2006, the idea of zero interest rates was hard to imagine. In 2009, no one could imagined 13 years of zero interest rates, and at the start of 2022, how many people predicted 14 consecutive interest rate rises in the UK?

Problem of low interest rates

It is also worth adding, I hope interest rates don’t fall to zero. It might be good for my mortgage, but in the long-term ultra low interest rates are not helpful for the economy. It distorts investment decisions, encouraging people to invest in property, assets and land, rather than say manufacturing and the real economy. It also makes Central Banks rely on quantitative easing for monetary policy, which has numerous issues. You could argue that the ultra-low rates of the 2020s did cause asset inflation, if not actual inflation in the economy.

Fixed vs Variable

Back in May of 2023 I had a choice between a fixed and variable mortgage. I explained why I chose a variable mortgage. To me it made no sense for the UK to have inflation of 10%, when the economy was barely growing. I guessed that inflation would fall sharply, enabling lower interest rates. Ironically, a few days later, inflation came in higher than expected causing a rise in mortgage rates. It temporarily looked a bad decision. But, nine months on, it looks more optimistic that interest rates have peaked and could fall quicker than expected. But what about other forecasts for the UK economy, this video goes into more detail about what could happen in 2024.

Related