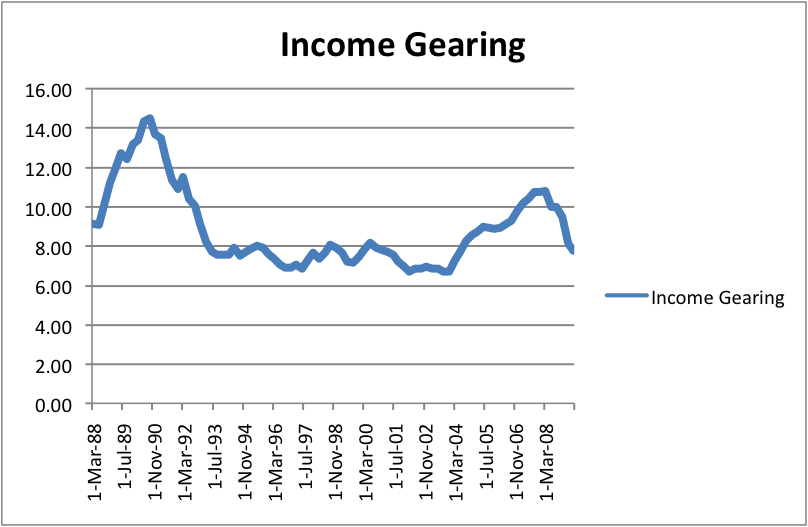

Definition of Income Gearing – this is the percentage of Post tax profits that are spent on obligatory debt interest payments

Household Income Gearing – The Bank of England measure obligatory payments by households on paying interest and other regular repayments on debt. This is calculated as a proportion of post-tax income.

What Factors influence Income Gearing?

- Rate of Interest. A rise in bank interest rates will increase the cost of obligatory debt interest payments. The highest income gearing occurred in the late 1980s when interest rates rose to 15%. This rise in interest rates particularly affects those with large variable mortgages

- Amount of Debt. High levels of indebtedness increase the amount of debt interest, even at low-interest rates. The high gearing in 2008, was not due to high interest rates but high borrowing and a fall in the savings rate to close to 0%.

- Confidence. If consumers are confident about the future, they will take on more debt and be willing to devote a higher % of their income to debt repayments.

- House prices. A rise in house prices encourages householders to remortgage their house and devote a higher % of their income to interest payment

- Fall in Income. A fall in income (such as unemployment) would increase the debt burden for households. As fixed debt interest payments would now take a bigger % of income.

Related

Hi… Thanks for this blog it help me find, read and understand some of the things what I’m looking for… may you post of more good and worth to read articles like this. Thanks again…

Hello… thank you for the blog that you post it’s so good for me and I guess even for those readers… Thanks again…

I think unemployment is a big factor that affects gearing.

I agree unemployment is a major factor here.